November 18, 2024

Dufay Cu-Au Project, Quebec

Olympio Metals Limited (ASX:OLY) (Olympio or the Company) is pleased to announce that it has signed an option to acquire 80% of the highly prospective Dufay Cu-Au Project on the Cadillac-Lake Larder Fault Zone, known as the ‘Cadillac Break’ (Dufay Option), in Canada.

Highlights

- Option to acquire 80% of the Dufay Copper-Gold Project from private vendors

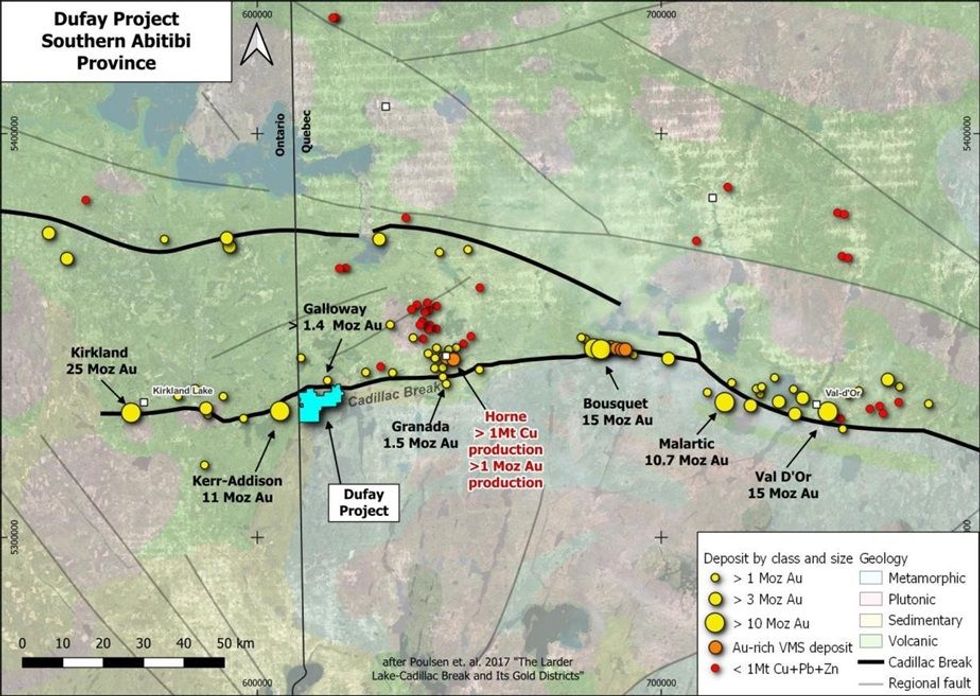

- Located on the Cadillac Break, a regional structure associated with world class gold and copper mineralisation (>110 Moz Au1)

- Outcropping copper sulphides with numerous high grade rockchips up to 7.7% Cu

- 60km2 of tenure, covering 10km of strike of the Cadillac Break

- Multiple large Au-Cu mineral resources within 5km (Kerr-Addison2 >11Moz, Galloway3 >1.4 Moz)

- 35km west of world class Rouyn-Noranda Cu-Au province (VMS) and Horne Copper Smelter (Glencore)

- Excellent road and rail infrastructure with year round access

- Untested high priority IP anomaly (>1.2km) adjacent to syenite porphyry

- Underexplored property with no drilling since the 1980s

- Drilling approvals underway with drilling planned for January 2025

- Option represents a low cost strategic addition for Olympio

Olympio’s Managing Director, Sean Delaney, commented:

“The Dufay Project offers Olympio significant strike exposure to one of the world’s premier mineralised structures, the famed Cadillac Break. The Project offers a range of underexplored exploration targets, including high-grade copper showings that have never been drilled and compelling porphyry Cu-Au geophysical targets that remain untested.

“The Project is adjacent to numerous large gold-copper mineral resources, with a major highway through the project directly to the Rouyn-Noranda copper smelter 35km to the east. The Project has significant potential to host porphyry Cu-Au mineralisation, with exploration drilling planned to commence during the upcoming Canadian winter field season.”

This terrane bounding structure is associated with world class endowments of VMS and orogenic gold and copper mineralisation1. The Project is located 35km west of the Rouyn-Noranda mining centre and copper smelter in southwest Québec (Figure 3 and Figure 4).

