May 26, 2024

Many Peaks Minerals Limited (Many Peaks or the Company) (ASX: MPK) is pleased to advise drilling has commenced at its Odienné Gold Project (Odienne) located in northwest Côte d’Ivoire. The company has initiated a campaign of concurrent diamond drilling and auger sampling. This follows the recent completion of the Company’s acquisition of 100% ownership of CDI Holdings (Guernsey) Ltd from Turaco Gold Ltd and Predictive Discovery Ltd, which holds the right to acquire an 85% interest in four mineral permits totalling a 1,275km2 land package in Cote d’Ivoire, with recent gold discoveries and over US$4 million in prior exploration expenditure (refer to ASX release dated 8 May 2024)

HIGHLIGHTS

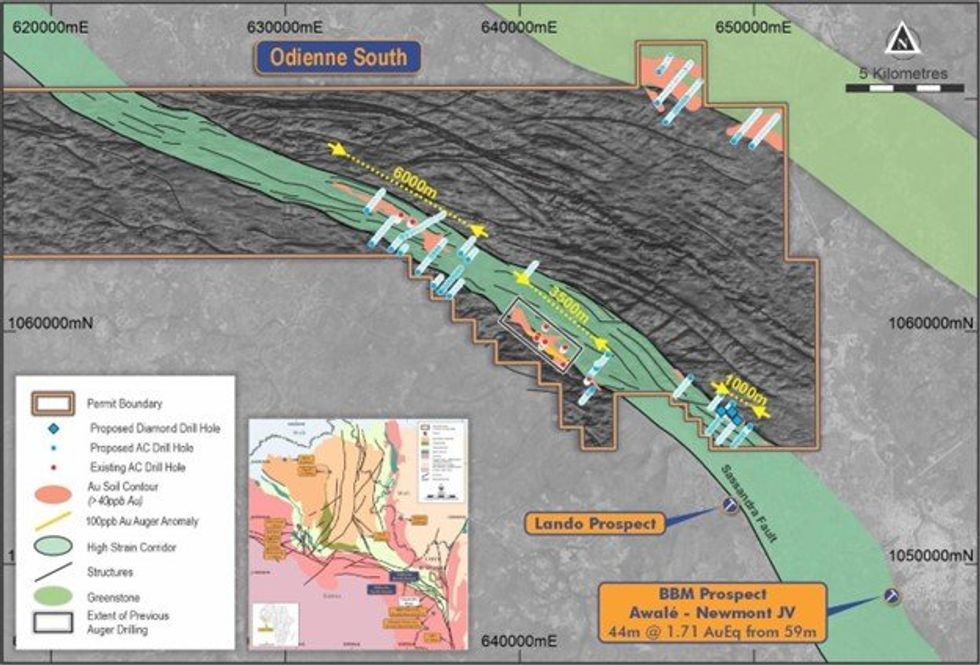

- 6,500m drilling campaign is now underway at the Odienne Project in northwest Côte d’Ivoire

- Current phase of work is comprised of diamond drilling and auger with reconnaissance tests including;

- 1,000m diamond drilling planned in 5 holes on 400m spaced lines to follow-up open gold mineralisation highlighted in preliminary air core programmes completed in late 2023

- 4,000m of auger across three priority gold-in-soil anomalies over more than 20km extent

- 1,500m of auger in first follow-up test of surface gold-in-soil anomalism on a 6km long, sub- parallel structure 11km northeast of previous drilling

- The current campaign comprises reconnaissance drilling across an aggregate 26km extent of gold anomalism on two sub-parallel structural trends associated with the flexure in the high-strain corridor proximal to the margin of the Archean Man craton

- High strain corridor targeted is on trend with the 5.4Moz Au Bankan Project (ASX: PDI), the 2.16Moz Au ABC project (LSE: CEY) and is a contiguous land position with the Awalé Resources (TSXV: ARIC) / Newmont joint venture which is host to multiple recent high-grade gold and copper discoveries

Many Peaks’ Executive Chairman, Travis Schwertfeger commented:

“Through our board’s depth of West African operational experience, we have established an experienced technical team and have quickly advanced to a drill-ready stage at the Odienné Project. We are very excited about follow-up work across the extensive anomalies at Odienné and the opportunity to leverage off quality work by previous explorers generating systematic exploration datasets including high-resolution geophysics and surface geochemistry.

