June 14, 2022

Galan Lithium Limited (ASX: GLN) (Galan or the Company) is pleased to provide an update on its ongoing exploration activities at the Greenbushes South Lithium Project (a joint venture between Galan (80%) and Lithium Australia Limited (ASX:LIT)(20%) (Greenbushes South).

Highlights:

- Recent airborne radiometric, magnetic and DEM survey data processed for Greenbushes South Project

- Interpretation provided 18 key target zones for lithium pegmatites near the mineralising Donnybrook-Bridgetown Shear Zone

- Follow-up mapping and sampling of the first target site (GS11) resulted in a discovery of an approx. 200 m x 40 m outcropping pegmatite lens

- Soil samples and rock chips from GS11 site sent for geochemical assay

- Further fieldwork on GS11 and other key targets scheduled from July

- Conservation Management Plan for pending tenements has reached final revision stage for planned H2 2022 exploration activities

Airborne geophysics processed and key target zones identified

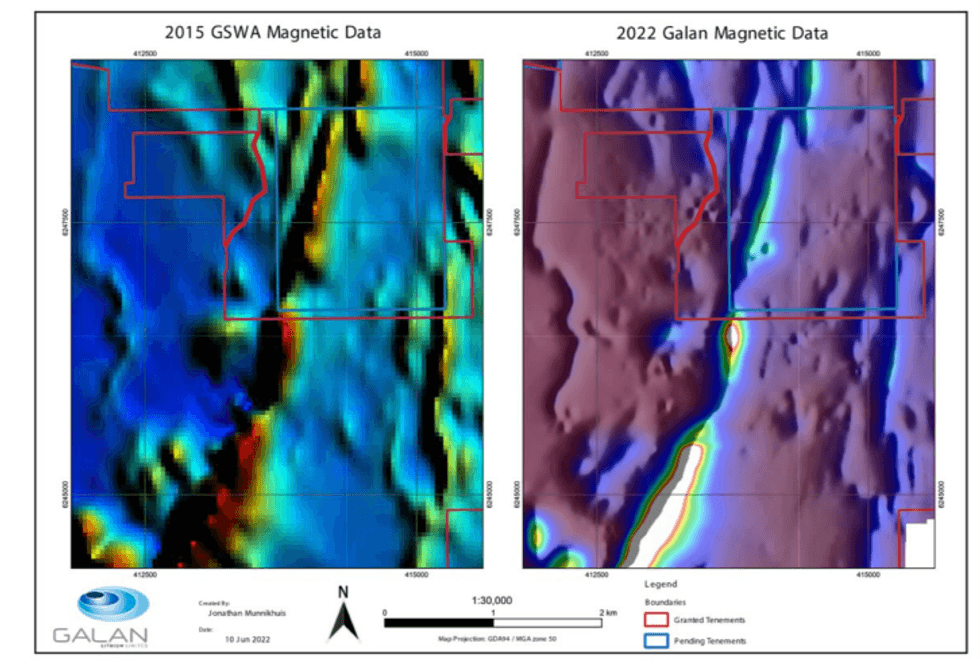

Galan has received the processed data and target generation report from the recent airborne geophysical survey campaign for its Greenbushes South tenement (E70/4790). This survey provided high-resolution radiometric and magnetic data from a fixed-wing aircraft flying at an average of 45 metres of terrain clearance, a significant improvement for resolution over previous publicly available data sets (Figure 1).

Southern Geoscience Consultants (SGC) provided processing and interpretation of this new data as well as the development of key target zones for lithium-bearing pegmatites. Target generation incorporated structural and lithological information (provided by the airborne data), as well as field mapping and surface geochemistry undertaken by Galan.

The new magnetic, radiometric and DEM data gives more precision to the location of the mineralising Donny-Brook Bridgetown Shear Zone (DBSZ), associated with the Greenbushes pegmatite. The final report from SGC identified twelve (12) pegmatite targets within Galan’s granted E70/4790 tenement, and an additional six (6) pegmatite targets within Galan’s pending tenements (Figure 3).

