October 27, 2024

Tartana Minerals Limited (ASX: TAT) (the Company), is pleased to advise that it has received assays and metallurgical testwork based on sampling the D15 metallurgical hole drilled in May this year. D15 hole was a diamond hole drilled at initially PQ size and decreasing to HQ size and drilled to 300 metres depth and was drilled parallel and below TRC098 which had previously intersected 77 m @ 0.62% Cu.

Highlights:

- Tartana D15 assays confirm broad zones of copper mineralisation including 76 m @ 0.60% Cu, 178 m @ 0.40% Cu or 221 m @ 0.35% Cu, all from 31 m depth downhole.

- Excellent copper recoveries (89%) to saleable copper concentrate when testing a sample that was below the resource grade average.

- Bulk Sample Tomra ore sorting results indicate that using this process will result in a 72% grade increase and recover 71% of the contained copper.

- Mineralisation trends indicates the presence of a higher grade zones (1 million tonnes @ 0.82% Cu) enabling the potential for a high grade starter pit with the remaining resource at 8.5 million tonnes @ 0.38 % Cu which can be upgraded if required.

- The results form part of a Scoping Study which will investigate options for third party processing and/or installation of a copper sulphide crushing, milling and flotation plant or a combination of both. This is separate from the current copper sulphate pentahydrate production which is ongoing.

The hole was successfully completed on 13th May 2024. The assay and metallurgical data have now been received and as discussed below, have returned positive results which can be incorporated into a Scoping Study which will also consider processing options. These options include third party processing and/or installation of a copper sulphide crushing, milling and flotation plant and which may be a combination of both.

Tartana Primary Copper Mineralisation

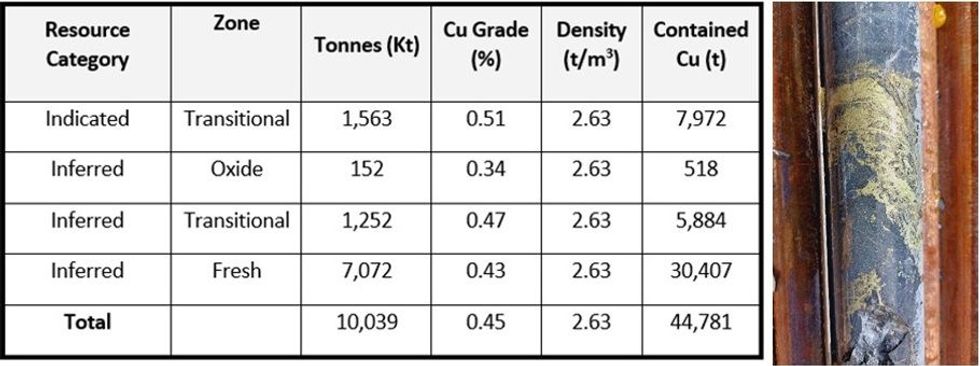

The Company has previously advised the presence of primary copper (chalcopyrite) mineralisation below the Tartana pit floor and in early 2023 reported 45,000 tonnes of contained copper resource to 130 m depth (see ASX release dated 9 February 2023). The details are outlined in Figure 1.

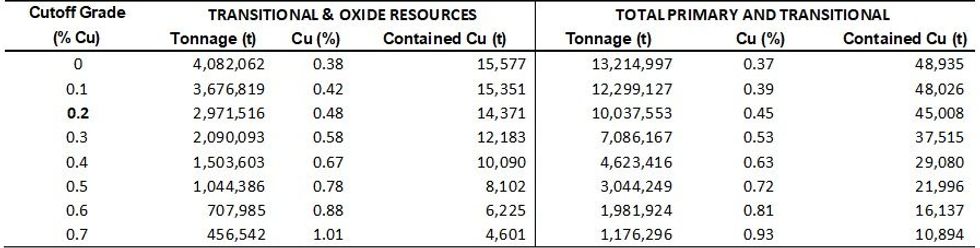

The resource grade and tonnage for the total primary and transitional resources at different cut-off grades are presented in Figure 2.

The Company has designed a drilling programme with a target of increasing the current resource to greater than 100,000 tonnes of contained copper which includes drilling to test mineralisation below 130 m depth and also shallower mineralisation on the periphery of the resource.

However, prior to embarking on this drilling campaign, in May 2024 the Company drilled a metallurgical test hole (D15). This was a diamond hole drilled with large diameter core commencing with PQ size and then reducing to HQ core to increase the recovered core sample. It was drilled to 300 metres depth and was drilled parallel and below TRC098 which had previously intersected 77 m @ 0.62% Cu although D15 was drilled beyond the edge of the existing resource. The purpose of the hole was to:

- Test mineralisation trends including continuity downdip from TRC098 and other nearby holes and beyond the existing resource.

- Check assay grade variability between chips from the earlier RC drilling and diamond drill core.

- Inspect geological features such as lithologies, bedding trends and structural logging.

- Provide an adequately sized sample for flotation and recovery testwork to produce a saleable copper concentrate.

- Provide a large bulk sample for testing for Tomra ore sorting

The hole was successfully drilled and completed on 13th May 2024. An outline of the findings is presented below.

Click here for the full ASX Release

This article includes content from Tartana Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TAT:AU

The Conversation (0)

12 August 2025

Financing Update and AGM Date

Tartana Minerals (TAT:AU) has announced Financing Update and AGM DateDownload the PDF here. Keep Reading...

31 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Tartana Minerals (TAT:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

13 May 2025

Director led financing and change of Chairman

Tartana Minerals (TAT:AU) has announced Director led financing and change of ChairmanDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Tartana Minerals (TAT:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

24 April 2025

Beefwood Project Clarification and Drilling Update

Tartana Minerals (TAT:AU) has announced Beefwood Project Clarification and Drilling UpdateDownload the PDF here. Keep Reading...

3h

How to Invest in Gold Royalty and Streaming Stocks

Gold royalty companies offer investors exposure to gold and silver with the benefits of diversification, lower risk and a steady income stream. Royalty companies operating in the resource sector will typically agree to provide funding for the exploration or development of a resource in exchange... Keep Reading...

3h

How Would a New BRICS Currency Affect the US Dollar?

The BRICS nations, originally composed of Brazil, Russia, India, China and South Africa, have had many discussions about establishing a new reserve currency backed by a basket of their respective currencies. The creation of a potentially gold-backed currency, known as the "Unit," as a US dollar... Keep Reading...

7h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

10h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

23 February

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23 February

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00