July 05, 2022

Valor Resources Limited (Valor) or (the Company) (ASX:VAL) is pleased to announce the completion of an extensive data review and targeting process on the Surprise Creek Project (the Project) to the northwest of the Athabasca Basin. This work has highlighted a significant number of very prospective targets, which will be followed up on-ground in the coming few weeks.

URANIUM HIGHLIGHTS

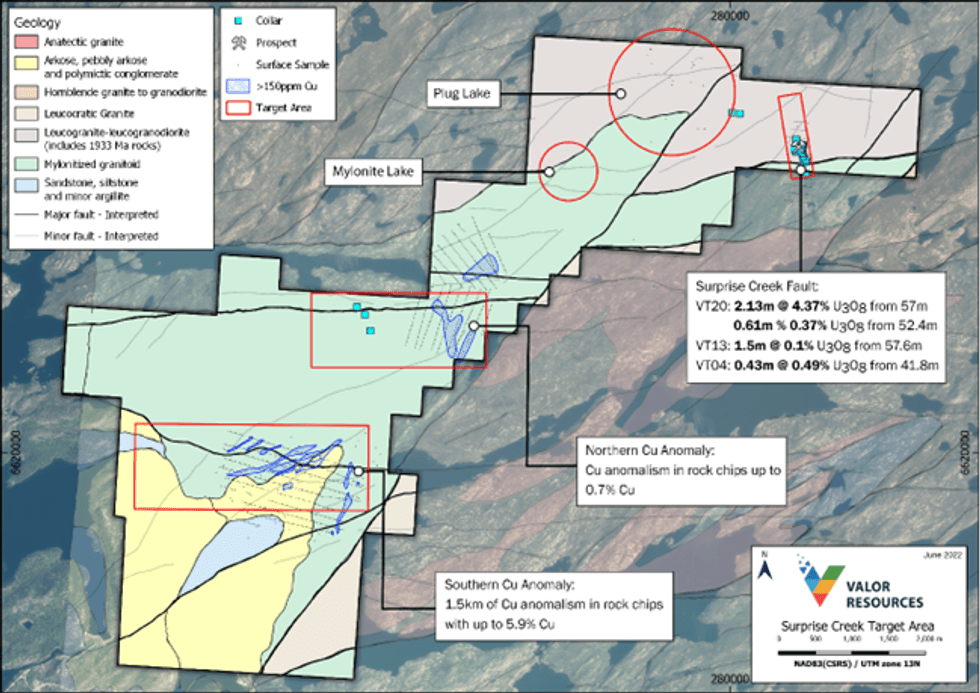

- Historical drilling on the Surprise Creek Fault target highlighted by 2.1m @ 4.37% U3O8 from 57m (VT20) including 0.9m @ 7.5% U3O8

- Other significant historical drilling results at Surprise Creek Fault target include 1.5m @ 0.1% U3O8 (VT13), 0.43m @ 0.49% U3O8 (VT05) and 0.15m @ 0.83% U3O8 (VT02)

- Surprise Creek Fault target comprises a uranium geochemical anomaly (>25ppm U) in soils over 500m in strike length and including rock chips up to 6.37% U3O8, associated with a north-northwest striking fault system

- Uranium soil geochemical anomaly was partially drill tested and remains open in several directions

- The Exploration Model is a structurally controlled vein type uranium deposit, a sub-type of the basement- hosted unconformity-related uranium deposits

- Reconnaissance field work to commence in mid-July with geological mapping and rock chip sampling to validate the current targets and improve geological understanding of the exploration model.

