October 30, 2024

Elixir Energy Limited (“Elixir” or the “Company”) is pleased to present its Quarterly Activities and Cash Flow Report.

HIGHLIGHTS

- Daydream-2 well successfully stimulated and flow tested

- Gas flowed from multiple stimulated zones, including deep coals for the first time

- ATP 2077 formally awarded and 173 Bcf additional contingent resources booked

- Elixir’s fiscal position remains strong - $10M at quarter end

MANGAGING DIRECTOR’S REPORT TO SHAREHOLDERS FOR THE QUARTER

The Daydream-2 appraisal well was again the key focus for Elixir during the quarter. The considerable successes of this program (albeit with some ebbs and flows typical of an early stage appraisal program) has provided the Company with a very strong platform to continue to de-risk the Grandis Project.

North America’s considerable experience in large unconventional plays over the last two decades indicates that having multiple operators try different approaches to “cracking the code” to most effectively liberate gas presents by far the optimal approach to really open up such plays.

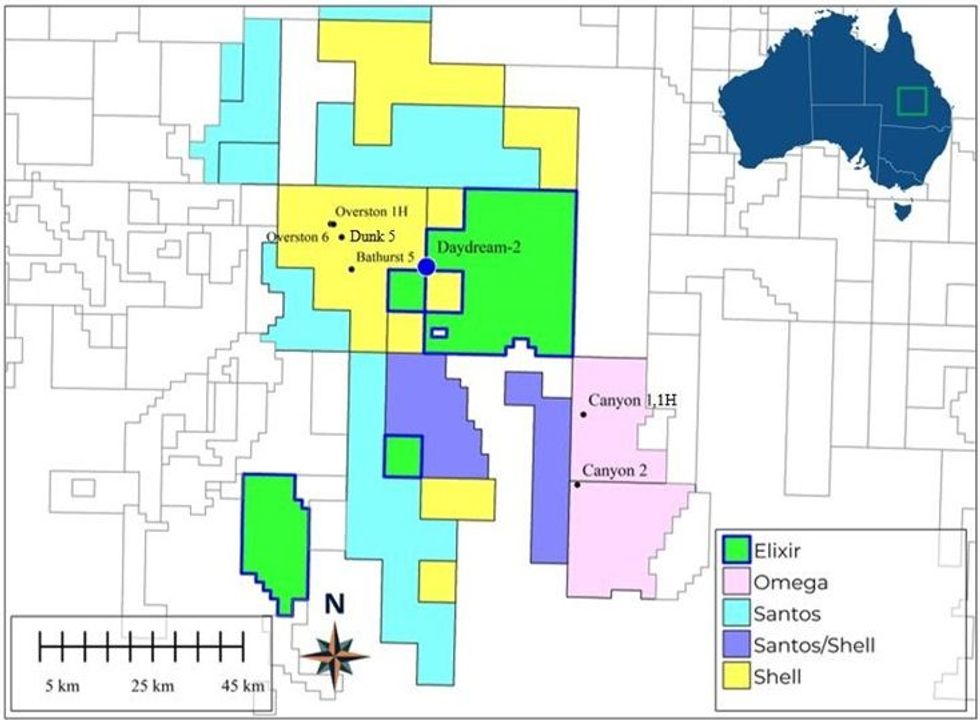

In this context Elixir is very pleased to be currently accompanied by other active explorers in Queensland’s Taroom Trough. Collectively, considerable sums are being invested, contingent resources booked, knowledge transferred and service sector capabilities continuously improved.

During the last quarter Elixir’s contributions to these collective efforts were material and multiple. These included flowing gas from five out of six stimulated zones, including from deep coals for the first time in this region.

Elixir expects the various current – and likely new – Taroom Operators to expand their efforts in the years to come - to ultimately deliver a lot of gas into the nearby infrastructure that can readily take it to desperately short domestic and international markets.

In the current early stage of such a large play, the teething issues that typically arise include rationing of the required equipment, service sector companies requiring different approaches, etc. Elixir has experienced some of these – but we are convinced that we can see these already being ironed out. For instance, the collective efforts in the region are already leading to interest from the likes of new service sector and infrastructure companies, with highly relevant international expertise and equipment.

During the quarter Elixir was formally granted ATP 2077 – which immediately added 175 Bcf of new contingent resources. The timeline from being notified as preferred tenderer to formal award was very rapid – reflecting the strong Queensland regulatory environment generally and the well established oil and gas presence in the immediate region specifically.

Post the end of the quarter, Elixir was pleased to execute a Memorandum of Understanding with Australian Gas Infrastructure Group (AGIG) to provide a framework under which to better investigate the development of the required infrastructure to take Taroom sourced gas to the nearby market interfaces. Elixir sees this is also an area of potential fruitful cooperation.

Click here for the full ASX Release

This article includes content from Elixir Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EXR:AU

The Conversation (0)

02 May 2024

Elixir Energy

Early-mover in natural gas exploration and appraisal in Australia and Mongolia.

Early-mover in natural gas exploration and appraisal in Australia and Mongolia. Keep Reading...

06 February

Syntholene Energy Corp. Announces $2.0 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it intends to complete a non-brokered private placement of... Keep Reading...

05 February

Angkor Resources Celebrates Indigenous Community Land Titles and Advances Social Programs, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 5, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") is pleased to announce that nine Indigenous community land titles have been formally granted to Indigenous communities in Ratanakiri Province, Cambodia, following a... Keep Reading...

05 February

Syntholene Energy Corp Strengthens Advisory Board with Former COO of Icelandair Jens Thordarson

Mr. Thordarson brings two decades of expertise in operations, infrastructure development, and large-scale business transformation in the aviation industrySyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces the nomination of Jens... Keep Reading...

04 February

The Future of Aviation is Synthetic: Syntholene CEO Highlights Growing Demand for E-Fuel

The global aviation industry is entering a period of rapid transition as airlines seek low-carbon fuel alternatives that meet both performance and regulatory demands. It’s a market Syntholene Energy (TSXV:ESAF,OTCQB:SYNTF) is aiming to supply through its breakthrough synthetic fuel, or... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00