SAMPLING RETURNS 16.2 G/T and 15.1 G/T GOLD IN OUTCROP

Power Nickel Inc. ("Power Nickel" or the "Company") (TSXV:CMX)(OTCQB:CMETF) is pleased to report assay results from its summer 2021 Golden Ivan Property (the "Property") exploration. The highly successful 2021 prospecting and geologic mapping program has resulted in the discovery of two new high-grade gold zones yielding 16.2 grams-per-tonne (gt) gold (Au) and 15.1 gt Au in outcrop

The 2021 Golden Ivan Property campaign completed during July and August 2021, included the collection of 210 surface rock samples including 7 channel samples, in addition to reconnaissance geologic mapping and whole-rock geochemical analysis throughout the Property. A total of 17 of the 210 rock samples returned greater than 0.1 g/t Au, up to 16.2 g/t Au from the newly discovered Lone Goat Showing, and 15.1 g/t Au over 0.75 metres from a channel sample at the newly discovered Molly B. East showing in addition to significant silver and base metal values (Table 1).

Terry Lynch, CEO director of Power Nickel comments, "We are excited to announce the results of our 2021 field program at Golden Ivan, which resulted in the discovery of two new high-grade gold zones. Further defining the mineralization controls, lateral, and vertical continuity of these emerging precious metal trends will be the next steps as we continue to demonstrate the significant potential of the Golden Ivan property and move toward developing drill targets for testing during the 2022 season."

Table 1. 2021 Golden Ivan Project 2021 Prospecting - Significant Results

Sample ID | Showing | Material | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | |

P385752 | Gold Zones | Lone Goat (New) | Talus | 16.2 | 25 | 1.56 | - |

P385831 | Outcrop | - | 47 | 0.18 | - | ||

P385732 | Outcrop | 3.41 | 14 | - | - | ||

P385774 | Outcrop | 0.76 | 176 | 0.64 | - | ||

P385703 | Float | - | 22 | 1.14 | 0.15 | ||

P385691 | Float | - | 31 | 0.82 | - | ||

P385857 | Molly B. East (New) | Channel (0.75 m)* | 15.1 | 12 | 0.10 | - | |

P385801 | Outcrop | 1.43 | 39 | 0.16 | - | ||

P385809 | Ice valley (New) | Outcrop | 0.73 | 47 | 0.27 | - | |

P385760 | Outcrop | 0.53 | 5 | - | - | ||

P385840 | Silver Zones | Silverado No.4 East trend (Historic) | Outcrop | - | 76 | - | - |

P385841 | Outcrop | - | 27 | - | 1.13 | ||

P385682 | Float | - | 30 | - | 0.73 | ||

P385739 | Outcrop | - | 19 | 1.82 | - | ||

P385693 | Magge Sky Annex (Historic) | Outcrop | - | 47 | 0.38 | - | |

*The approximate true width of the channel sample is 80-100 sample width

Mineralization and Alteration of New Discoveries

The Molly B. East high-grade gold showing is associated with subvertical southeast tending quartz-pyrrhotite-chalcopyrite veins hosted within andesitic volcanic rocks with fine-grained sulphide halos.

The Lone Goat high-grade gold showing comprises an approximately 700 x 200 metre NE-SW trending subvertical zone of multi-stage quartz-epidote-sericite-carbonate altered andesite that returned multiple anomalous (n=8 greater than 0.1 g/t Au) gold assays.

