(TheNewswire)

-

- Previous diamond drilling by Noble found gold mineralization over 7.5 kilometers of strike, open in both directions and in width

-

- Drill intersections included; 2.84 g/t gold over 1.5 meters and 0.67 g/t over 18.0 meters*

- Present work program includes a 20 kilometer Induced Polarization survey and 2,000 meters of additional diamond drilling

- Noble has made application to the Ontario Junior Exploration Program sponsored by the Ontario Government to fund up to $200,000 of the proposed program

* True widths not known at this time

Toronto, Ontario – TheNewswire - August 9, 2021 - Noble Mineral Exploration Inc. ( "Noble" or the "Company" ) (TSXV:NOB ) ( FRANKFURT:NB7 ) ( OTC:NLPXF) is pleased to announce that due to favourable results from the initial 2020 work program in Dargavel Township, further work has been recommended to better define gold mineralization that has now been identified along a strike length of 7.5 km. An Induced Polarization survey will be done to identify areas of increased sulphide concentration within the gold horizon. Geophysical work is expected to start immediately with the 2,000 meter drill program beginning in September. The Dargavel Property is owned 100% by Noble subject to a 2% Net Smelter Royalty.

The funding for this program is being provided 50% by Noble and 50% by a private investor. Noble has agreed with the investor that if the outcome of the program is positive, Noble will enter into good faith negotiations with the investor to enter into an option and joint venture agreement that would recognize the investor and Noble as each holding their respective interests in the drilled property, subject to standard dilution provisions to the extent that either does not fund future maintenance and exploration expenditures. All agreements between Noble and the investor are subject to compliance with TSX Venture Exchange policies.

The 2020 drill program detected gold mineralization over a strike length of 7.5 kilometers, open in both directions. In addition, the true width of the zone has not been determined as evidenced by the fact that drill hole DAR-20-06 ended in mineralization after cutting more than 18 meters of core mineralized with gold. Very little work has been done in the past in Dargavel Township due to the heavy overburden cover and the fact that the area was not open for traditional staking due to the predominance of patented claims.

Of the six holes drilled in 2020, five intersected gold mineralization. The mineralized zones appear to be associated with magnetic and electromagnetic (EM) anomalies that have been identified over the entire strike length by a regional airborne survey executed by Noble and by historic EM surveys.

In addition to gold values, the drilling also detected 1.51 g/t combined platinum and palladium over 1.5 meters associated with gold mineralization in Hole DAR-20-05. Past work in the township has also detected significant nickel, cobalt and platinum group mineralization.

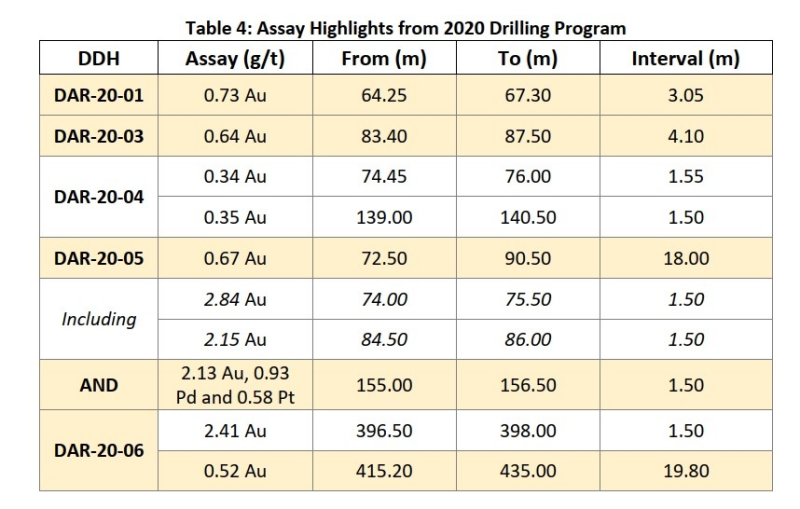

A summary of the significant results can be found in Table 1 and Figure 1.

Table 1: Significant Gold Intersections from the 2020 Drill Program*

* True widths not known at this time

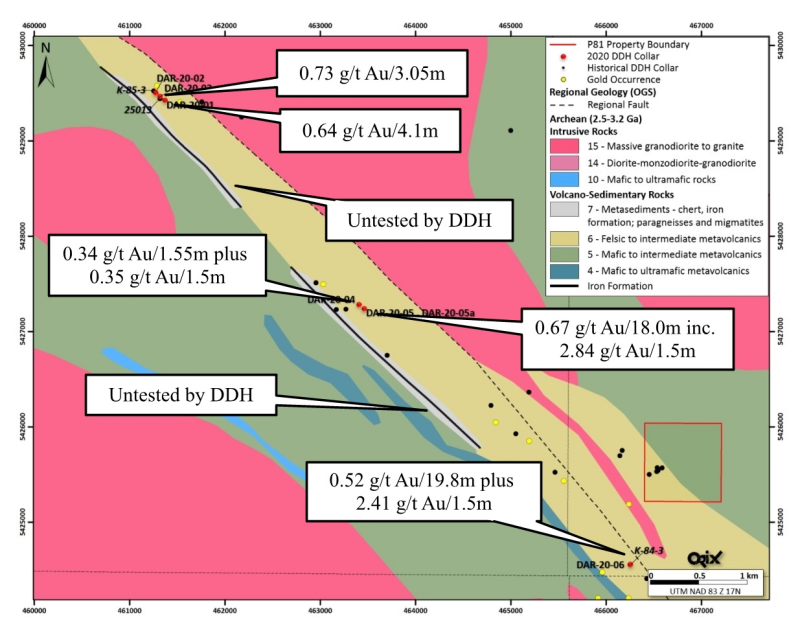

Figure 1: Map Showing Previous drilling with Significant Drill Intersections*

* True widths not known at this time

Vance White, President and CEO of Noble, said "We are excited to continue the exploration on the Dargavel Township Property. Previous work on the property detected gold mineralization in the five out of six holes drilled. What was not defined by the last program was the total strike length of the zone and the width of the zone. The present program of geophysics and diamond drilling will help to define these unknowns."

Michael Newbury PEng (ON), a "qualified person" as such term is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Noble.

About Noble Mineral Exploration Inc.:

Noble Mineral Exploration Inc. is a Canadian-based junior exploration company which, in addition to its shareholdings in Canada Nickel Company Inc., Spruce Ridge Resources Ltd. and MacDonald Mines Exploration Ltd., and its interest in the Holdsworth gold exploration property in the Wawa, Ontario area, holds approximately 72,000 hectares of mineral rights in the Timmins-Cochrane areas of Northern Ontario known as Project 81. Project 81 hosts diversified drill-ready gold, nickel-cobalt and base metal exploration/VMS targets at various stages of exploration. More detailed information is available on the website at www.noblemineralexploration.com .

Noble's common shares trade on the TSX Venture Exchange under the symbol "NOB".

Cautionary Statement:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

The foregoing information may contain forward-looking statements relating to the future performance of Noble Mineral Exploration Inc. Forward-looking statements, specifically those concerning future performance, are subject to certain risks and uncertainties, and actual results may differ materially from the Company's plans and expectations. These plans, expectations, risks and uncertainties are detailed herein and from time to time in the filings made by the Company with the TSX Venture Exchange and securities regulators. Noble Mineral Exploration Inc. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

Contacts:

H. Vance White, President

Phone: 416-214-2250

Fax: 416-367-1954

Email: info@noblemineralexploration.com

Investor Relations

Email: ir@noblemineralexploration.com

Copyright (c) 2021 TheNewswire - All rights reserved.