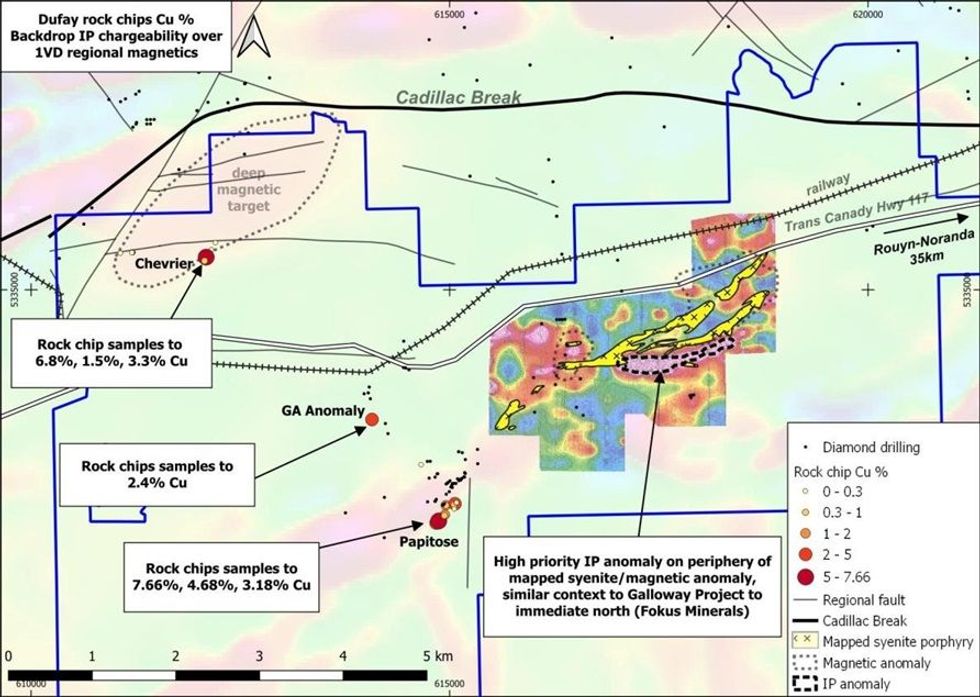

The Dufay Project contains numerous historical showings of chalcopyrite-rich quartz veining, including the Chevrier working (refer Figure 1 and Figure 2), which was mined briefly in the late 1920s. There has been limited drilling on the Property, with the majority of holes drilled pre-1945 and no drilling for the last 36 years.

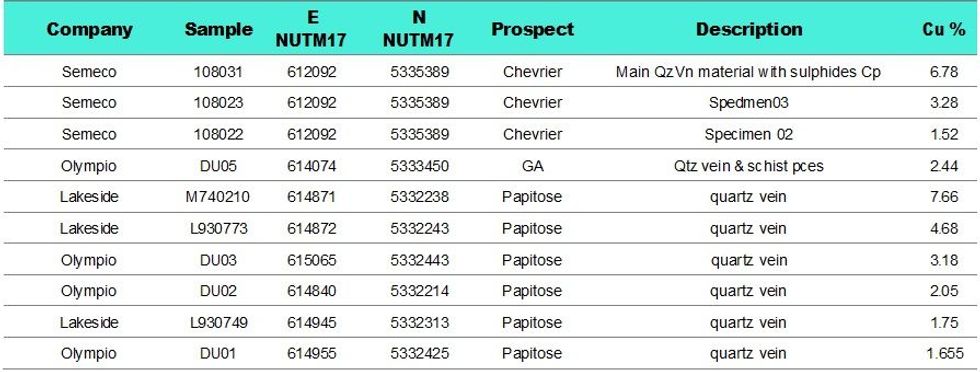

Numerous high grade copper rock chips samples across many prospect locations within the tenure, including up to 7.66% at the Papitose Prospect and up to 6.78% at the Chevrier Prospect (Figure 1, Table 1).

