January 30, 2024

Galan Lithium Limited (ASX: GLN) (Galan or the Company) is very pleased to announce that it is undertaking an equity raising of A$19.51 million having secured firm commitments of A$18.0 million to institutional, sophisticated and professional investors (Placement) and intends to undertake a non- underwritten Share Purchase Plan (SPP) offer of A$1.5 million to existing Galan shareholders.

Highlights:

- Galan has received firm commitments to raise A$18 million at A$0.46 per share

- Strong support received from offshore and domestic institutional and sophisticated investors, with the Placement oversubscribed

- Galan board and management to subscribe for A$1.5 million subject to shareholder approval

- Funds will be used for ongoing HMW Phase 1 development costs, exploration and resource work, corporate overheads and working capital

The equity raising enhances Galan’s balance sheet by providing additional working capital and financial flexibility during Hombre Muerto West (HMW) Phase 1 construction and provides sufficient working capital headroom whilst Galan finalizes negotiations of alternative funding solutions including debt and prepayment facilities that will enable completion of HMW Phase 1. Proceeds from the Placement will be applied to:

- Remaining HMW phase 1 developments costs;

- Exploration and resource work; and

- Corporate overheads, working capital and transaction costs

Canaccord Genuity (Australia) Limited and Jett Capital Advisors LLC acted as Joint Lead Managers and Bookrunners to the Placement.

Galan’s Managing Director, Juan Pablo (JP) Vargas de la Vega, commented: “We are very pleased with the outcome of the placement considering the tougher market conditions at the moment. The strong support from both new and existing institutional investors is a clear endorsement of Galan’s timely path to low cost, Phase 1 production at its 100% owned Hombre Muerto West lithium brine project in Argentina.”

Placement

Under the Placement, the Company will issue 35,869,565 fully paid ordinary shares in the Company at A$0.46 per share (New Shares) plus 35,869,565 quoted options (exercisable at $0.65 with a 5 year exercise period) (New Options), raising a total of A$16.5 million (before costs), to institutional, sophisticated and professional investors. Additionally, Galan director’s will be subscribing for 3,260,870 New Shares plus 3,260,870 New Options on the same terms raising a total of A$1.5 million (before costs) (“Director Placement”) in a second tranche that will be subject to shareholder approval at a forthcoming General Meeting (GM).

The issue price of A$0.46 per share, represents a 14.8% discount to the last closing price of A$0.54 on 25 January 2024 and a 23.5% discount to the 15-day VWAP of A$0.60 as at the same date.

The New Shares and New Options will be issued under the Company’s existing placement capacity under ASX Listing Rules 7.1 and 7.1A. The Placement is not underwritten.

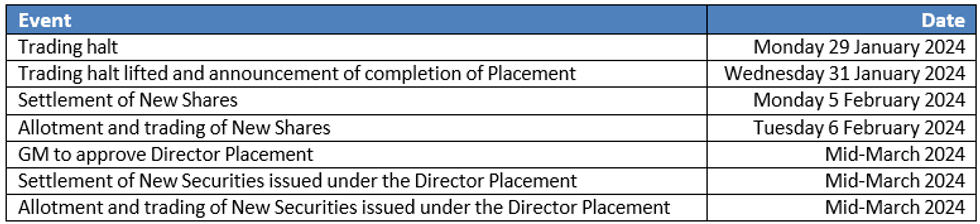

Indicative Placement Timetable

*These dates are indicative only. The Company reserves the right to vary the dates without notice.

Share Purchase Plan (SPP)

In addition to the Placement, the Company will offer all eligible existing Australian and New Zealand shareholders (including retail shareholders) the opportunity to apply for new GLN shares, at the same issue price and same terms and conditions as the Placement. The issue price will be $0.46 per share and will include one listed option (exercisable at $0.65 with a 5 year exercise period) on a one for one basis, without brokerage fees.

Galan intends to raise up to A$1.5 million and retains discretion over the allocation of shares per investor. The SPP will allow eligible shareholders to apply for the maximum allowed of $30,000 of new fully paid ordinary shares, per shareholder.

The SPP is not underwritten. An SPP booklet containing further terms and conditions of the SPP is expected to be provided to eligible shareholders in the next week or so.

Click here for the full ASX Release

This article includes content from Galan Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLN:AU

The Conversation (0)

20 April 2025

Galan Lithium

Developing high-grade lithium brine projects in Argentina

Developing high-grade lithium brine projects in Argentina Keep Reading...

24 August 2025

Successful Due Diligence Ends - $20M Placement To Proceed

Galan Lithium (GLN:AU) has announced Successful Due Diligence Ends - $20m Placement To ProceedDownload the PDF here. Keep Reading...

01 August 2025

Final At-The-Market Raise for 2025

Galan Lithium (GLN:AU) has announced Final At-The-Market Raise for 2025Download the PDF here. Keep Reading...

30 July 2025

Quarterly Activities and Cash Flow Report

Galan Lithium (GLN:AU) has announced Quarterly Activities and Cash Flow ReportDownload the PDF here. Keep Reading...

25 July 2025

Incentive Regime for HMW Project in Argentina

Galan Lithium (GLN:AU) has announced Incentive Regime for HMW Project in ArgentinaDownload the PDF here. Keep Reading...

24 July 2025

Trading Halt

Galan Lithium (GLN:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00