February 05, 2025

Arizona Lithium Limited (ASX: AZL, AZLO, OTC: AZLAF) (“Arizona Lithium”, “AZL” or “the Company”), a company focused on the sustainable development of two large lithium development projects in North America, the Prairie Lithium Project (“Prairie”) and the Big Sandy Lithium Project (“Big Sandy”), is pleased to provide a progress update for the commercial scale proof of concept facility at Pad #1 and further outlay the development plan for the Prairie Project. The Prairie Project will be put into production across three phases of development. Phases I, II, and III represent the methodical steps being taken to cost-effectively bring the project into production while minimising the risk associated with commercialising a first-of-its-kind process.

HIGHLIGHTS

- Updated strategic phased development plan has been implemented for the Prairie Lithium Project.

- Phase I will see the Prairie Lithium Project go into production at Pad #1 using a commercial-scale DLE unit capable of producing 150tpa of Lithium Carbonate Equivalent (LCE).

- To get into production, only AUD35m (USD22m) required to spend on Phase 1 CAPEX.

- Non-dilutive capital initiatives currently being considered with multiple potential strategic partners completing extensive due diligence on the Prairie Lithium Project, in addition to existing Government grants and loans being considered as well as traditional debt financing solutions.

- First commercial production marks the first Company in North America to reach this milestone.

- De-risking by a commercial scale proof of concept allows production to be increased by rapid replication of the process at Pad #1.

- Construction work will commence at Pad #1 in Q2 2025.

- Phase 2 will immediately expand the facility with additional commercial-scale DLE units. Additional units can be rapidly deployed to increase production at Pad #1. Phase III will see the Pad design replicated across the already drilled and de-risked Pad #2, and Pad #3. Additional Pad locations are also being finalised in 2025.

- Grey Owl Engineering has been engaged for facility engineering, procurement, and construction (EPC). Grey Owl is a leading Western Canadian oil & gas facilities engineering company.

- The Prairie Lithium Project in Canada is perfectly positioned to feed battery-grade lithium carbonate into the mature Asian battery market. Battery-grade samples produced from the Prairie project are currently being distributed and tested in Asia.1

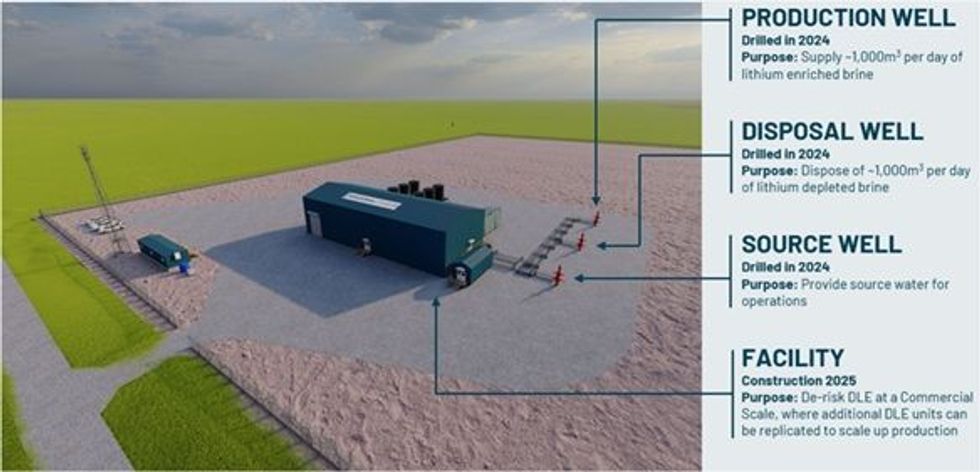

Phase I will see the project go into production at Pad #1 using a commercial-scale Direct Lithium Extraction (“DLE”) unit capable of producing 150 Tonnes Per Annum (“TPA”) Lithium Carbonate Equivalent (“LCE”). The lithium produced will be used to de-risk end market opportunities where battery-grade samples are currently being tested by interested groups in Asia. Phase I will process brine at a rate of approximately 1,000m3 per day. It is critical to process raw brine at this commercial scale to de-risk the temperature, pressure and chemical constituents of the brine while feeding a commercial scale DLE unit 24 hours per day, 7 days a week. A video rendering of Phase I at Pad #1 has been prepared and can be viewed here: https://youtu.be/mUNExsUBjfo

This will represent one of the world's largest DLE facilities and provide the guidance required to scale up production cost-effectively across the Prairie Project shortly thereafter. Upon commissioning and operating at this scale, the Company will have significantly de-risked the process and proceed to Phase II.

Phase II will see the immediate expansion of production on Pad #1. Phase II expansion will highlight the benefits of modularised scale-up as additional commercial-scale DLE units will be rapidly deployed. Additional wells will also be drilled to maximise production from Pad #1.

Phase III will see the replication of the wells and facility at Pad #1, applied to Pad #2, Pad #3 and additional Pads that are currently being identified.

Arizona Lithium Managing Director, Paul Lloyd, commented: “We are excited to share additional details about our plans for the Prairie Project. In 2023, a PFS was released that highlighted lithium production across three pad locations from the Prairie Project. In 2024, we partnered with three landowners to secure the three pad locations and immediately went to work permitting and clearing the ground for the pads. A major drilling program was then executed across those three pads, which significantly de-risked the project and put us in a position to continue development toward production. 2025 will be a year of facility construction and commissioning Phase I at Pad #1. Our phased development plan clearly articulates how we will continue to de-risk and develop the project. Modularisation allows rapid and cost-effective scale-up to increase production in Phase II and III.”

About the Prairie Lithium Project

AZL’s Prairie Lithium Project is located in the Williston Basin of Saskatchewan, Canada. Located in one of the world’s top mining friendly jurisdictions, the project has easy access to key infrastructure including electricity, natural gas, fresh water, paved highways, and railroads. The project also aims to have strong environmental credentials, with Arizona Lithium targeting to use less freshwater, land and waste, aligning with the Company’s sustainable approach to lithium development.

Click here for the full ASX Release

This article includes content from Arizona Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00