May 27, 2024

Aurum Resources Limited (ASX: AUE) (Aurum) is pleased to report high-grade gold intercepts from step-back diamond hole at BD Target 1 as part of ongoing diamond drilling at its Boundiali Gold Project in Côte d'Ivoire, West Africa.

Highlights

- Step-back diamond drilling (355.5m) at BD Target 1 on the Boundiali BD tenement returns shallow, wide high-grade gold hits1 including:

- 12.22m @ 14.56 g/t Au from 275m inc. 1m @ 163.42 g/t Au (DSDD0051)

- Intercept is ~60m down dip from 4m @ 22.35 g/t Au from 226m (DSDD0004)2 and ~230m below surface and gold mineralisation remains open

- BD Target 1 is a 1.3km by 1km wide gold prospect within a 13km by 3km gold mineralised corridor

- More assay results from BD Targets 1, 2 and 3 are expected over the coming weeks

- Drill program is ongoing with more than 30,000m of diamond drilling planned for this year

- Aurum has three rigs on site and will increase to four diamond rigs drilling ~6,000m per month

- Aurum is targeting an initial Mineral Resource Estimate for Boundiali in late CY2024

- Aurum has a strong cash balance of ~A$5M (unaudited) to support its aggressive drill program.

Aurum’s Managing Director Dr. Caigen Wang said: “We are very pleased to see this project best result for BD target 1 with DSDD0051 hitting 1m @ 163.42 g/t Au within an interval of 12.22m @ 14.56 g/t Au from 275m. This interval was 60m down dip from 4m @ 22.35 g/t Au (DSDD0004) and the system remains open as we systematically step out along strike and step back to test down dip.

We will soon have four diamond drill rigs working at Boundiali as we increase our drilling rate to ~6,000m per month. We are in an incredibly target-rich environment as our geology team adds new targets to test at BD within the 13km by 3km gold corridor.

We are leveraging the work completed by previous explorers at Boundiali and thanks to our supportive shareholders are well funded. Our aggressive drilling ensures consistent news flow as we build on the encouraging results to date from known targets on the BD and BM tenements and look forward to testing new targets whilst we aim to deliver inaugural JORC resources for Boundiali by late 2024.”