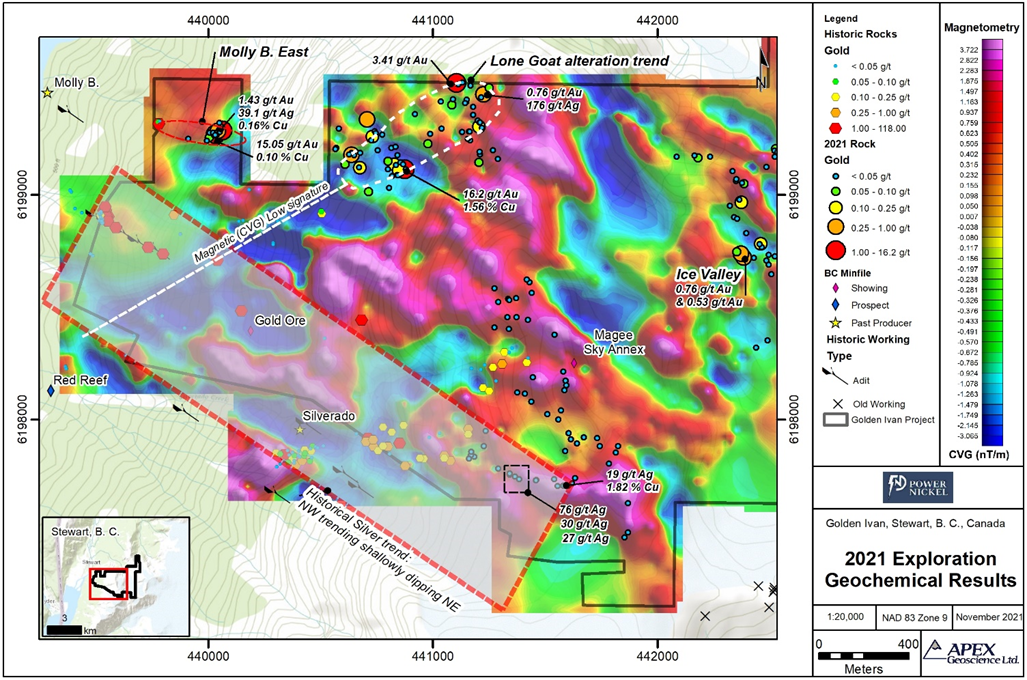

The newly discovered Lone Goat, Molly B. East gold showings, and the historical high-grade gold-silver Molly B trend to the south are coincident with northeast and northwest-trending airborne magnetic (low) lineaments respectively (Figure 1).

General Geology

The results of reconnaissance geologic mapping indicate the Golden Ivan Property is underlain by a layered sequence of andesitic volcanic and volcaniclastic rocks attributed to the Lower Jurassic Hazelton Group. The volcanic package is cut by late andesite dykes and rhyolite bodies, while the northeast area of the Property lies in faulted contact with interpreted Stuhini Group metasediments.

Figure 1. Golden Ivan Project 2021 Surface Rock Assay Results

Golden Ivan Historical Data Compilation

Prior to initiating the 2021 exploration, Power Nickel commissioned a digital historical data compilation with respect to the Golden Ivan Property. The compilation comprised publicly available mineral assessment reports and property files from as early as 1929 to date and as recently as 2020. Documented exploration within the Golden Ivan Property includes extensive prospecting, geochemical analysis of surface rock and chip/channel samples, trenching, small-scale underground development, and geophysical surveys (airborne magnetic, VLF-EM, multi-frequency EM, and magnetic/radiometric surveys).

A total of 124 rock and rock chip/channel samples were digitized, which returned an average grade of 2.45 g/t Au and 79.4 g/t Ag, up to a maximum of 118 g/t Au and 2,400 g/t Ag. Of the 124 rock samples, a total of 17 returned greater than 1 g/t Au and a total of 16 returned greater than 50 g/t Ag, including seven samples returning both greater than 1 g/t Au and 50 g/t Ag.

Several small-scale historical workings occur within the Golden Ivan claim group, comprising surface pits, trenches, and short adits. These include the Gold Ore, Eagle & Big Bell, Magee Sky Annex, and Molly-B prospects near the western claim boundary. Molly B prospect sampling returned an average grade of 9.2 g/t Au for 11 samples, and up 45.7 g/t Au and 90.2 g/t Ag collected intermittently over a 750 m NW trending zone. In addition, the area between the Silverado No. 4 and Magee Sky Annex shows a northeast trend returned assays including 6.2 g/t Au, 1,300 g/t Ag, and 1.4 g/t Au, 2,400 g/t Ag. The significant Silverado No. 4 workings, located to the south outside the Property, returned values up to 60 g/t Au and 90 g/t Ag.

