April 08, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to provide an update on exploration programmes planned for its Eastern Goldfields and Gascoyne region projects.

- Working towards maiden Bangemall Ni-Cu-Co-PGE drill campaign

- Targets outlined for RC drill testing at Gidji JV gold project north of Kalgoorlie

- New tenement application over 11 kilometre long aircore gold anomaly with similarities to +2Moz Invincible gold deposit

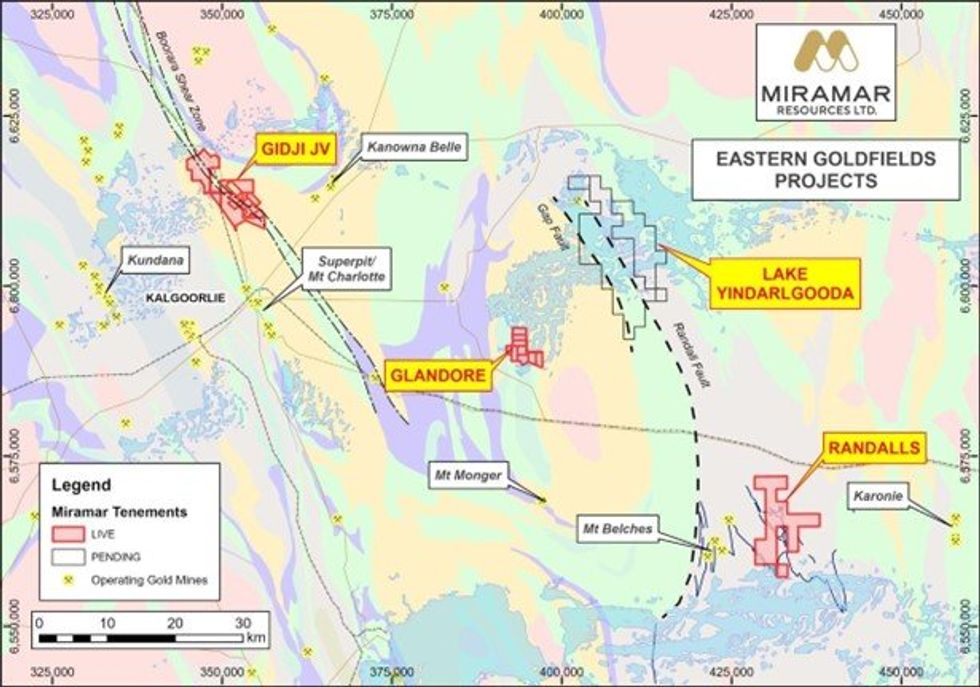

The Company is currently working toward the maiden drilling campaign within the Bangemall Ni-Cu-Co- PGE projects and has expanded its strategic 480 km2 Eastern Goldfields tenement portfolio (Figure 1).

Miramar’s Executive Chairman, Mr Allan Kelly, said the Company’s Eastern Goldfields exploration project portfolio had significant value not recognised in the current share price.

“Since listing in 2020 with a portfolio of highly prospective early-stage gold, nickel and copper projects in Western Australia, we have systematically advanced our key projects up the exploration value chain, added to our land position through strategic tenement applications and relinquished those tenements which lacked significant discovery potential,” Mr Kelly said.

“In a record gold price environment, the inherent value of our gold projects, including our flagship Gidji JV Project, where we have made multiple new gold discoveries immediately along strike from one of the richest patches of earth on the planet, is significant,” he added.

“We’ve also advanced our Bangemall Projects from the initial concept to high priority drill targets which could define a new style of nickel mineralisation in a new mineral province,” he said.

Bangemall Ni-Cu-Co-PGE Projects

Miramar holds a strategic land position within the Edmund and Collier Basins where it is targeting nickel- copper-cobalt-PGE mineralisation related to Kulkatharra Dolerite sills, part of the Warakurna Large Igneous Province and the same age as the Giles Complex intrusions which host the large Nebo and Babel nickel-copper deposits in the West Musgraves of WA.

Miramar’s initial aim is to show “proof of concept” of its Norilsk-style deposit model by discovering Ni-Cu- Co-PGE sulphide mineralisation.

Over the previous 24 months, the Company has progressed from regional-scale area selection to collection of project-scale datasets and, more recently, to delineation of individual drill targets at the Mount Vernon and Trouble Bore Projects (Figure 2).

The Company is now working towards the first drill programme targeting this style of mineralisation within the region and has already received Programme of Work (POW) approval from the Department of Energy, Mines, industry Regulation and Safety (DMEIRS).

Upcoming work includes completion of a heritage survey, systematic rock chip sampling and/or further ground geophysics to help refine the initial RC drill targets.

Pending receipt of all relevant approvals, the Company hopes to complete the maiden drill programme during mid-2024.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

18h

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

21h

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00