May 18, 2022

Green Technology Metals Limited (ASX: GT1) (GT1 or the Company) is pleased to provide further assay results from the Phase 1 diamond drilling program at its Seymour Lithium Project in Ontario, Canada.

HIGHLIGHTS

- Assays received for further seven holes from Phase 1 step-out diamond drilling of North Aubry deposit at GT1’s flagship Seymour Lithium Project.

- Additional thick, high-grade extensional intercepts of North Aubry deposit including:

- GTDD-22-0001 for 10.5m @ 1.77% Li2O from 123.2m (incl. 7.0m @ 2.11% Li2O)

- GTDD-22-0013 for 18.2m @ 1.10% Li2O from 304.2m (incl. 3.1m @ 2.05% Li2O)

- GTDD-22-0014 for 4.5m @ 0.61% Li2O from 250.7m (incl. 2.5m @ 1.01% Li2O)

- Further northern step-out drilling of North Aubry deposit commenced; hole GTDD-22-0320 intercepts 10.7m of pegmatite with significant visible spodumene (assays pending), extending the known North Aubry pegmatite a further 150m down-dip from the nearest intercept.

- Results from Phase 1 drilling (assays now returned for all 16 holes) indicate substantial potential upside to existing Seymour Mineral Resource estimate of 4.8 Mt @ 1.25% Li2O 1 .

- Updated Mineral Resource estimate for Seymour on track for completion during Q2 CY2022.

- No significant lithium intercepts >1.0% Li20 were returned from initial exploration drilling of the eastern Central Aubry zone (7 holes) and Pye prospect (6 holes).

- Drilling is targeted to resume from June at both Central Aubry (western) and Pye (targeting LCT�type pegmatites of over 250m strike that were identified in the initial drilling).

“In total, the Phase 1 drilling program at Seymour has been highly successful. The results are expected to drive a substantial increase to the existing Seymour resource this quarter. We are also pleased to have commenced further northern and down-dip extensional drilling of the North Aubry pegmatite so rapidly. The initial result from hole GTDD-22-0320 offers further immediate potential to positively impact on mineralised pegmatite extents and volume.” - GT1 Chief Executive Officer, Luke Cox

Further significant step-out intercepts at North Aubry

The Phase 1 drilling program at Seymour was designed to evaluate potential along-strike and down-dip extensions of the North Aubry deposit that were open and untested. The final program consisted of 16 diamond drill holes for a total of 5,826 metres.

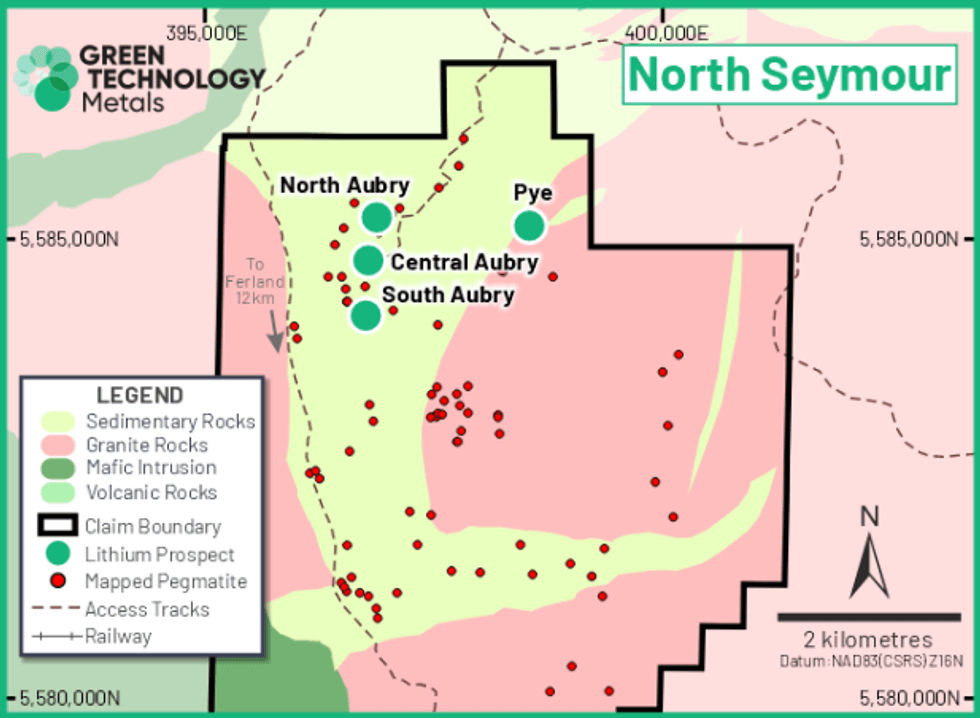

Figure 1: Location map of northern area of the Seymour Project showing North and South Aubry deposits, Central Aubry zone and Pye prospect

All but one hole in the Phase 1 program intersected pegmatite along strike and down dip (refer GT1 ASX release dated 28 April 2022) with the single hole barren of pegmatite, GTDD-22-011, on the southeast flank of the deposit, marking the southerly limit of the North Aubry pegmatites. The intercepts returned from solely the upper pegmatite at North Aubry range in thickness up to 42.7m, with the widest intervals located in the northern extensions of the deposit.

Assays have now been returned for all 16 of the holes drilled in the Phase 1 program.

Significant assay results from the seven further holes that were recently received are detailed in Table 1 (along with details of the previously released intercepts also). The key intercepts were:

- GTDD-22-0001 for 10.5m @ 1.77% Li2O from 123.2m (incl. 7.0m @ 2.11% Li2O)

- GTDD-22-0013 for 18.2m @ 1.10% Li2O from 304.2m (incl. 3.1m @ 2.05% Li2O)

- GTDD-22-0014 for 4.5m @ 0.61% Li2O from 250.7m (incl. 2.5m @ 1.01% Li2O)

- GTDD-22-0002 for 9.0m @ 0.68% Li2O from 174.0m

Click here for the full ASX Release

This article includes content from Green Technology Metals Limited (ASX: GT1), licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GT1:AU

Sign up to get your FREE

Green Technology Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 September 2025

Green Technology Metals

Delivering the next lithium hub in North America

Delivering the next lithium hub in North America Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Green Technology Metals (GT1:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

07 January

EDC Extends LOI for Seymour Lithium Project of up to C$100m

Green Technology Metals(GT1:AU) has announced EDC Extends LOI for Seymour Lithium Project of up to C$100mDownload the PDF here. Keep Reading...

30 November 2025

Altris Engineering Appointed to Optimise & Lead Seymour DFS

Green Technology Metals (GT1:AU) has announced Altris Engineering Appointed to Optimise & Lead Seymour DFSDownload the PDF here. Keep Reading...

17 November 2025

Ontario Lithium Project Development Update

Green Technology Metals(GT1:AU) has announced Ontario Lithium Project Development UpdateDownload the PDF here. Keep Reading...

31 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Green Technology Metals(GT1:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Sign up to get your FREE

Green Technology Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00