November 27, 2022

Queensland Pacific Metals Ltd (ASX:QPM) (“QPM” or “the Company”) is pleased to announce the results of its Advanced Feasibility Study (“Feasibility Study”) for Stage 1 of the TECH Project and a Scoping Study for Stage 2 expansion of the TECH Project.

Highlights

- Advanced Feasibility Study on Stage 1 TECH Project complete, facilitating formal commencement of debt funding with potential lenders and providing guidance to investors.

- Scoping Study on Stage 2 TECH Project expansion also complete.

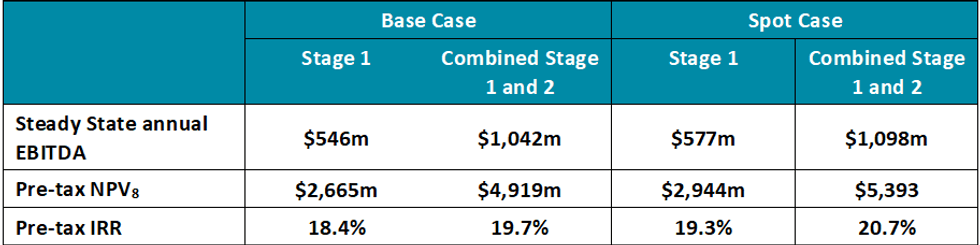

- The studies highlight the strong financial metrics of the TECH Project:

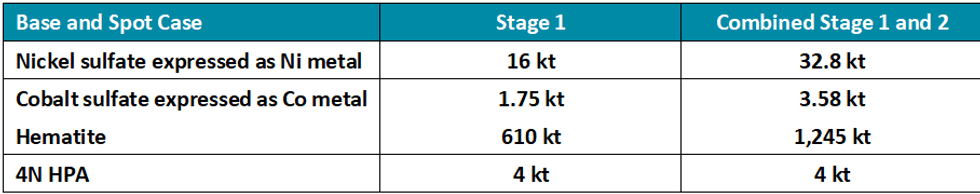

- Nameplate production of:

- Lowest quartile operating cost (after co-product credits) on nickel cost curve

- Stage 1 development capex estimate of A$1.9b + contingency allowance compares well with the 2020 Pre-Feasibility Study estimate of A$650m, considering a 2.7x plant scale increase and global equipment cost inflation over the past two years.

- Capital estimate prepared by recognised engineering firm Hatch with support from other key vendors and consultants.

- Debt financing due diligence process, lead by advisors KPMG, will commence immediately and which will include:

- NAIF – Strategic Assessment Phase completed;

- Export Finance Australia – conditional commitment received of A$250m;

- K-Sure – formal expression of interest to participate on terms similar to Export Finance Australia; and

- Other export credit agencies and commercial banks who have provided formal expressions of interest.

- Feasibility Study presents the strong financial metrics of the TECH Project, which has already secured offtake agreements for 100% of nickel and cobalt sales for the life of the project with General Motors, LG Energy Solutions and POSCO, all three of which are also shareholders of QPM.

- Capex estimate has been undertaken at a peak in global inflation and equipment pricing – advice from key vendors is that they are seeing the cost of manufacturing reduce significantly, which will assist QPM when it is time to place formal orders.

- Ongoing work on some aspects of the TECH Project to improve estimate accuracy and value engineering initiatives to implement identify capex savings will take place over the next few months in parallel with the debt financing process.

Stage 1 Overview and Financing Strategy

Stage 1 of the TECH Project has been designed at a nameplate capacity to process 1.05m dmt (1.6m wmt) per annum. Key assumptions and operating parameters are detailed in the tables below.

The capital estimate for Stage 1 of the TECH Project currently sits at an accuracy range of –15% to +24% and is presented in the table below.

QPM and its debt advisors KPMG have made significant progress to date on procuring debt funding for the TECH Project:

- NAIF – Strategic Assessment Phase completed;

- Export Finance Australia – conditional commitment received for A$250m;

- K-Sure – formal expression of interest to participate on terms similar to Export Finance Australia; and

- Other export credit agencies and commercial banks who have provided formal expressions of interest.

As part of QPM’s ongoing discussions with these debt financiers, the Feasibility Study is sufficiently advanced to commence formal due diligence with an Independent Technical Expert (“ITE”). This body of work will begin imminently in parallel with QPM continuing to undertake engineering work on certain aspects of the plant to improve accuracy. These aspects primarily concern the KBR engineering package, which includes iron hydrolysis, aluminium removal and nitric acid recovery and recycle. QPM, Hatch and KBR are working as an integrated team to optimise the design and minimise technical risk in these areas. In addition, value engineering (cost reduction) initiatives will also be undertaken across the Project.

Contingency in the capital estimate has currently been assumed at 10%. Following the KBR engineering package work and value engineering, a detailed contingency estimate will be undertaken using the standard Quantitative Risk Assessment methodology.

In preparing the capital estimate, QPM believes it has been undertaken at the peak of global manufacturing pricing. This is based on discussions with key equipment vendors who are seeing significant reductions in international producer price indices.

Click here for the full ASX Release

This article includes content from Queensland Pacific Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

QPM:AU

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

20 April 2022

Queensland Pacific Metals

Developing a Sustainable and High-Purity Battery Materials Refinery Project

Developing a Sustainable and High-Purity Battery Materials Refinery Project Keep Reading...

Keep reading...Show less

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00