BD Target 1 - Latest Drill Results

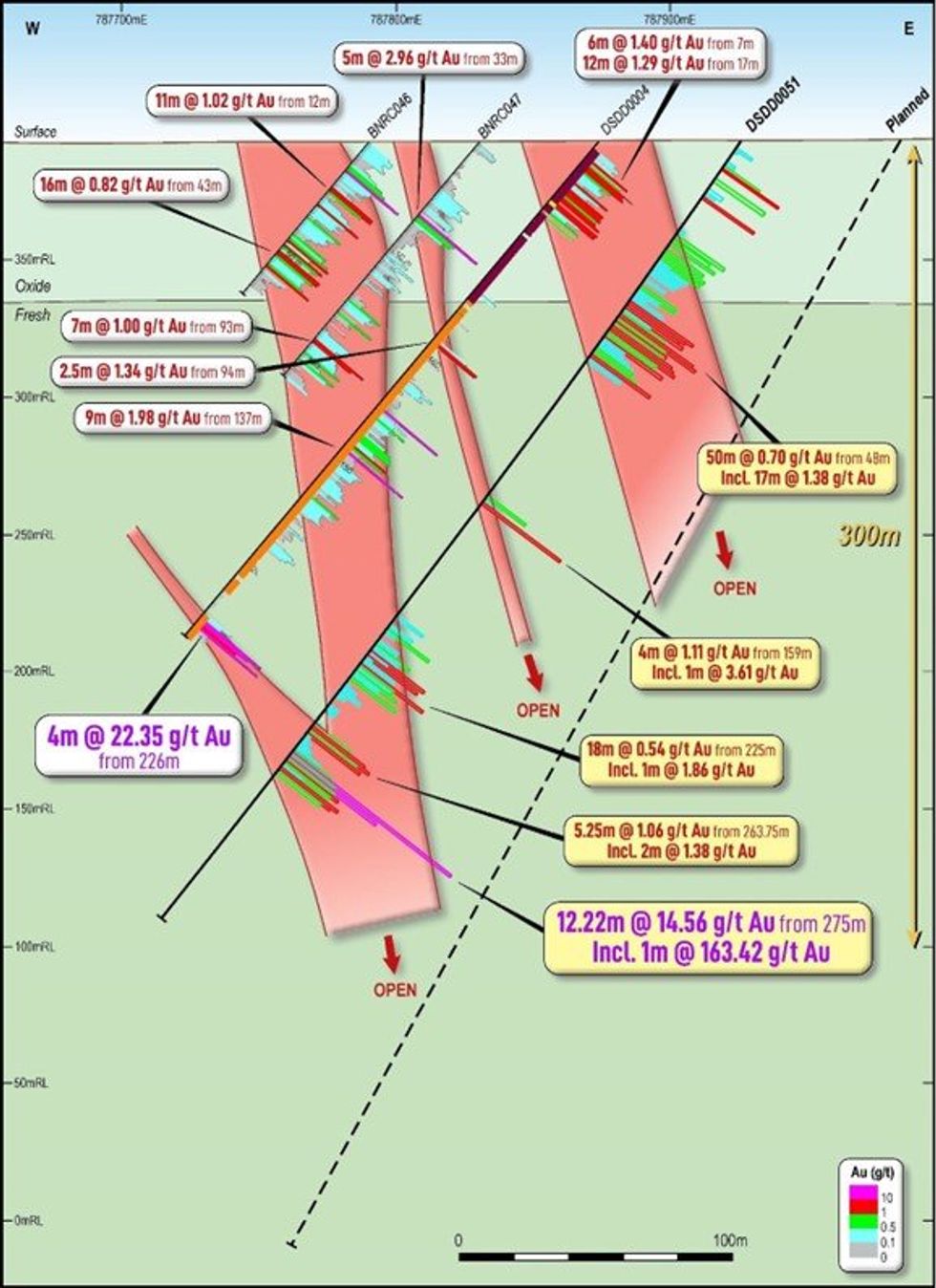

Assay results reported in this release are from DSDD0051, a 355.5m step-back diamond hole drilled at BD Target 1. Aurum has intersected gold mineralisation (12.22m @ 14.56 g/t Au from 275m inc. 1m @ 163.42 g/t Au) in DSDD0051, 60m down dip of 4m @ 22.35 g/t Au from 226m (DSDD0004) and approximately 230m below surface. This target remains open with further drilling planned. Assay results for this hole3 include:

- 12.22m @ 14.56 g/t Au from 275m inc. 1m @ 163.42 g/t Au & 50m @ 0.70 g/t Au from 48m inc. 17m @ 1.38 g/t Au (DSDD0051)

These new results are in addition to diamond holes drilled at BD Target 1 and reported previously on 1 March 2024, 12 March 2024 and 10 May 2024 which include:

- 73m @ 2.15g/t Au from 172m inc. 4m @ 18.63g/t Au (DSDD0012)

- 36m @ 2.53 g/t Au from 104m inc. 16m @ 5.03 g/t Au (DSDD0011)

- 59m @ 1.42 g/t Au from 68m inc. 13m @ 3.92 g/t Au (DSDD0010)

- 90m @ 1.16 g/t Au from 143m inc. 51m @ 1.04 g/t Au & 35m @ 1.47 g/t Au (DSDD0050)

- 4m @ 22.35 g/t Au from 226m, which is 173m vertically below surface (DSDD0004)

- 22m @ 1.98g/t Au from 35m inc. 9m @2.76g/t Au (DSDD0003)

- 14m @ 1.65g/t Au from 76m inc. 5m @ 3.07 g/t Au (DSDD0007)

- 4m @ 22.35 g/t Au from 226m, which is 173m vertically below surface (DSDD0004)

These shallow wide high-grade gold intercepts are predominately from the hanging wall lodes at BD target 1 and true widths estimated at around 70% - 80% of reported downhole lengths.

Details of drill collar location and assay results for DSDD0051 from drilling on BD Target 1 can be found in Table 1 and Table 2 respectively. Plans showing location of the Boundiali Gold Project including locating the assay results are presented in (Figure 2 to Figure 6) and a cross section of these latest drill results can be found in Figure 1.

Gold mineralisation remains open along strike and at depth on all prospects, with drilling ongoing and further work being planned. A program of trenching is underway to define additional high priority targets for drill testing within the 13km by 3km gold mineralised corridor sitting outside of the three defined gold prospects.

Click here for the full ASX Release

This article includes content from Aurum Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 September 2025

Aurum Resources

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa.

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa. Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00