- WORLD EDITIONAustraliaNorth AmericaWorld

Overview

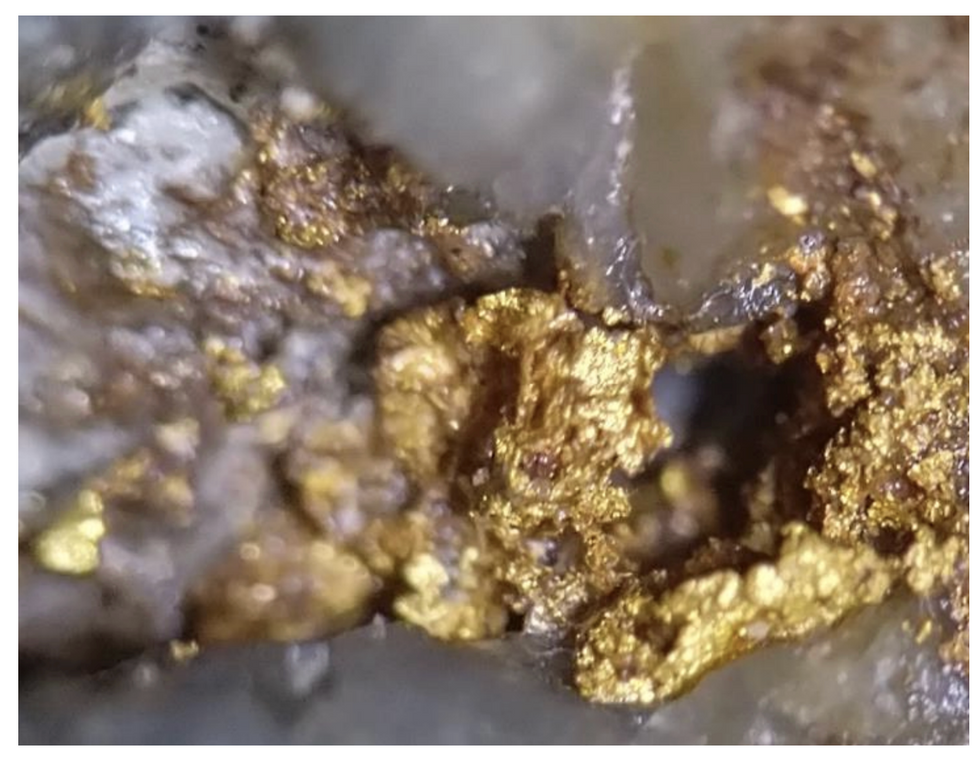

Siren Gold (ASX:SNG) is an exploration and development company focusing on gold assets at its 1,100-square-kilometer tenement package located on the historic, high-grade Reefton, Lyell and Sams Creek goldfields in New Zealand.

Reefton Goldfield was first discovered in 1866 with total current recorded production of 11 million ounces (Moz) of gold, consisting of 2 Moz @ 16 grams per ton (g/t) gold from underground, 0.7 Moz from open pit and ~8 Moz gold from alluvial mining.

Mining and the local communities thrived in the region during the early 1900s, but most of the 94 underground mines closed by 1942 during WWII, and the Blackwater mine, which produced 740 koz @ 19 g/t down to more than 700 meters below the surface, finally shut down in 1951 bringing the entire field to a close. The gold price in 1951 was US$35 per ounce.

Fast forward to 2023, mining analysts believe current gold prices are only the beginning of a large upward trend, with gold prices reaching the $2,000 mark in the last quarter of 2023. What we know is clear: Gold has outperformed the S&P 500 over the past 20 years, as production from gold mines runs low without enough new projects to replace them.

Siren’s gold projects present an opportunity for new supply sources to emerge. The Reefton Goldfield is a high-grade mining district located on the West Coast of the South Island of New Zealand.

Siren’s global mineral resource currently sits at 1.33 million ounces at 3.3 grams per ton (g/t) AuEq (gold equivalent), from Sams Creek, Alexander River, Big River, Supreme and Auld Creek.

The district is widely known for producing gold, antimony and coal. A crucial aspect of the Reefton Goldfield is the significant occurrence of antimony, a rare thermal-resistant metal and a poor conductor of electricity. These attributes make it ideal for flame retardants, paints and various industrial applications to improve thermal tolerance. Additionally, antimony is a critical element in lithium-ion batteries and next-generation liquid metal batteries utilized for energy storage systems. The presence of antimony in the goldfield creates additional value for Siren’s projects as exploration continues.

Siren currently has seven projects, many of which were active sites that were closed during WWII despite encouraging exploration or production. Now, the company has built an expansive portfolio of projects and will undergo systematic exploration of its assets using leading-edge technologies and techniques.

With seven projects under its belt, Siren is primarily focused on Sams Creek, Alexander River, Big River and Auld Creek. These four projects are slated for future exploration and potential development to improve the assets’ value.

A skilled management team leads the company towards fully exploring its promising portfolio, with diverse expertise in geology, corporate administration and finance.

Company Highlights

- Siren Gold is an exploration and development company focusing on gold assets in the high-grade, historic Reefton Goldfield and Sams Creek in New Zealand.

- Siren owns seven highly prospective projects throughout the region, each with the potential for gold and antimony, a rare metal used in various thermal-resistant applications.

- The company’s global mineral resource is currently at 1.33 million ounces at 3.3 g/t AuEq (gold equivalent), with significant potential to increase as exploration continues.

- The Reefton Goldfield historically produced over 11 million ounces of gold before the entire field closed after WWII.

- Siren’s assets within the Reefton Goldfield are highly prospective but have yet to be fully explored through modern exploration techniques, creating significant blue-sky potential.

- A management team with a range of expertise in the natural resources industry leads the company towards fully realizing the potential of its highly prospective portfolio.

Get access to more exclusive Gold Investing Stock profiles here