April 27, 2023

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to provide the following activities report for the quarterly period ending 31 March 2023 (the “Quarter”).

HIGHLIGHTS

- Completion of Phase 2 drilling program at the Lana Corina Copper and Molybdenum Project with significant intersections received during the Quarter including:

- Hole CMLCD010 169m @ 1.21% CuEq1 (from 239m); and

- Hole CMLCD013 72m @ 0.91% CuEq2 (from 352m).

- High-grade molybdenum zone confirmed at depth and extended 700m down plunge:

- 35m @ 1,704ppm Mo (0.84% CuEq) (570-605m), including:

- 4m @ 8,845ppm Mo (3.48% CuEq) (589-593m); and

- 1m@ 15,000ppm Mo (6.09% CuEq) (591-592m).

- Hole CMLCD011 extended mineralisation 100m south, confirming T10 target area, with an intersection of:

- 100m @ 0.38% CuEq2 (334-434m); including:

- 28m @ 0.55% CuEq (345-373m).

- Phase 2 drilling program targeted extensions of known copper mineralisation in previously reported drilling including:

- 104m @ 0.81% CuEq in CMLCD001 from 155m3;

- 257m @ 1.10% CuEq in CMLCD002 from 170m4;

- 173m @ 1.09% CuEq in CMLCD003 from 313m5;

- 81m @ 1.16% CuEq in CMLCD005 from 302.1m6; and

- 113m @ 0.68% CuEq in CMLCD009 from 331m7.

- Lana Corina mineralised corridor extended to >3km long, with mapping and surveys confirming continuity of mineralisation to the northeast (Vista Montana Prospect)8.

- Completion of a detailed 50m by 100m geochemical survey with 321 samples taken9.

- Five new high-priority targets for copper mineralisation generated at the Vista Montana Prospect10.

- Culpeo increased its ownership of the Lana Corina Project to 20% following the satisfaction of certain conditions of the earn-in agreement11.

Operating Activities

Lana Corina Copper and Molybdenum Project

Drilling Continues to Intersect Significant Copper Mineralisation

During the Quarter, the Company completed the Phase 2 drilling program at the Lana Corina Copper and Molybdenum Project in Chile (“Lana Corina” or the “Project”).

The Phase 2 drilling program was designed to expand the mineralised footprint at the Project, which remains open in all directions and at depth. The significant results from the Phase 2 drilling program (ASX announcement 16 January 2023) include:

- 104m @ 0.74% Cu & 73ppm Mo (0.81% CuEq) in CMLCD001 from 155m3;

- 257m @ 0.95% Cu & 81ppm Mo (1.10% CuEq) in CMLCD002 from 170m4;

- 173m @ 1.05% Cu & 50ppm Mo (1.09% CuEq) in CMLCD003 from 313m5;

- 81m @ 1.06% Cu & 145ppm Mo (1.16% CuEq) in CMLCD005 from 302.1m6; and

- 113m @ 0.60% Cu & 122ppm Mo (0.68% CuEq) in CMLCD009 from 331m7.

Geochemical Survey Identifies Multiple Surface Targets at Lana Corina

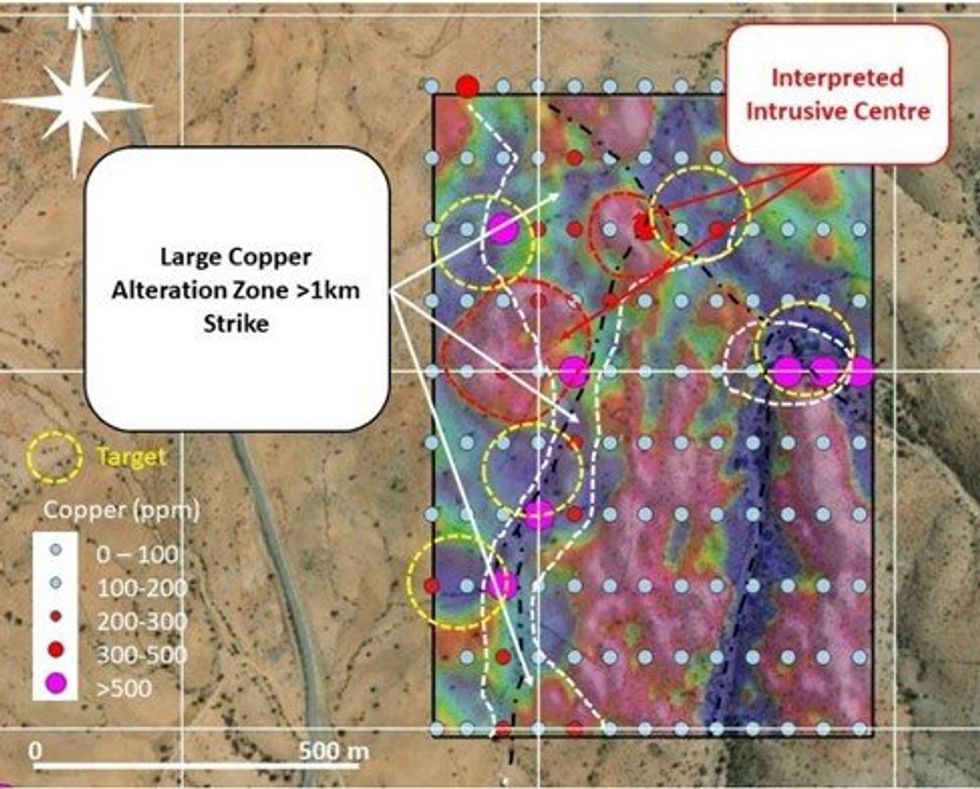

The Company completed a soil geochemical survey at the Vista Montana Prospect within the Lana Corina Project, resulting in the identification of five new high-priority targets within a >3km-long copper alteration zone defined by the geochemistry survey (Figure 1). This increases the overall strike length of the Cu-mineralised trend at Lana Corina to over 3km.

The soil geochemistry program was undertaken on a 50m x 100m grid and consisted of 321 samples in total. The results indicate that the overall pattern of the Cu, Cu + Mo, Cu/Mn and alkali elements suggest a copper bearing alteration zone is present at Vista Montana and is over three times the size of the Lana Corina mineralised zone defined from drilling to date (Figure 2).

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

5h

ASX Copper Mining Stocks: 5 Biggest Companies in 2026

Copper prices have been volatile throughout 2025 and into 2026, fueled by economic uncertainty from an ever-changing US trade policy and strong supply and demand fundamentals. The International Copper Study Group, the leading copper market watcher, reported an apparent refined copper surplus of... Keep Reading...

5h

What Was the Highest Price for Copper?

Strong demand in the face of looming supply shortages has pushed copper to new heights in recent years.With a wide range of applications in nearly every sector, copper is by far the most industrious of the base metals. In fact, for decades, the copper price has been a key indicator of global... Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00