Investor Insight

Tartana Minerals is a new copper producer with strong cash flow and a substantial exploration footprint in a tier 1 mining jurisdiction. Tartana Minerals is creating shareholder value through investment in increasing its existing copper, zinc and gold resources and accelerating exploration of key projects within its highly prospective exploration portfolio. Tartana Minerals presents a compelling investment against a strong macroeconomic environment for copper.

Overview

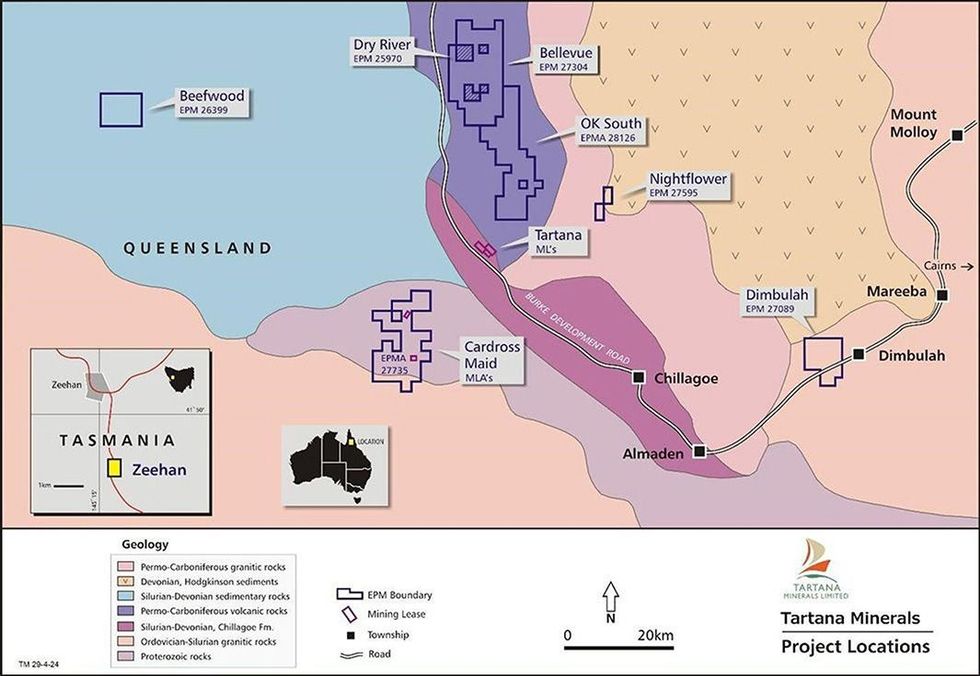

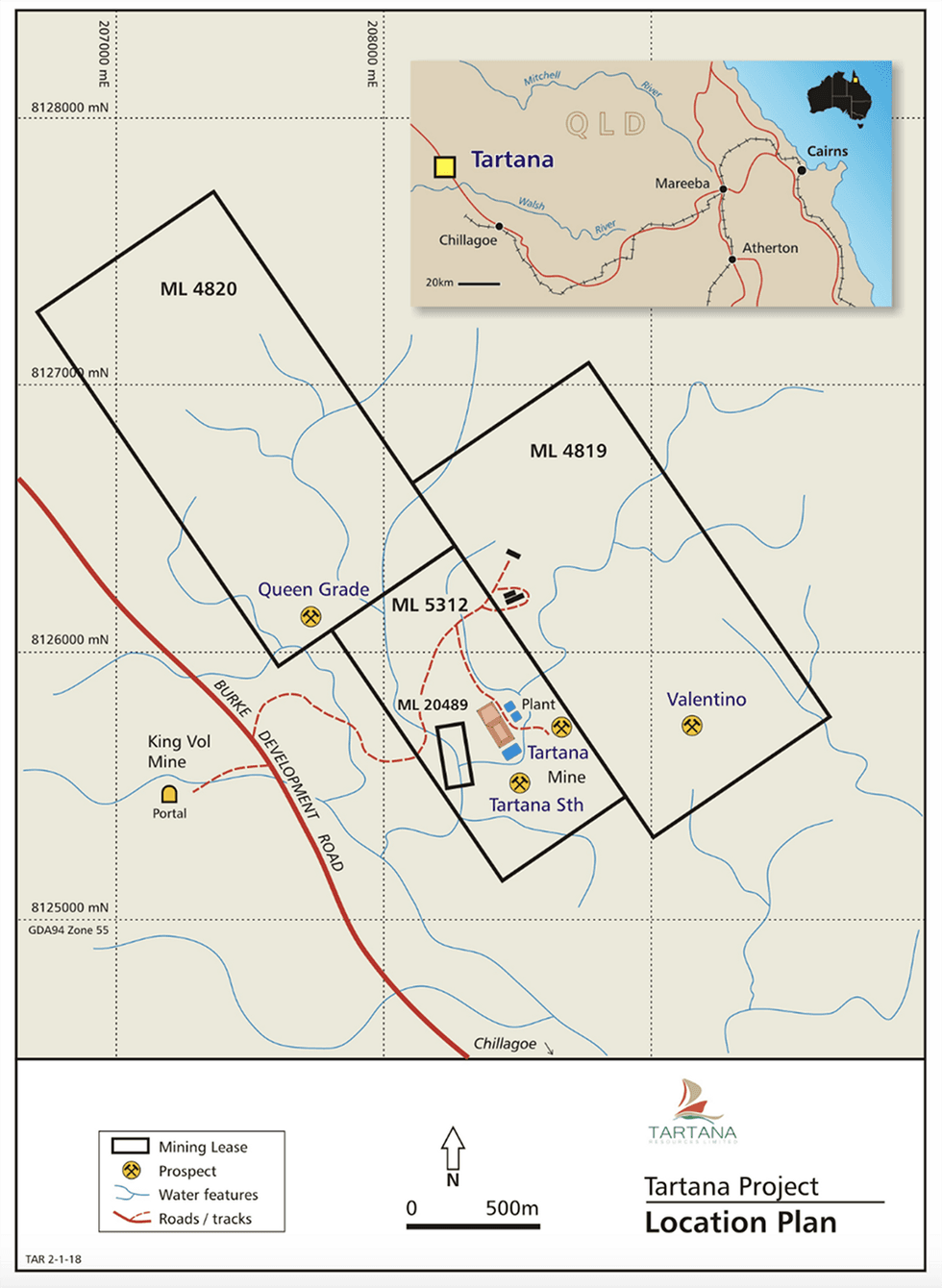

Tartana Minerals (ASX:TAT) is a copper, gold, silver and zinc, producer, explorer and developer in Far North Queensland. Its flagship project is the 100 percent owned Tartana copper and zinc project which comprises four mining leases located north of Chillagoe. The company’s business model has involved refurbishing an existing heap leach - solvent extraction – crystallisation plant which is located on the Tartana mining leases. The refurbishment and commissioning of this plant is now completed and the company is producing copper sulphate pentahydrate which is sold to offtaker, Kanins International. Copper sulphate is priced on a premium plus percentage of the LME copper price and provides investors with leverage to anticipate increasing copper prices.

The company, formerly known as R3D Resources, changed its name to Tartana Minerals in April 2024. Tartana Minerals is based in Sydney, Australia.

Tartana Minerals has reported the following resources:

- 45,000 tonnes of contained copper at 0.45 percent copper in combined inferred and indicated resources in the Tartana open pit and northern oxide zone

- 39,000 tonnes of contained zinc at 5.29 percent zinc in inferred resources in the Queen Grade project, also located on the Tartana mining leases, and

- 415,000 oz contained gold at 0.34 g/t in inferred resources at Mountain Maid – subject to a mining lease application.

These copper, zinc and gold resources remain open at depth and along strike and the company has designed drilling programs to expand these resources. In particular, the copper mineralisation and potentially the gold mineralisation have scope to be upgraded through ore sorting.

However, the refurbished heap leach – solvent extraction – crystallisation plant utilises existing copper in the ponds and the heaps and these copper sources will be replenished when we commence mining from the open pit.

Copper sulphate contains 25 percent copper metal and payment is based on the LME copper price for the preceding month plus a premium. It is one of the few forms of saleable copper where the copper content receives the full LME price.

Sprinklers operating on the lower heap. Note the presence of copper (blue).

Tartana Minerals completed the acquisition of Queensland Strategic Metals with drilling planned to commence in 2025 that includes the Daisy Bell tin-tungsten project where historical drilling and our mapping have identified a potentially tin-rich zone.

Get access to more exclusive Gold Investing Stock profiles here