September 10, 2023

Toro Energy Limited (Toro or the Company) is pleased to announce that it has secured firm commitments for a A$4.5 million placement (before costs) comprising the issue of 450,000,000 new fully-paid ordinary shares in the capital of the Company (Placement). The Placement was well supported by new and existing institutional, sophisticated and professional investors.

- Toro has received firm commitments to raise A$4.5 million at $0.01 per share

- Strong support from offshore and domestic institutional and sophisticated investors

- Toro’s board to participate subject to shareholder approval

- Use of funds include for the Lake Maitland Scoping Study Extension and preparations for a pilot plant programme as part of the Lake Maitland/Wiluna Uranium Project study

The Placement funds will primarily support further development of the Lake Maitland Project and provide working capital for the Company. Specifically, funds raised from the Placement will be applied to:

- The Lake Maitland Scoping Study Extension, investigating ore trucked from Centipede, Millipede and Lake Way (Wiluna Uranium Project) to be processed at Lake Maitland.

- Lake Maitland resource drilling to upgrade the vanadium resource from Inferred to Indicated under JORC 2012 (as appropriate).

- Pilot plant programme as part of the Lake Maitland pre-feasibility study and to test samples across the other three deposits.

- General working capital.

- Costs of the Placement.

Commenting on the capital raise, Executive Chairman, Richard Homsany said:

“Toro is pleased with the outcome of this fundraising and is delighted to welcome new highly reputable investors to its register and increased investment from existing shareholders. On behalf of the Board, we would like to thank the lead managers and all investors who supported the transaction. Toro is enthusiastic about advancing its potential Tier-1 asset in WA – the world-class Wiluna Uranium Project. Toro also owns the high-quality Dusty Nickel Project in close proximity. These projects both have considerable upside and unlocked value. With further work Toro is confident its assets will continue to emerge as stand-alone mining projects.”

Canaccord Genuity (Australia) Limited acted as Lead Manager and Bookrunner to the Placement.

Placement

Toro received strong support from a number of high-quality institutional investors both domestically and internationally for the Placement.

Under the Placement, the Company will issue new fully-paid ordinary shares (Placement Shares) at $0.01 per Placement Share, together with a free-attaching listed option with an exercise price of $0.015 and a term of 24 months from the date of issue (Option) on the basis of one (1) Option for every two (2) Placement Shares subscribed for and issued. The Placement offer price represents a 16.7% discount to the last-close on 6 September 2023 ($0.012 per share) and a 15.6% discount to the 5-day VWAP ($0.0119). The directors of the Company may participate in the Placement up to an amount of $250,000, subject to the receipt of prior shareholder approval.

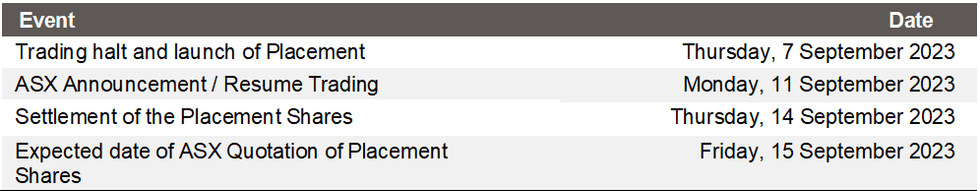

The Placement Shares and Options will be issued within the Company’s existing placement capacity under ASX Listing Rules 7.1 and 7.1A. Settlement of the Placement Shares is expected to occur on Thursday, 14 September 2023. The Options are to be offered under a Prospectus as soon as reasonably practicable after the issue of the Placement Shares and an application for their quotation on ASX is intended to be made. All Placement Shares and shares issued upon exercise of the Options will rank equally with the Company’s existing shares on issue.

Key Dates:

Uranium Market Update

There has been renewed sector momentum with a rising spot price and recent supply constraints. UxC reported that ~121mlbs have been put under long-term contract so far in 2023 – this compares to a total of 125mlbs in 2022 (the highest level in 10 years), suggesting contracting levels will significantly outperform those in 2022. Security of supply remains critical with the Nuclear Fuel Security Act (which includes Russian Sanctions) progressing through the US political process, the ongoing coup in Niger (~4% of 2022 global mine supply) and recent downgrades/pushing out of uranium production.

Click here for the full ASX Release

This article includes content from Toro Energy Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TOE:AU

The Conversation (0)

12 October 2025

IsoEnergy to Acquire Toro Energy

Toro Energy (TOE:AU) has announced IsoEnergy to Acquire Toro EnergyDownload the PDF here. Keep Reading...

12 October 2025

Joint Investor Presentation

Toro Energy (TOE:AU) has announced Joint Investor PresentationDownload the PDF here. Keep Reading...

31 July 2025

Quarterly Activities and Cashflow Report June 2025

Toro Energy (TOE:AU) has announced Quarterly Activities and Cashflow Report June 2025Download the PDF here. Keep Reading...

27 May 2025

Updated Scoping Study Results Lake Maitland Uranium Project

Toro Energy (TOE:AU) has announced Updated Scoping Study Results Lake Maitland Uranium ProjectDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities and Cashflow Report March 2025

Toro Energy (TOE:AU) has announced Quarterly Activities and Cashflow Report March 2025Download the PDF here. Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00