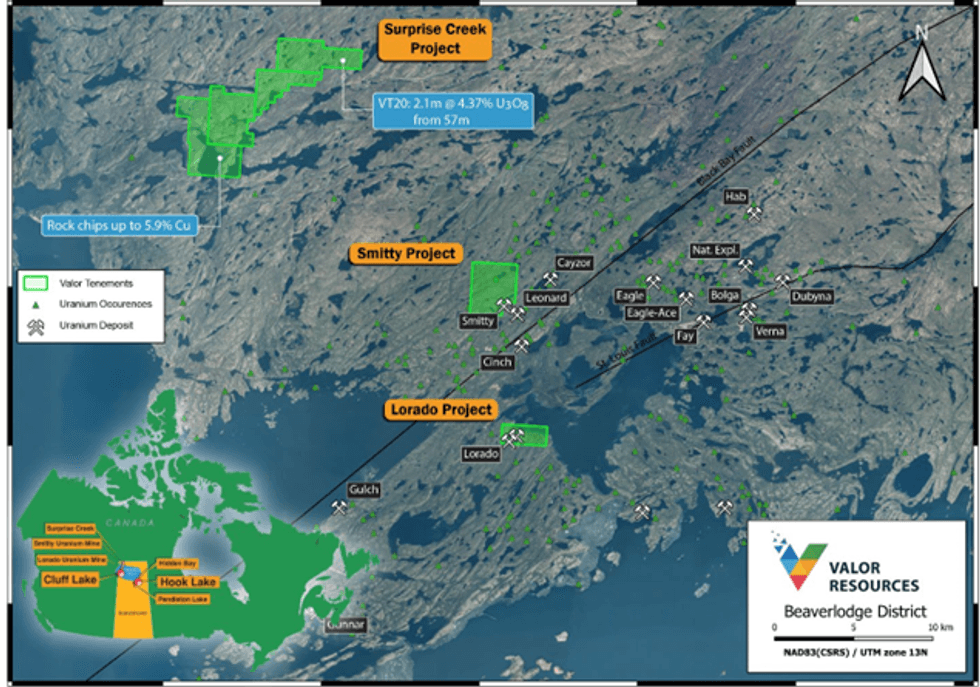

Figure 1: Surprise Creek – Project location

COPPER HIGHLIGHTS

- Data review also highlights several copper targets in the southwest of the project area with soil and rock chip anomalies (>150ppm Cu) over a strike length of 1.5km and open to the north and south.

- Copper target areas include several rock chip samples >0.25% Cu, up to 5.9% Cu and soil samples up to 3,300ppm Cu.

- Valor’s landholding increased in the area following historical data review, with an additional 11 km2 pegged to the southwest of the copper anomalies.

- No modern exploration for uranium or copper in the project area for over 20 years.

Figure 2- Surprise Creek Project - Target areas

Executive Chairman George Bauk commented “The historical data review has highlighted some exciting uranium and copper targets with the high-grade uranium drill results of 2.1m @ 4.37% U3O8 at Surprise Creek Fault being most noteworthy. The historical results and lack of modern exploration for over 20 years suggests there is great potential in this area.”

“Based on the historical data review, the Company increased its land position at the Project to the southwest by pegging a further 11km2. Given the copper mineralisation trend at the southwest part of the property, we thought it was only logical to peg the open ground.”

“We are continuing to work through the historical exploration data from our eight projects in the Athabasca Basin and will release further results of these reviews in the coming months. The exploration team will commence on-ground work at the Cluff Lake and Surprise Creek Projects in July and results of the recently completed airborne gravity surveys at the Cluff Lake, Hook Lake and Hidden Bay Projects will be finalised during the current quarter."

Historical data review targets

The following targets are based on a thorough review of historical exploration data which has been integrated with a detailed geological interpretation of all publicly available geophysical data completed by Valor’s consultant geophysics team, Terra Resources. The historical exploration data is from the 1950s through to the late 1970s. Between the 1980s and the present day, little uranium or copper exploration has been carried out in this area. Details of relevant drill holes and surface sampling information that have been used in determining some of these targets, have been included in Appendices 1, 2 and 3. All diamond drill holes have been reported and surface samples reported have been filtered based on: Soil samples > 2ppm U, rock chip(boulder) and unknown sample types > 5ppm U. Due to the historical nature of some of this data, some aspects of the sampling and drilling cannot be verified and therefore some caution must be applied. The Company intends to carry out on-ground work to verify aspects of the historical data before advancing targets to the next stage.

Surprise Creek Fault

The Surprise Creek Fault target is an area where uranium exploration occurred in the late 1960s. The most significant exploration was conducted by Van-Tor Resources who completed 27 diamond holes in 1968 to test an area of uranium mineralisation at surface. Prior to that, in 1955, Independence Mining drilled 14 shallow (mostly 25-50m and up to 85m deep) diamond drillholes in the area following prospecting and trenching, which located uranium mineralisation at surface.

Click here for the full ASX Release

This article includes content from Valor Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00