May 28, 2024

Alligator Energy Limited (ASX: AGE, ‘Alligator’ or ‘the Company’) is pleased to confirm that the 2024 Blackbush resource extension and broader exploration drilling programs have recommenced at the Samphire Uranium Project, south of Whyalla, South Australia.

Highlights

- Resource extension drilling for 2024 commenced at the Blackbush Deposit in late January and continued until mid-April when the program was suspended for the pastoral lambing season.

- Significant intersections from that drilling as set out in ASX Announcement - 1 May 2024 included:

- 1.47m @ 0.40% (3,992ppm) pU3O 1; 4.44m @ 0.43% (4,370ppm) pU3O8; 3.07m @ 0.05% (493ppm) pU3O8; and 1.32m @ 0.10% (978ppm) pU3O8.

- Continued refinement in understanding the roll front morphology at Blackbush has delivered broader step-out targets for the upcoming round of exploration drilling.

- The Company’s drilling contractor is back on site with the following objectives:

- Initial focus on further investigation of Blackbush Extension Areas 1 and 2; and

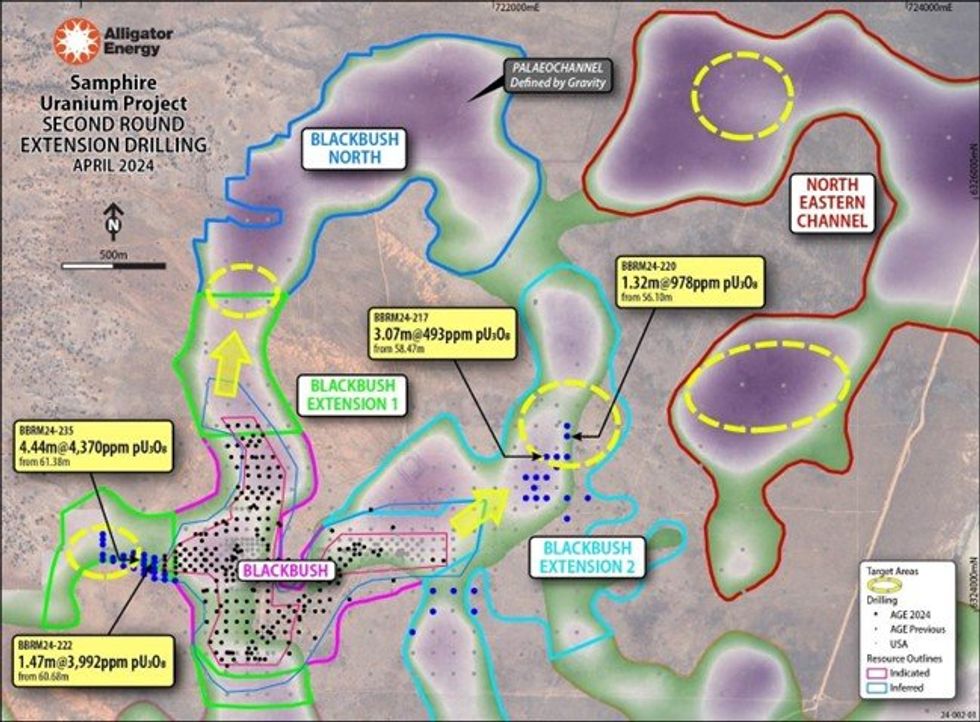

- Assess expansion potential within the Project area targeting historical gamma intercepts within the Blackbush North and Blackbush North-eastern palaeochannels. (Figure1)

- Evaluation is underway to increase the drilling rate up to the maximum of our down-hole logging capacity, to assist in exploring the vast palaeochannel system within the Samphire Project area during the second half of 2024.

- Resource extension drilling and step-out exploration drilling planned through to Q4 of 2024 will then be incorporated in an update of the Blackbush Mineral Resource Estimate.

Project Update – Field Recovery Trial (FRT)

- Retention lease assessment for the planned FRT is continuing, with some additional information requested by SA Govt departments which Alligator is now compiling and working with the Regulator to complete. We will advise the market as approvals are received, which will start the process of operating plan authorisation, FRT site construction followed by FRT operations.

Alligator’s Managing Director and CEO, Greg Hall stated: “Alligator is planning near-continuous Blackbush deposit resource extension drilling through this year, with a target to increase the resource and hence the potential annual production rate in a future feasibility study. We have worked closely with the local pastoralist to ensure that our operations do not impact their important lambing season. Drilling and logging results will feed into a further update to the Blackbush resource estimate at year end.”

Commencement of Second Round Drilling

Drilling has re-commenced at the Samphire Uranium Project following a short break due to the lambing season. Drilling will initially focus on investigating encouraging results intersected in the first round of drilling within the Blackbush Extensions 1 and Blackbush Extension 2 areas (Figure 1). Encouraging results included:

Blackbush Extensions 1 Target Area

BBRM24-235 4.44 meters at 0.43% (4,370ppm) pU3O8 from 61.38m (GT 19,403)

BBRM24-222 1.47 meters at 0.40% (3,992ppm) pU3O82 from 60.68m (GT 5,868)

Blackbush Extension 2 Target Area

BBRM24-217 3.07 meters at 0.05% (493ppm) pU3O8 from 58.47m (GT 1,514)

BBRM24-220 1.32 meters at 0.10% (978ppm) pU3O8 from 56.10m (GT 1,291)

The First Round Drilling confirmed the presence of roll fronts and redox fronts extending out from the known Blackbush mineralisation. This will form the basis of a focused exploration approach to extend the existing mineralisation envelope and identify the broader existence uranium mineralisation. Drilling will also be carried out in the Blackbush north and Northeastern palaeochannel areas (Figure 1) to investigate anomalous historical gamma intercepts, and to confirm the presence of prospective palaeochannels interpreted from ground gravity data.

An increase to the drilling rate (up to the capacity of the down hole logging equipment) in the second half of 2024 is being evaluated to increase the drilling coverage given the vast area of interpreted palaeochannels that exist in the Samphire Project area. This would then lead into the drilling of the required production wells following the approval of a Retention Lease and operating plan (PEPR) for the Field Recovery Trial.

It is anticipated that drilling over the next 6 months will then lead into an update of the Blackbush Mineral Resource Estimate in Q4, 2024.

Click here for the full ASX Release

This article includes content from Alligator Energy Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

27 January

Standard Uranium CEO Outlines Athabasca Exploration Plans and Uranium Market Outlook

Standard Uranium (TSXV:STND,OTCQB:STTDF) is advancing an ambitious exploration strategy in Saskatchewan’s Athabasca Basin, according to CEO and Chairman Jon Bey, who spoke with the Investing News Network at the 2026 Vancouver Resource Investment Conference.The company is preparing for a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00