May 07, 2023

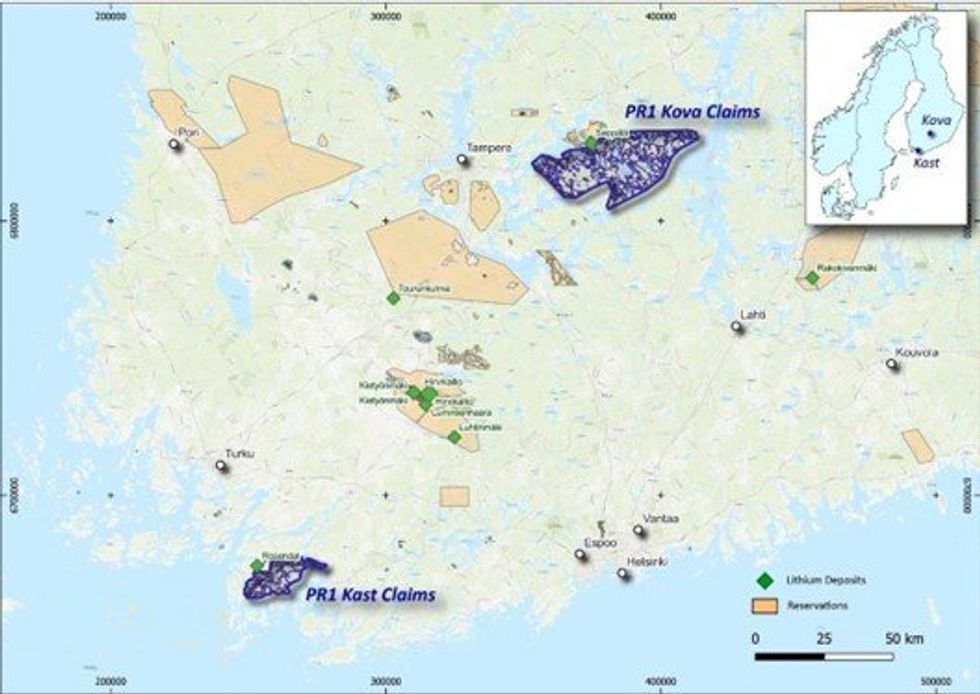

Pure Resources Limited (Pure or Company) is pleased to announce it has secured two Prospecting Reservations totalling 683km2 of highly prospective ground in southern Finland (Figure 1). The Company applied for the Kova and Kast Reservations following a global review for future facing metal exploration opportunities.

HIGHLIGHTS

- Pure has secured the Kast and Kova Prospecting Reservations totalling 680km2 of highly prospective ground in southern Finland in close proximity to other existing Lithium and critical mineral deposits (Figure 1).

- Both prospects are considered highly prospective for Lithium-Caesium-Tantalum pegmatite deposits and are also prospective for gold and base metal mineralisation.

- The Kova Reservation (544km2) (Figure 2):

- Situated 130km north of Helsinki in the Tampere region of Finland.

- Adjacent to, and geologically analogous to, the Seppälä lithium pegmatites.

- Reservation partially sits within the Eräjärvi metallogenic area.

- More than 70 pegmatite dykes, enriched in B, Be, Li, Nb, Sn and Ta, are reported from the Seppälä area.

- Little modern systematic exploration for lithium deposits has been undertaken in the area.

- Within the Kova Reservation, multiple pegmatite granites have been mapped by the Finnish geological survey (GTK) which will be targeted in upcoming field programs.

- The Kast reservation (139km2) (Figure 3):

- Situated 110km west of Helsinki in the Kimito region of southern Finland (Figure 3).

- Adjacent to, and geologically analogous to the Rosendal tantalum deposit and sits within the Kemiö metallogenic area (Figure 3).

- The Kemiö metallogenic area is defined by the presence of a late-orogenic granitic, complex pegmatite swarm with a significant potential for lithium, tantalum and beryllium exploitation.

- Within the Kast Reservation area, a number of pegmatite granites have been mapped by the Finnish geological survey which the Company plans to map and sample in upcoming field programs.

- The Company (across the two projects) is currently negotiating the purchase of available drillhole (approximately 235 holes drilled historically for ~19,000m), geochemical and geophysical data relevant to the two reservation areas as part of its ongoing data review process. Following completion of the data review, Pure intends to undertake mapping and sampling programs through the northern summer.

Pure’s prospectus dated 11 March 2022 and released to the ASX on 19 April 2022 (Prospectus) outlined the Company’s use of funds (Use of Funds). Under the Use of Funds, Pure has allocated $400,000 for project generative activities.

Pure’s Executive Chairman, Patric Glovac, commented:

“With our current belt-scale Laforge lithium project in Quebec exposing us to the Canadian government’s progressive Critical Mineral Strategy, we have now identified Europe and more specifically, Scandinavia as an area we believe will see significant growth in the battery metals sector with favourable geopolitical and geological conditions.

“As such, we have been reviewing a number of opportunities in Scandinavia and the application of the two Reservations in close proximity to other known lithium areas and is another great step forward in building an excellent, and global, battery metals portfolio.

“The project generation team have been working around the clock with our Finnish counterparts and have again done an excellent job to secure the highly prospective Reservations. With the snow melting as we speak, we are looking forward to completing boots-on-ground exploration over the coming months.”

The Finland Reservations

PR1 Finland Oy (a wholly owned subsidiary of Pure) has registered two Prospecting Reservations, with the Finnish Mining Authority, in southern Finland (Figure 1). The two Reservations cover an area of ~683km2 and are considered highly prospective for Lithium- Caesium-Tantalum (LCT) pegmatite deposits and are also prospective for gold and base metal mineralisation.

Click here for the full ASX Release

This article includes content from Pure Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00