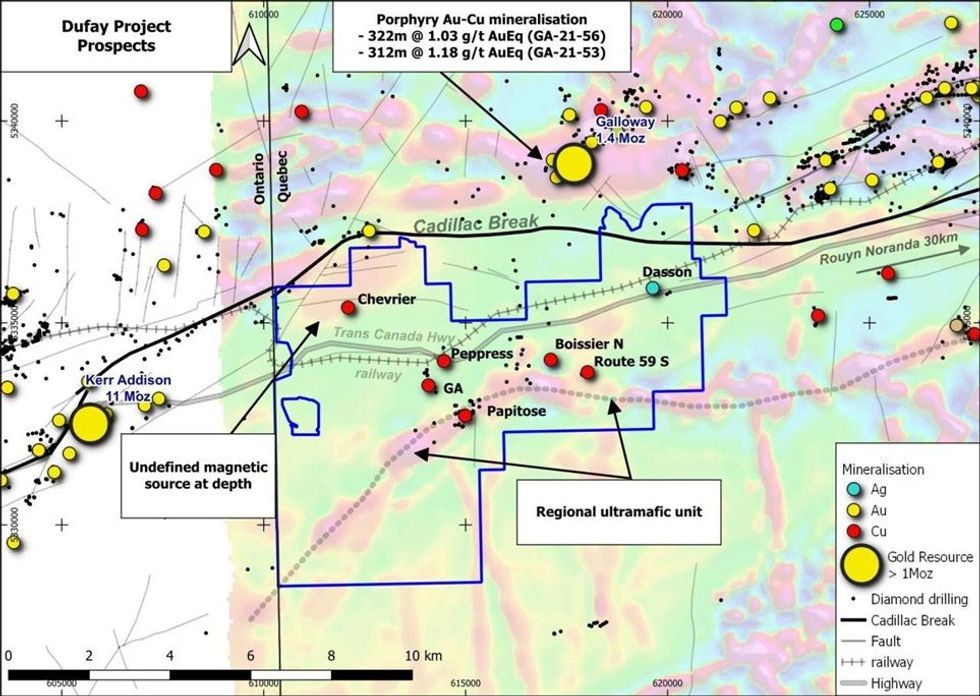

There are numerous elongated exposures of syenite porphyry mapped in the Dufay Project (Figure 1). The Dufay Project syenite occurs <4km south of the Renault Bay Syenite, which is directly associated with the >1.4 Moz Au-equivalent Galloway Project 4km to the north3 (Fokus Minerals) (Figure 2). An Induced Polarisation (IP) ground survey over the area was completed in 20114, and recorded a large (>1200m long), high conductivity anomaly typical of copper sulphide mineralization immediately adjacent to the syenite porphyry. Importantly, this compelling copper target has never been drilled.

The extensive IP anomaly, the Chevrier Prospect and the Papitose Prospect are immediate priority drill targets with the approvals process already underway for drilling planned to start in January 2025.

TECHNICAL INFORMATION

The Dufay Copper-Gold Project is located immediately south of the Cadillac-Lake Larder Fault Zone, or the Cadillac Break, a major crustal discontinuity separating the Archean Abitibi Greenstone sub-province to the north from the Pontiac sub-province to the south.

The gold endowment of the orogenic deposits located along the Cadillac Break totals approximately 111 Moz1. Multiple >1Moz gold projects occur within 5km of the Dufay Project , including Kerr-Addison (11 Moz2) and the recently increased Galloway Au-Cu mineral resource (Fokus Minerals, >1.4 Moz Au-equivalent3) (Refer Figure 2 and Figure 3). The Pontiac Sub-Province sediments host numerous gold mineral resources peripheral to the Cadillac Break, including the nearby Granada mineral resource (>1.0Moz)6 and the >10Moz Malartic deposit7.

The Cadillac Break is also linked to the Noranda Volcanic Complex, which hosts numerous VMS deposits (Cu-Au-Zn-Ag) including the Horne deposit (>1Mt Cu, 0.5Mt Ag, 9Moz Au production8; Refer Figure 3).

The Project is highly prospective for porphyry Au-Cu mineralisation and shear-hosted quartz- carbonate-pyrite lode gold mineralisation. The nearby Galloway gold deposit (<4 km to the north, Fokus Minerals) is strongly associated with a syenite intrusive, similar to those mapped within the Dufay tenure.

Dufay hosts numerous quartz vein-sulphide hosted copper-gold-silver prospects with strike extents to hundreds of metres. The Archaean host geology includes a wide variety of rock types, including metasediments, ultramafic talc-chlorite schists, porphyry/syenite, felsic to intermediate intrusives and gneisses, and Proterozoic dolerite dykes. Disseminated chalcopyrite mineralisation is widespread in selected areas examined by Olympio to-date, suggestive of a large pervasive mineralising system.

Click here for the full ASX Release

This article includes content from Olympio Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00