Pampa Metals Corp. ("Pampa Metals" or the "Company") (CSE:PM)(FSE:FIR)(OTCQB:PMMCF) is pleased to report that diamond drillhole PIU-01 (refer figure 1) was completed at a downhole depth of 867m. First assay results are expected shortly. Drillhole PIU 02, the second hole of the current program, has commenced

Hole PIU-01, designed to extend Cu-Au mineralization to depth on the southwestern margin of the Piuquenes Central porphyry, intersected a 160m zone of supergene copper enrichment between 220m and 380m downhole, coincident, and overlapping with primary mineralization from 350 meters. Strong primary mineralization associated with intense porphyry A type quartz stockwork veining is evident from 350m to approximately 650m. From 650m to the end of hole at 867m quartz veining and mineralization continues, becoming progressively less intense with depth. From 830m disseminated hematite/specularite-pyrite-chalcopyrite mineralization is hosted in volcanic host rocks outside the porphyry intrusive and remains open at depth.

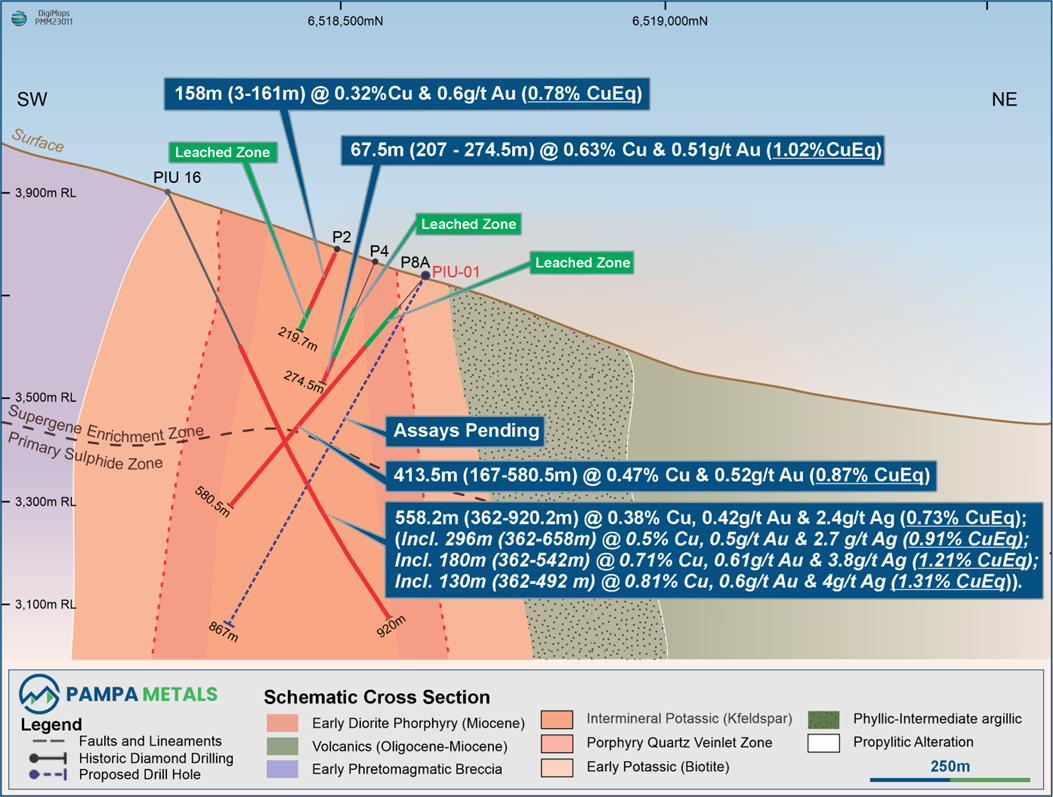

PIU-02, the second hole of the current program is oriented on an east-west section proximal to two historical holes drilled by Inmet Mining Corporation which reported 413.5m at 0.47% Cu and 0.52 g/t Au and 67.5m at 0.63% Cu and 0.51 g/t Au respectively. PIU-02 is designed to test the lateral extent of the Piuquenes Central porphyry mineralization, along the western margin of the deposit.