Sampling and mapping program commenced; pegmatite outcrop discovered

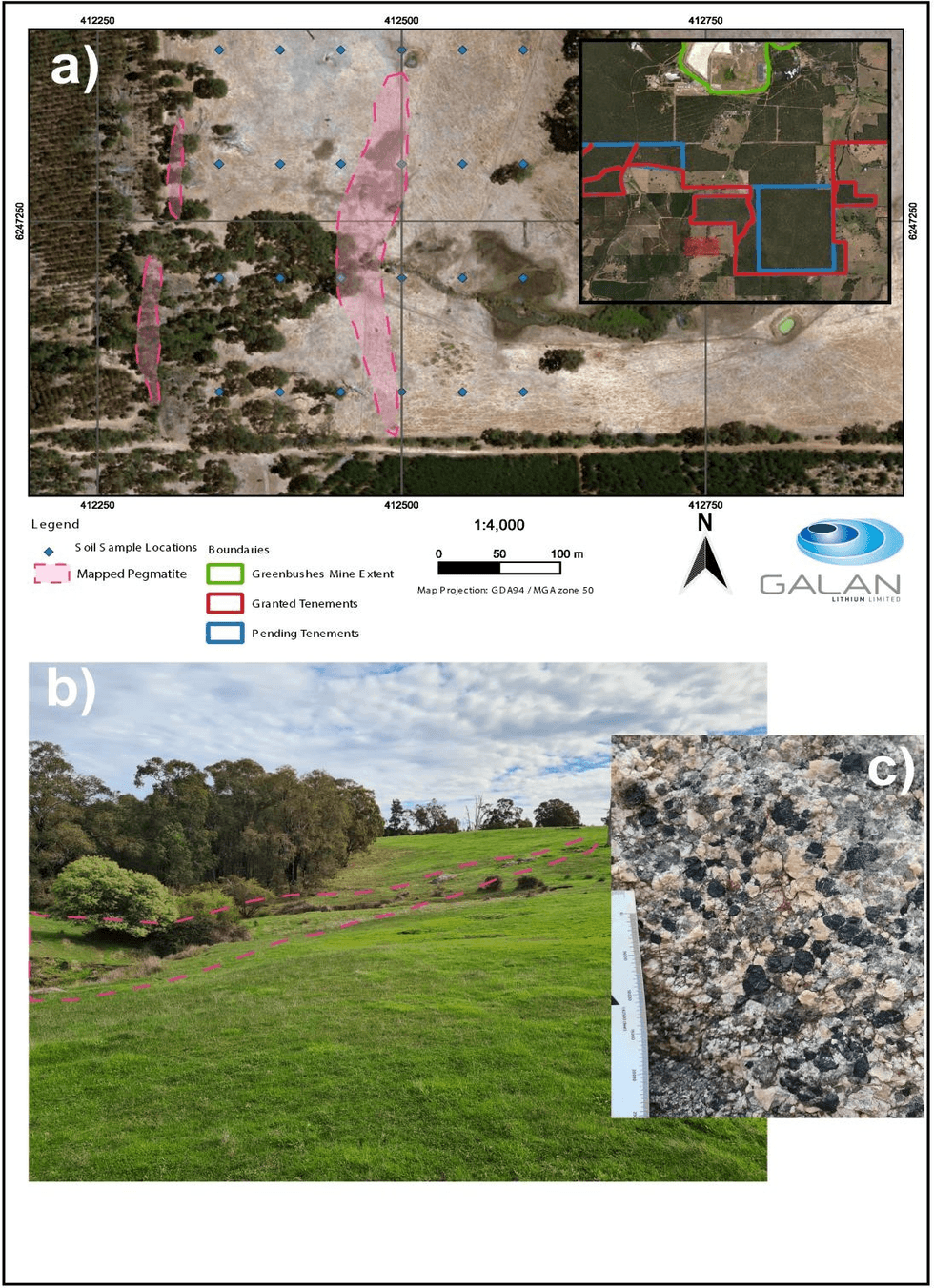

Following the above, Galan initiated a soil sampling and field mapping program over the first of the newly identified targets on E70/4790 (GS11 target zone; Figure 4).

Field mapping activities over the GS11 target area revealed an outcrop of approximately 200 m long by 40 m wide pegmatite. This pegmatite hassimilar macroscopic mineralogy to those pegmatites described at the Greenbushes Lithium Mine to the north. The assemblages are albite-quartz ± microcline ± muscovite ± garnet. The pegmatite lens hosts several tourmaline-rich zones at a metre scale and is recognized by coarse-grained tourmaline and high abundances of interstitial albite quartz and muscovite (Figure 2).

Galan has sampled four representative rock chip samples from the surficial pegmatite at GS11. A partially completed soil assay program has also been undertaken, with 65 soil samples to date at 50 m x 100 m grid spacing across the potential target zone centred over the pegmatite outcrop. The soil sampling program is aimed at delineating potential pegmatites at depth through the detection of elevated levels of pathfinder elements at the surface (As, Sn, Cs, Ta, Rb).

Galan has submitted these rock and soil samples for assay and is awaiting results. Completion of the soil grid over GS11, and further follow-up soil and rock chip sampling work on other targets along the major structure that hosts the mineralisation are planned in Q3, 2002. The results will help guide the geophysical survey to test for blind pegmatites.

Conservation Management Plan reaches final revisions

Galan has also received its final revisions from the Department of Biodiversity, Conservation and Attractions (DBCA) for the Conservation Management Plan (CMP) for its planned exploration activities on pending Greenbushes South tenements (E70/4889, P70/1702 & P70/1703). The CMP outlines the proposed exploration and prospecting activities, management, and communications for work within the Hester State Forest (30) / Proposed Nature Reserve (154).

Galan has provided the DBCA with its planned soil sampling and ground geophysics activities within these state forests. Planned activities are aimed to commence during Q3 2022. The DBCA has indicated that subject to the final revisions of the CMP, the pending tenements will then be submitted for ministerial approval to undertake these low-impact exploration activities.

Click here for the full ASX release

This article includes content from Lithium Australia Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LIT:AU

The Conversation (0)

17 September 2025

Livium Expands Clean Energy Waste Recycling Capabilities

Livium (LIT:AU) has announced Livium Expands Clean Energy Waste Recycling CapabilitiesDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00