The historical compilation results demonstrate the potential to expand and further delineate historical high-grade gold-silver mineralization with continued exploration.

Methodology and QA/QC

The analytical work reported herein was performed by ALS Global (ALS), Vancouver Canada. ALS is an ISO-IEC 17025:2017 and ISO 9001:2015 accredited geo analytical laboratory and is independent of Power Nickel Inc. Rock samples were subject to crushing at a minimum of 70% passing 2 mm, followed by pulverizing of a 250-gram split to 85% passing 75 microns. Gold determination was via standard atomic absorption spectroscopy (AAS) finish 30-gram fire-assay (FA) analysis, in addition to 48 element ICP-MS geochemistry.

Power Nickel Inc. follows industry standard procedures for the work carried out on the Golden Ivan Project, with a quality assurance/quality control (QA/QC) program. For the rock channel samples, blank and standard samples were inserted into the sample sequence sent to the laboratory for analysis. With respect to prospecting rock grab samples, the QP's have relied on the internal quality assurance/quality control (QA/QC) measure of ALS which includes the insertion of standard, blank and duplicate samples into the sample stream to confirm the accuracy of the reported results. The QP detected no significant QA/QC issues during the review of the data, and is not aware of any sampling, or other factors that could materially affect the accuracy of the results.

Nisk Update

Drilling at Nisk was completed before Christmas break and the Company is waiting on assay results which would be expected in mid-February.

"We were very pleased with what we saw in the drill core. The rock that historically carried the Nickel grade was present in all of our completed holes with encouraging widths. We are looking forward to getting the assays back. We believe these drill results will enable us to complete a new 43-101 Resource in early Q2"

Other Corporate Updates

The Company has retained the services of Trunice Capital as a strategic marketing consultant. In connection with this agreement, Trunice will be awarded 700,000 stock options under the Company's stock option plan vesting immediately and expiring in two years. In addition, a further 800,000 options were granted to the four board members of Power Nickel, and 100,000 options granted to a consultant. The board options have a five-year term and the consultant options have a two-year term. The exercise price for the options is $0.14 which was the price at the close on Monday, February 1, 2022

The Company advises that it plans to spend a minimum of $150,000 and a maximum of $250,000 on paid advertising to market the Company's activities to a wider audience. These expenditures are expected to be concluded between now and the end of Q2 2022.

Qualified Person

The scientific and technical information contained in this news release as it relates to the Golden Ivan Project has been reviewed and approved by Kristopher J. Raffle, P.Geo. (BC) Principal and Consultant, and Alfonso Rodriguez, P.Geo. (BC) Senior Project Geologist of APEX Geoscience Ltd. of Edmonton, AB, both "Qualified Persons" as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Mr. Raffle and Mr. Rodriguez verified the data disclosed which includes a review of the analytical and test data underlying the information and opinions contained therein.

ON BEHALF OF THE BOARD OF DIRECTORS

Power Nickel Inc.

Terry Lynch, CEO

647-448-8044

For further information, readers are encouraged to contact:

Power Nickel Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

Terry Lynch & CEO terry@powernickel.com

Cautionary Note Regarding Forward-Looking Statement

This news release may contain certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that PNPN expects to occur, including details related to the proposed spin out transactions, are forward looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements in this document include statements regarding current and future exploration programs, activities and results. Although PNPN believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration success, continued availability of capital and financing, inability to obtain required regulatory or governmental approvals and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Power Nickel Inc.

View source version on accesswire.com:

https://www.accesswire.com/686861/Power-Nickel-Discovers-Two-New-High-Grade-Gold-Zones-at-Its-Golden-Triangle-Project-Stewart-BC-Canada