Vizsla Copper Corp. (TSXV: VCU) (OTCQB: VCUFF) ( FRANKFURT : 97E0) (" Vizsla Copper " or the " Company ") is pleased to announce the acquisition of a 100% interest in the 37,466 hectare Copperview project (the " Copperview Project ") in the Aspen Grove area of south-central BC (the " Copperview Acquisition "). The Project is prospective for copper-gold porphyry-related mineralization.

HIGHLIGHTS

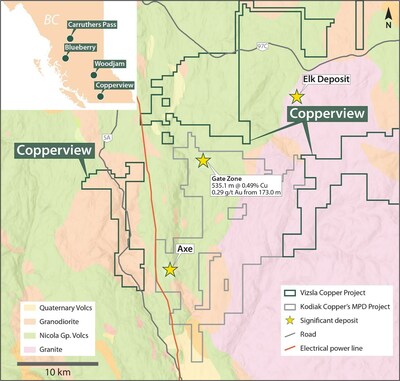

- Potential: The Copperview Project is located less than 4 kilometres north (and along trend) of Kodiak Copper's Gate Zone discovery (best drill intersection to date is 535.1m @ 0.49% Cu, 0.29 g/t Au from 201.9m in drill hole MPD-20-04) on the MPD property ("MPD").

- Prospective Geology: Mapping by the British Columbia Geological Survey indicates that prospective Nicola Gp. volcanic rocks extend northward from the MPD project to the Copperview Project claims where they are largely covered by a thin veneer of glacial till.

- Producing Mines: The Copperview Project is located within a prolific copper, gold and molybdenum mining region of the southern Quesnel Terrane; 50 kilometres north of the Copper Mountain mine, 65 kilometres southeast of the Highland Valley mine, and 90 kilometres south of the New Afton mine.

"This is an excellent and timely acquisition for Vizsla Copper and is a great example of our strategy of putting our foot on as much prospective copper ground as we can," commented Craig Parry, Executive Chairman . "Global electrification and a dwindling copper supply story will result in an exciting copper market going forward. "

"I'm very pleased to add the Copperview Project to the Vizsla Copper fold," commented Steve Blower , Vice President of Exploration . "The geology at Kodiak Copper's MPD project is interpreted to extend to the north onto the Copperview Project claims. In addition to Woodjam, where our inaugural drilling campaign is set to begin shortly, this is now also a high priority project for us and exploration will begin this year."

The Copperview Project

The Copperview Project consists of 37,466 hectares in 40 claims and is being acquired from Donald Rippon of Mineworks Ventures Inc. (the "Vendor" ) pursuant to a purchase agreement dated June 19, 2023 (the " Copperview Purchase Agreement "). A block of seven claims comprising 9,043 contiguous hectares (Figure 1) is considered the highest priority and will likely see significant exploration effort in the near term. This block is considered highly prospective for copper/gold porphyry-related mineralization due to its proximity to the Gate zone at MPD, which is on trend with and less than 4 kilometres to the south of the Copperview Project. Discovered by Kodiak Copper in 2019, drilling at the Gate zone has outlined a large 350m x 1km x 900m zone of copper/gold porphyry-related mineralization. The best drill intersection to date is 535.1m @ 0.49% Cu, 0.29 g/t Au from 201.9m in drill hole MPD-20-04 1 . The Copperview Project claim block is interpreted to be underlain by eastern facies Upper Triassic Nicola volcanics with local coeval intrusions – similar to MPD, and the Copper Mountain and New Afton mines.

Terms of the Deal

Pursuant to the terms of the Copperview Purchase Agreement, the Company will issue 600,000 common shares of Vizsla Copper to the Vendor (the " Consideration Shares "), grant him a 2% net smelter return royalty (" NSR ") and pay $5,000 cash in exchange for a 100% interest in the Copperview Project. One half of the NSR may be bought back from the Vendor for $3 million . The Consideration Shares will be subject to a voluntary one-year release schedule such that one-third of the Consideration Shares will be released every four months after the closing date of the Copperview Acquisition. The Copperview Acquisition is subject to standard closing conditions, including the approval of the TSX Venture Exchange (the " TSXV "). Subject to receiving the approval of the TSXV, and the satisfaction of the remaining closing conditions, the Copperview Acquisition is expected to close in the coming weeks.

