- WORLD EDITIONAustraliaNorth AmericaWorld

June 10, 2024

Element 25 Limited (E25 or Company) (ASX: E25; OTCQX: ELMTF) is pleased to provide an update on activities to investigate the potential to recommence operations at the Company’s 100%-owned Butcherbird Manganese Project in Western Australia (Butcherbird) to take advantage of recent upward movement in manganese ore prices caused by market factors including disruptions at South 32 Limited’s Groote Eylandt (GEMCO) operations1. This may include the sale of stockpiles and or recommencing processing of run-of mine (ROM) stockpiles.

HIGHLIGHTS

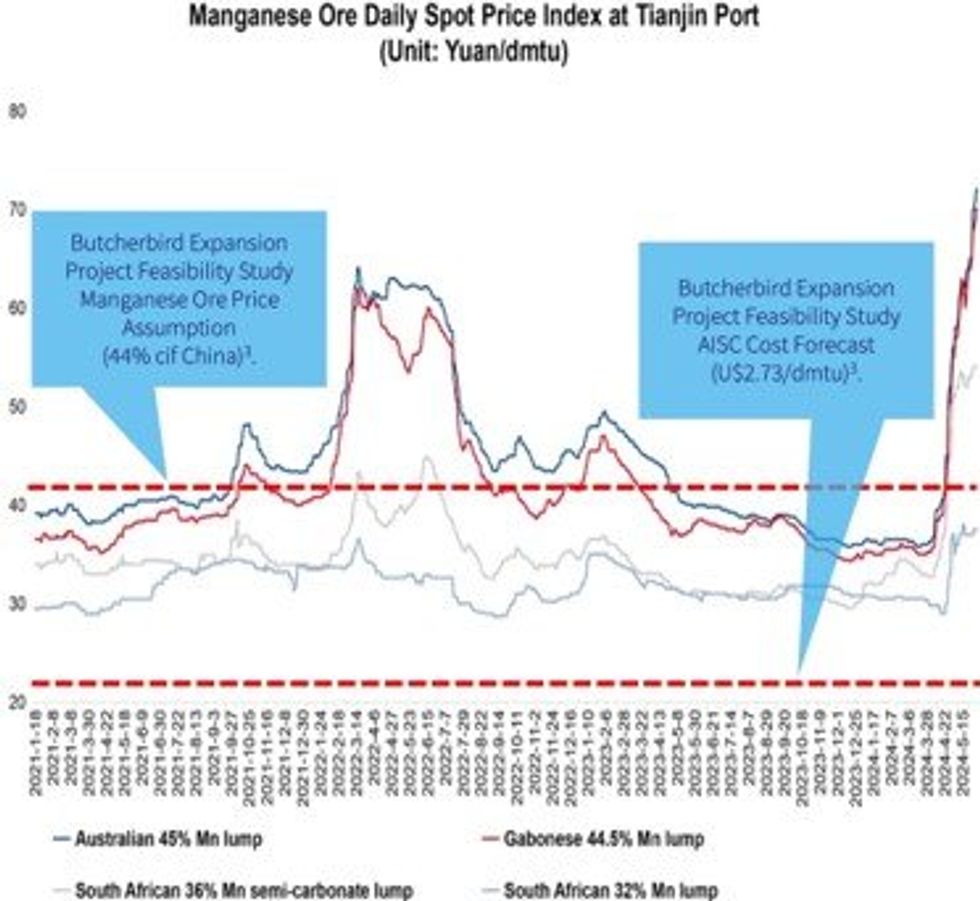

- Manganese ore prices rise to four-year highs to U$8.30/dmtu for 44% cif Tianjin, China1.

- E25 operations team and Board investigating opportunities to process ROM and low-grade stockpiles at Butcherbird.

- If operationally feasible, ore production at current prices presents an opportunity to generate short-term cash flow.

