February 20, 2024

Oceana Lithium Limited (ASX: OCN, “Oceana” or “the Company”) is pleased to add uranium to the target list of prospective elements at its 100% owned Napperby Project in the Northern Territory, Australia.

Highlights

Napperby Project, Northern Territory, Australia

- Oceana’s Napperby Project covers some of Arunta Province’s hottest granites plutons, the Wangala Granite (uranium) and Ennugan Mountains Granite (uranium/thorium)

- Both granite plutons show outstanding uranium/thorium ratios and are almost fully encapsulated within Napperby’s EL32836 and ELA32841

- Follow-up exploration activities will target uranium and Rare Earth Elements (REEs) in parallel with Lithium-Caesium-Tantalum (LCT) pegmatites

The project is located within the highly prospective Arunta Province, which is endowed with some of the most prospective rocks for lithium, Rare Earth Elements (REEs) and uranium mineralisation in the Northern Territory.

The Paleoproterozoic Wangala and Ennugan Mountains granites have long been recognised as “Hot Granites” and known to be anomalously enriched in a range of elements including U, Th, P, F and REEs.

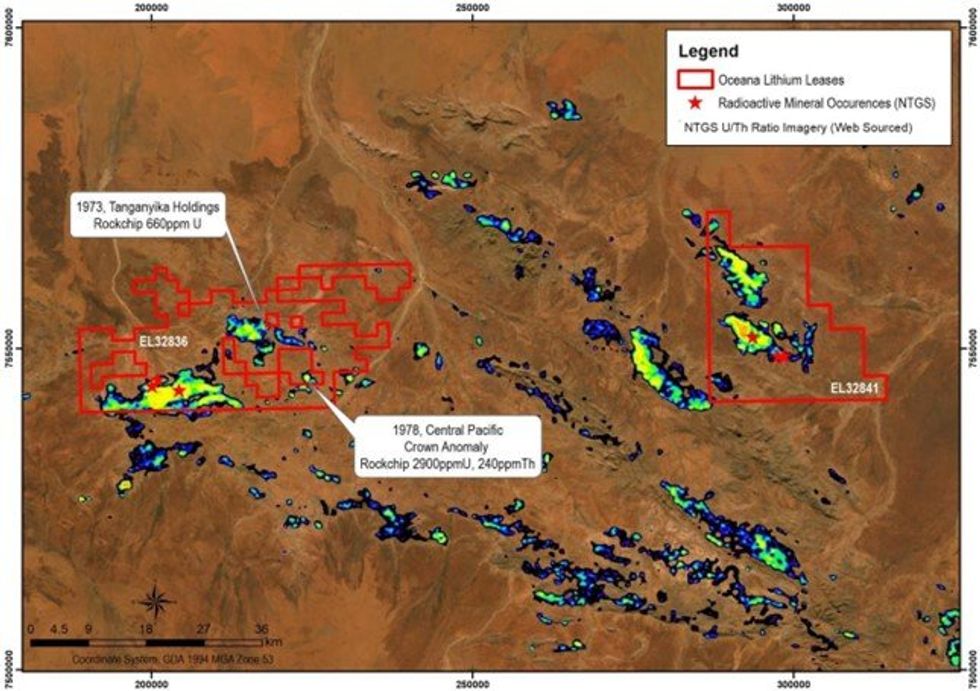

As shown in Figure 1, both granite plutons show outstanding Uranium/Thorium ratios and are almost fully encapsulated within Oceana’s Napperby Project leases EL32836 and ELA32841 (under application).

Over the years, several mineral occurrences with uranium and uranium/thorium have been recorded by the Northern Territory Geological Survey, with uranium being more common in the Wangala Granite and uranium/thorium occurring in the Ennugan Mountains Granite.

Further to the south in the Ngalia Basin there are several mineral occurrences and deposits recorded including the Napperby Uranium Deposit, with a JORC 2012 Inferred Mineral Resource of 9.54Mt at 382ppm U3O8 (refer to Core Exploration Ltd - ASX Announcement dated 12/10/2018) and the Cappers Deposit where Air Core hole NAC122 intercepted 2.2m @ 211ppm U3O8 from 3.55m (refer to Energy Metals - ASX Announcement dated 17/09/2009).

The following passages are taken from the independent geological report included in the Oceana’s prospectus and are still very relevant today.

Recent publications by the Northern Territory Geological Survey refer to the Wangala Granite as a composite multi-phase pluton that has been subject to a late hydrothermal event of ca 1575Ma (Chewings) age, which has introduced phosphorus, uranium, fluorine, tin, tungsten and REEs.

Of particular interest is a poorly exposed muscovite-rich granite with abundant pegmatite bodies at the eastern end of the pluton, believed to be the final phase of intrusion. This phase is especially fertile for both Niobium-Yttrium-Fluorine (NYF) and Lithium-Caesium-Tantalum (LCT) segregations in pegmatite, yet surprisingly there are very few analyses for lithium. Bed-rock interpretation indicates this phase is extensive in the sub-crop beneath alluvial-colluvial flats.

This area has been subject to shallow geochemical drilling mainly for uranium exploration in the 1970s, but there is no information on the lithological and geochemical nature of the bedrock.

The contact zones and the eastern termination of the Wangala pluton against Lander Formation are highly prospective for rare-element pegmatites and REEs but still totally unexplored.

The Ennugan Mountains Granite of 1621 Ma (post Yambam) age is a two-phase pluton. The southern phase is an I-type biotite-hornblende granite which implies derivation from lower crustal melting. It is characterised by lenses of biotite schist with elevated uranium, thorium, phosphorus, fluorine and REEs.

Click here for the full ASX Release

This article includes content from Oceana Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

OCN:AU

The Conversation (0)

12 March 2024

Oceana Lithium

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00