Previous work in combination with the current drilling and geochemical campaign positions Many Peaks to advance an aggressive exploration campaign at Odienné over the coming year, with results of the current campaign expected to define multiple prospects for continued drilling at Odienné to dovetail with commencement of drilling activities at the highly prospective Ferké Project in the 2nd half of the year.”

At Odienne, diamond drilling is in progress with a 1,000m programme following up better gold intercepts from an initial air core drilling campaign, completed in late 2023, targeting a 1km extent of surface gold anomalism in the southeast of the Odienne Project (refer to ASX release dated 26 March 2024) The targeted anomaly is located approximately 10km northwest and along trend of the BBM prospect where ongoing drilling is being completed by the Awalé Resources / Newmont joint venture on the adjoining permit to the south (Figure 1).

The recent air core drilling at Odienne intersected gold mineralisation in a predominantly clay-weathered profile, with only limited information that could be inferred about the mineralisation’s style and key structural controls. The current diamond drill holes will represent the first drilling into fresh rock within the extensive anomalous corridor at the Odienne permit.

In addition to the diamond drill programme, over 5,500m of planned auger drilling is anticipated to increase the resolution of geology and surface geochemistry datasets and enhance the target vectoring of follow up drilling planned for the second half of the year. Three auger rigs with Sahara Geoservices have been mobilised, with extensive auger coverage initiated across an approximately 26km extent of gold-in-soil anomalism on two sub-parallel structural corridors. It is anticipated to be completed over the next four weeks.

Odienne Project

The Odienne Project, comprising two granted exploration permits, cover an aggregate 758km2 in the north- western region of Cote d’Ivoire. The permits are held under an earn-in agreement between Many Peaks’ wholly owned Ivorian subsidiary and a local entity, under which Many Peaks has already earned into a 65% interest in the projects and holds the right to earn an 85% interest by sole funding exploration to feasibility study.

Geologically, the Odienne South permit area lies on the regional scale Sassandra fault which marks the boundary between the Archean Man craton and the Paleoproterozoic Baoule-Mossi domain (Figure 2). Despite hosting comparable stratigraphy to Guinea’s prolific, gold bearing Siguiri basin, the Odienne region remains largely unexplored. However, recent exploration success in the local area include Centamin Mining’s 2.2Moz ABC gold discovery (refer to Centamin PLC (TSX:CEE) announcement dated 19 December 2023 and available on SEDAR+ - Landing Page (sedarplus.ca) and the emerging gold discoveries contiguous with Odienne South by Awalé Resources (Awalé) (TSXV: ARIC) operating in joint venture with Newmont Corporation.

Click here for the full ASX Release

This article includes content from Many Peaks Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MPK:AU

The Conversation (0)

10 September 2024

Many Peaks Minerals

Advancing gold discoveries in Côte d’Ivoire, West Africa

Advancing gold discoveries in Côte d’Ivoire, West Africa Keep Reading...

14 April 2025

Diamond Drilling Commences at Ferke Gold Project

Many Peaks Minerals (MPK:AU) has announced Diamond Drilling Commences at Ferke Gold ProjectDownload the PDF here. Keep Reading...

19 March 2025

Raises A$6.22m to Intensify Drilling at Ferke

Many Peaks Minerals (MPK:AU) has announced Raises A$6.22m to Intensify Drilling at FerkeDownload the PDF here. Keep Reading...

16 March 2025

New High Grade Gold Shoot at Ferke Project

Many Peaks Minerals (MPK:AU) has announced New High Grade Gold Shoot at Ferke ProjectDownload the PDF here. Keep Reading...

11 March 2025

AC Drilling Commences on Priority Targets at Ferke Project

Many Peaks Minerals (MPK:AU) has announced AC Drilling Commences on Priority Targets at Ferke ProjectDownload the PDF here. Keep Reading...

23 February 2025

Reconnaissance AC Drilling Yield Structural Targets

Many Peaks Minerals (MPK:AU) has announced Reconnaissance AC Drilling Yield Structural TargetsDownload the PDF here. Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00