GEMCO’s Groote Eylandt Mine typically produces more than 6M tonnes of high-grade manganese ore a year, and damage to the mine’s haul road and ship loading facilities from Tropical Cyclone Megan in March 2024 has resulted in a forecast supply disruption of up to twelve months. GEMCO is currently targeting a production restart in Q3 2025.2

The loss of GEMCO supply coupled with political instability in South Africa has resulted in a significant and rapid increase in manganese ore prices due to increased competition for available supply. This presents an opportunity to potentially sell stockpiles that are of a lower grade, preventing their previous sale at lower prices but which may be profitable to ship now.

Additionally, ROM stockpiles that have been mined but not yet processed are available at site. The cost structure of a restart is not currently defined, however E25’s Board recognises the potential opportunity of selling existing product stockpiles and/or recommencing the processing of ROM stockpiles at Butcherbird to produce material for sale at current elevated prices. If viable, these activities will occur in parallel with and will not impact the expansion plans for the Butcherbird Project. E25 suspended Butcherbird production in early 2024 during a period of depressed ore prices while readying for an upgrade of facilities to achieve a nominal 1.1Mpta manganese concentrate production, as outlined in a Feasibility Study completed on January 20243.

The expansion of Butcherbird production aligns with E25’s strategy to produce high-purity manganese sulphate monohydrate (HPMSM) at a facility planned to be built in Louisiana, USA, in partnership with global automakers General Motors LLC and Stellantis NV4.

Element 25 Managing Director Justin Brown said:

“A potential restart of Butcherbird’s processing operations at these increased manganese ore prices on a de-risked basis may be an ideal opportunity to monetise existing stockpiles and generate short-term cashflow. E25 looks forward to updating the market further as these investigations are completed and we will continue to monitor ore markets in the meantime to optimise any potential opportunities that may arise.”

Click here for the full ASX Release

This article includes content from Element 25 Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

E25:AU

The Conversation (0)

14 August 2023

Element 25

Australia’s Largest Manganese Resource Driving Multiple Growth Pathways Towards a Zero-Carbon EV Battery-grade Manganese Future

Australia’s Largest Manganese Resource Driving Multiple Growth Pathways Towards a Zero-Carbon EV Battery-grade Manganese Future Keep Reading...

21 April 2024

Goldfields Exploration Update

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to provide an update on gold exploration activities within the Company’s strategic Eastern Goldfields project portfolio. RC drill hole completed under high-grade Blackfriars gold prospect (Gidji JV)New Exploration Licence... Keep Reading...

12 February

Top Australian Mining Stocks This Week: Great Dirt Leads with Rise of Over 155 Percent

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Australia’s mining industry is entering mid-February with electrification and clean energy initiatives continuing to reshape... Keep Reading...

23 January

Top 5 Canadian Mining Stocks This Week: Euro Manganese Gains 134 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.On Monday (January 19), Statistics Canada released the consumer price index (CPI) figures for... Keep Reading...

22 January

Manganese Market Forecast: Top Trends for Manganese in 2026

After taking a bearish turn in late 2024, manganese prices started 2025 on a flat note despite a robust demand outlook supported by growth in the electric vehicle (EV) battery segment. In the first half of 2025, the manganese market experienced mixed signals as supply dynamics shifted and demand... Keep Reading...

04 December 2025

Rubidium Could be Next Frontier for Critical Minerals Exploration, Investment

In the evolving landscape of critical minerals investing, the alkali metal rubidium is increasingly gaining attention as a potential growth opportunity. Historically under the radar compared to lithium, cobalt or rare earth elements, rubidium’s unique properties, constrained supply and emerging... Keep Reading...

12 November 2025

Spartan Metals Touts Eagle Project as Critical Minerals Supply Source to DoD

On the heels of the recent identification of a silver-rich deposit at its Eagle project in Nevada, Spartan Metals (TSXV:W) is ramping up exploration and drilling efforts toward a potential resource estimate.In a recent interview, Spartan President and CEO Brett Marsh highlighted the polymetallic... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00