Figure 1 – Copperview Project Location and Geology

RG Copper Acquisition Update

Vizsla Copper is also pleased to provide an update on its previously announced acquisition of RG Copper Corp. (" RG Copper ") pursuant to a share exchange agreement dated May 10, 2023 (the " RG Copper Acquisition ").

As disclosed by the Company on May 12, 2023 , RG Copper has the right to acquire up to a 70% interest in the Redgold Copper-Gold Project (the " Redgold Project ") pursuant to an option agreement entered into with the owners of the Redgold Project (the " Underlying Option Agreement ").

In connection with the RG Copper Acquisition, the Company, RG Copper and the owners of the Redgold Project (the " Underlying Owners ") have amended the terms of the Underlying Option Agreement. Pursuant to the amended terms, RG Copper may acquire up to a 70% interest in the Redgold Project by meeting the following requirements:

- RG Copper must pay $500,000 ( $50,000 paid), incur eligible expenditures of $2,000,000 and issue 400,000 common shares and an additional $400,000 in common shares prior to October 1, 2026 to earn a 51% interest.

- RG Copper has the option to increase its interest in the Redgold Project from 51% to 70% by paying an additional $500,000 , incurring an additional $2,000,000 of eligible expenditures and issuing an additional $500,000 in common shares prior to October 1, 2028 .

- RG Copper will grant the Underlying Owners a 2.5% net smelter royalty (subject to a buy down to 1.0% for $2,000,000 ), which will come into effect if and when the Underlying Owners' collective participating interest in the Redgold Project is diluted to less than or equal to 15%.

Any shares issued to the Underlying Owners pursuant to the Underlying Option Agreement will be subject to a floor price of $0.17625 per share (the " Floor Price "), resulting in a maximum of 5,106,384 common shares of the Company being issued. The Company has also agreed to make maximum cash payments of $644,681 to the Underlying Vendors if the value of the Company's common shares is below the Floor Price on the relevant issuance date.

The RG Copper Acquisition remains subject to standard closing conditions, including the approval of the TSXV. Subject to receiving the approval of the TSXV, and the satisfaction of the remaining closing conditions, the RG Copper Acquisition is expected to close in the coming weeks.

Additional details regarding the RG Copper Acquisition and the Redgold Project are set out in the Company's news release dated May 12, 2023 .

Technical Information

- See Kodiak Copper's news release dated September 3, 2020 , which is available at www.sedar.ca

About Vizsla Copper

Vizsla Copper is a Cu-Au-Mo focused mineral exploration and development company headquartered in Vancouver, Canada . The Company is primarily focused on its flagship Woodjam project, located within the prolific Quesnel Terrane, 55 kilometers east of the community of Williams Lake, British Columbia . It now has four additional copper exploration properties; Copperview, Redgold, Blueberry and Carruthers Pass , all well situated amongst significant infrastructure in British Columbia . The Company's growth strategy is focused on the exploration and development of its copper properties within its portfolio in addition to value accretive acquisitions. Vizsla Copper's vision is to be a responsible copper explorer and developer in the stable mining jurisdiction of British Columbia, Canada and is committed to socially responsible exploration and development, working safely, ethically and with integrity.

Vizsla Copper is a spin-out of Vizsla Silver (TSX.V: VZLA) (NYSE: VZLA) and is backed by Inventa Capital Corp., a premier investment group founded in 2017 with the goal of discovering and funding opportunities in the resource sector. Additional information about the Company is available on SEDAR ( www.sedar.com ) and the Company's website ( www.vizslacopper.com ).

Qualified Person

The Company's disclosure of technical or scientific information in this press release has been reviewed and approved by Ian Borg , P.Geo., Senior Geologist for Vizsla Copper. Mr. Borg is a Qualified Person as defined under the terms of National Instrument 43-101. Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Copperview Project.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

The information contained herein contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including, without limitation, planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Forward-looking statements in this news release include, among others, statements relating to: obtaining required regulator approvals for the Copperview Acquisition and the RG Copper Acquisition; satisfying the requirements of the Underlying Option Agreement; the exploration and development of the Woodjam Project, Redgold Project and Copperview Project; and the Company's growth and business strategies.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the results of planned exploration activities are as anticipated, the anticipated cost of planned exploration activities, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company's planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves or resources, the limited operating history of the Company, the influence of a large shareholder, aboriginal title and consultation issues, reliance on key management and other personnel, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, availability of third party contractors, availability of equipment and supplies, failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

SOURCE Vizsla Copper Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/June2023/20/c6290.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/June2023/20/c6290.html