September 18, 2024

Sarama Resources Ltd. (“Sarama” or the “Company”) (ASX:SRR, TSX- V:SWA) is pleased to report that on 18 September 2024, it had completed the issue of shares in part settlement of deferred executive salaries and director fees (the “Compensation Shares” or the “Shares for Debt”) as previously announced in a news release dated 17 July 2024.

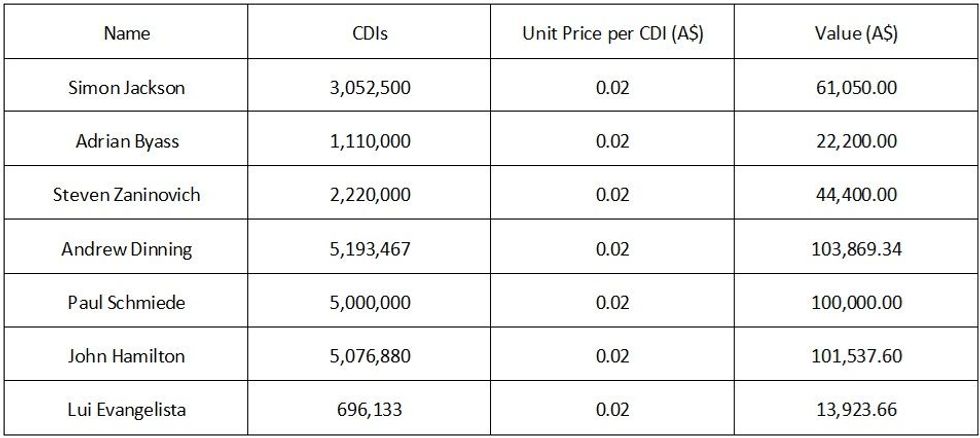

The Shares for Debt arrangement comprised the issue of 22,348,980 Chess Depository Instruments (“CDIs”) at a deemed issue price of A$0.02 per CDI, equivalent to A$446,979.60 as detailed in Table 1 below. Each new CDI issued under the Placement will rank equally with existing CDIs on issue and each CDI will represent a beneficial interest in one common share of the Company. The issuance of the Shares for Debt was subject to TSXV and shareholder approval which was obtained at the annual general meeting held on 11 September 2024 (the “Meeting”).

The Compensation Shares and Shares for Debt were issued upon receipt of shareholder approval, as required by the Australian Securities Exchange Listing Rules, at the Meeting. An Appendix 2A was announced to the ASX on 18 September 2024 and provides further detail on the issue of the Compensation Shares and Shares for Debt.

The Share for Debt arrangement will reduce the Company’s liabilities.

The CDIs issued under the Placement are subject to a TSX Venture Exchange (“TSXV”) “hold period” of 4 months and one day from the date of issue of the CDIs.

The Securities have not been and will not be registered under the U.S. Securities Act of 1933, as amended, (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from registration is available. This announcement does not constitute an offer to sell or a solicitation of an offer to buy any of the Securities within the United States or to, or for the account or benefit of, U.S. Persons (as defined under Regulation S under the U.S. Securities Act), nor shall there be any sale of these Securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Click here for the full ASX Release

This article includes content from Sarama Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SRR:AU

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 November 2025

Sarama Resources

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim.

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim. Keep Reading...

14 August 2025

Q2 2025 Interim Financial Statements

Sarama Resources (SRR:AU) has announced Q2 2025 Interim Financial StatementsDownload the PDF here. Keep Reading...

04 August 2025

Sarama Provides Update on Arbitration Proceedings

Sarama Resources (SRR:AU) has announced Sarama Provides Update on Arbitration ProceedingsDownload the PDF here. Keep Reading...

09 July 2025

Completion of Tranche 1 Equity Placement & Cleansing Notice

Sarama Resources (SRR:AU) has announced Completion of Tranche 1 Equity Placement & Cleansing NoticeDownload the PDF here. Keep Reading...

29 June 2025

A$2.7m Equity Placement to Fund Laverton Drilling Campaign

Sarama Resources (SRR:AU) has announced A$2.7m Equity Placement to Fund Laverton Drilling CampaignDownload the PDF here. Keep Reading...

25 June 2025

Trading Halt

Sarama Resources (SRR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

19h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

19h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

20h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

20h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00