November 02, 2023

Oceana Lithium Limited (ASX: OCN, “Oceana” or “Company”) is pleased to report the preliminary results of the phase one scout RC drilling campaign at its Solonópole Lithium Project in Ceará State, Brazil (Figure 1), which was successful in intercepting multiple thick pegmatites and some anomalous Lithium grades at shallow depth.

Highlights

- Preliminary assay results received from 21 out of 30 shallow scout RC drill holes at Solonópole

- Anomalous lithium grades returned from four drill holes (NGR-RC-002, NGR-RC-009, SOL-RC-001 and SOL-RC-005)1

- Approximately 6,200 soil samples collected from Solonópole and analysed by XRF for lithium-caesium-tantalum (LCT) pathfinders

- Series of high-resolution drone geophysics (magnetometry) surveys flown over high-priority LCT pegmatite target areas (BJdB, Lapinha, Urubu, Rolados, Nira and Zilcar)

- Oceana is the first listed Lithium exploration company to complete RC drilling in this highly prospective Lithium region of Brazil

- RC results and other field data to be used to plan a robust diamond drilling campaign

Oceana’s Senior Exploration Geologist James Abson said: “Although early days, I am encouraged by the preliminary results of the scout drilling program, as the anomalous Lithium grades intercepted suggests that the Lithium mineralization observed at surface continues at depth. The follow-up Diamond Drilling campaign being planned by Oceana will not only assist to confirm the exact extension of this Lithium mineralization at the BJdB targets but also test other new pegmatites intercepted at other locations within the various Li-anomalous soil grids. The following Diamond Drilling campaign at Solonópole will now be supported by robust geological and geophysical data sets generated by Oceana.”

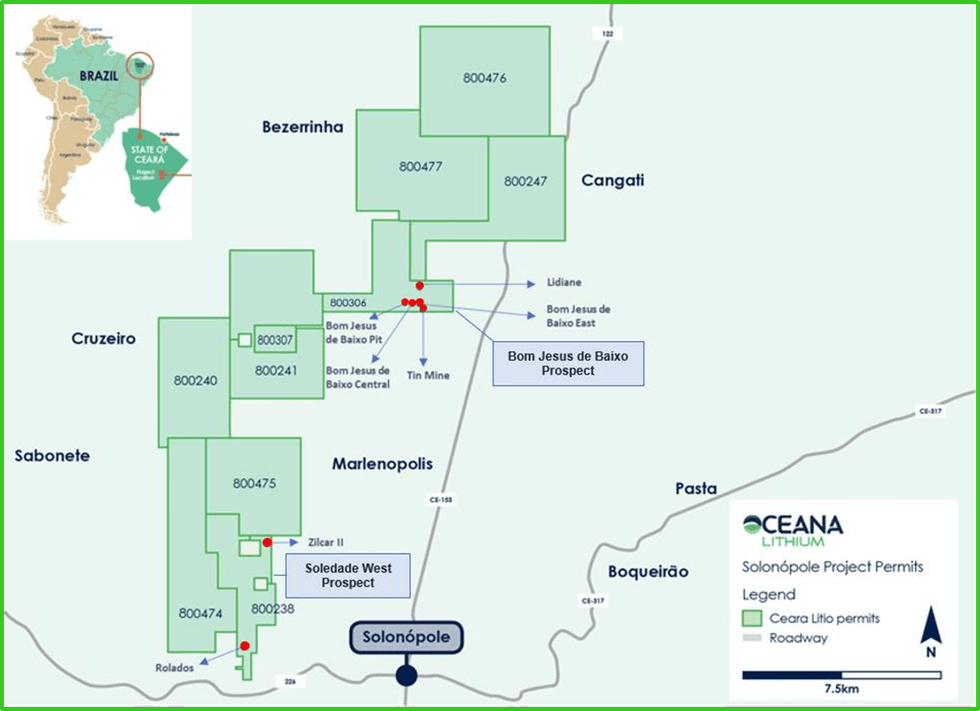

The Solonópole Project area is located in the state of Ceará, north-eastern Brazil and consists of ten (10) exploration permits covering approximately 124km2 (Figure 1), owned by Oceana’s subsidiary Ceará Litio. The project is approximately three to four hours by road from the state capital Fortaleza and the deep-water Port of Pecém and is well serviced by sealed highways and high voltage electricity.

As reported by Oceana on 7 August 2023, a ~2,000 metre RC scout drilling program comprising 30 mostly shallow holes up to 60m in depth was completed in July 2023. The first phase of scout drilling was planned on a 20m x 20m grid to assist in determining the actual pegmatite dimensions and dip at each location, as well as preliminary results for Lithium grade and mineralogy. Oceana is still at an early stage of exploration, testing new hypotheses and exploration methods to increase the geological knowledge of the region for Lithium.

These shallow holes returned individual pegmatite intercepts of up to 37m wide and combined intercepts of up to 46m1. Best combined pegmatite intercepts included:

- 46m from surface to end of hole (EoH), including 37m continuous from surface1 (NGR-RC-15, Tin Mine target)

- 21m from surface to EoH, including 18m continuous from 21m to 39m1 (SOL-RC-06, Zilcar II target)

- 19m from surface to EoH, including 18m continuous from 39m to 57m1 (SOL-RC-08, Zilcar II target)

The first 22 RC holes (NGR-RC-001 to NGR-RC-022) confirmed the presence of thick pegmatites in five different outcropping areas (BJdB Pit, BJdB Central, BJdB East, “Tin Mine” and “Lidiane”) on Permit 800306 (see Figure 2).

Click here for the full ASX Release

This article includes content from Oceana Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

OCN:AU

The Conversation (0)

12 March 2024

Oceana Lithium

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00