Joseph van den Elsen, Pampa Metals President and CEO commented: " We are very pleased to have intersected wide intervals of both supergene enrichment and primary copper mineralization on the first hole of our maiden drill campaign at the Piuquenes Project and now eagerly await first assay results. Excellent progress was made to reach target depth on our first hole, and we look forward to completing an additional two, and possibly three, holes to further test the depth and lateral extensions of the previously reported high-grade copper-gold intervals at Piuquenes Central. Subsequent drill programs will also test the undrilled Piuquenes East porphyry target and other nearby targets identified on the property. "

A Company Presentation is available at: www.pampametals.com/investor/presentations

Figure 1: Piuquenes Central Schematic Cross Section

Geology and Mineralization - Diamond Drillhole PIU-01

Moderate porphyry A-type quartz stockworks are present from approximately 150m downhole, increasing in intensity from 220m depth. Supergene copper enrichment is evident from 220m to 380m depth, partially coincident (from 288 m depth) with increasing intensity of porphyry A-type quartz vein stockworks and evidence of intermineral potassic alteration. A narrow zone of copper oxides is observed from 220 - 229m downhole.

Dense porphyry A-type quartz vein stockwork with chalcopyrite and traces of disseminated bornite mineralization hosted in potassic altered diorite porphyry was intersected from 350m to approximately 650 m. From 650m to approximately 740m downhole a zone of moderate intensity quartz veining was intersected, prior to a zone of sporadic quartz veining which remains open at 867m (EOH). From 730m intermediate argillic alteration is present, and molybdenite, sphalerite and hematite/specularite associated with grey sericite-chlorite veining and fine-grained disseminated chalcopyrite-bornite. From 830m the host-rock is volcanic, superimposed by sericite-chlorite alteration and disseminated hematite/specularite-pyrite-chalcopyrite mineralization, veining and breccias.

Image 1: Intense porphyry A type qtz vein stockwork overprinting early potassic altered diorite porphyry

Image 2. Porphyry A-type qtz-veining with potassic (K-Spar) altered vein halos and disseminated chalcopyrite

ON BEHALF OF THE BOARD

Joseph van den Elsen | President & CEO

INVESTOR CONTACT

Joseph van den Elsen | Joseph@pampametals.com

ABOUT Pampa Metals

Pampa Metals is a copper-gold-silver-molybdenum porphyry exploration company listed on the Canadian Stock Exchange (CSE:PM), Frankfurt (FSE: FIR), and OTC (OTCQB: PMMCF) exchanges.

In November 2023, the Company announced it had entered into an Option and Joint Venture Agreement for the acquisition of an 80% interest in the Piuquenes Copper-Gold Porphyry Project in San Juan Province, Argentina.

Previous intervals of significant copper and gold mineralization at Piuquenes Central (refer 5 December 2023 News Release) include:

- 413.5 m (167-580.5 m) @ 0.47% Cu and 0.52 g/t Au (0.87% CuEq)*; and

- 558.2 m (362-920.2 m EOH) @ 0.38% Cu, 0.42 g/t Au and 2.4 g/t Ag (0.73% CuEq)*

- including 130 m (362-492 m) @ 0.81% Cu, 0.6 g/t Au and 4 g/t Ag (1.31 % CuEq)*

Qualified Person

Technical information in this news release has been approved by Mario Orrego G. Mr. Orrego G. is a Geologist, a Registered Member of the Chilean Mining Commission and a Qualified Person as defined by National Instrument 43-101. Mr. Orrego G. is a consultant to the Company.

* %CuEq values are calculated based on copper and gold metal prices: Cu = US$3.20/lb, Au = US$1,700/oz and Ag = US$ 20/oz. The formula utilized to calculate %CuEq is: Cu Eq Grade (%) = Cu Head Grade (%) +