(TheNewswire)

-

Noble has acquired by staking 677 claims (1400 hectares or 140 sq. km.) on Nagagami Carbonatite/Alkalic Complex

-

Exploration model is a Niobec-style of mineralization (Quebec) where Niobium has been produced since 1976 and the property has a measured and indicated resource of Rare Earth Metals

-

The Nagagami Project falls within the Ontario Government Critical Minerals Directive issued this year in order to find local sources of strategic materials

-

Around the world, governments are implementing policies that are accelerating innovative technology that rely heavily on critical and strategic minerals as raw materials for electric vehicles, clean energy and information communications technology

-

In addition, the project will qualify for the Ontario Junior Exploration Program for 2022, sponsored by the Ontario Government to fund up to $200,000 of the proposed exploration program which will begin in early 2022

-

The Nagagami Complex has been grossly under-explored with a limited amount of drilling by Algoma in the 1960's in search of iron deposits.

Toronto, Ontario – TheNewswire - December 16 , 2021 - Noble Mineral Exploration Inc. ( "Noble" or the "Company" ) (TSXV:NOB ) ( FRANKFURT:NB7 ) ( OTC:NLPXF) Noble Minerals is pleased to announce that it has acquired 677 claims through staking, to cover the Nagagami Carbonatite/Alkalic Complex, located about 65 kilometers Northwest of Hearst Ontario. The staked area is equivalent to about 1400 hectares or 140 square kilometers.

Recent research by Noble indicated remarkable similarities between the niobium producing Niobec Mine and the Nagagami Complex. The Niobec Mine now owned by IAMGOLD started commercial production of niobium pentoxide in 1976. It is one of the major sources of niobium in the world and North America's only source of pyrochlore. It currently produces around 7%-8% of the niobium used globally. Niobec also has a resource in rare earth metals.

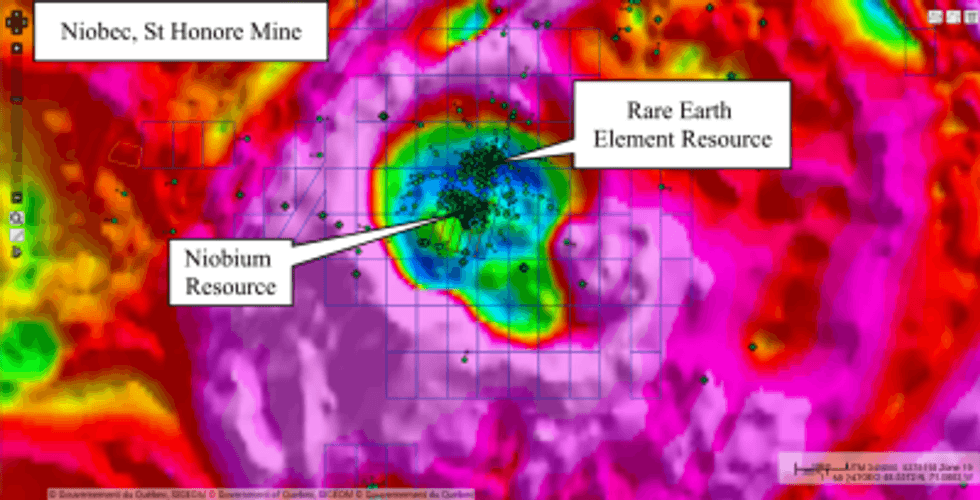

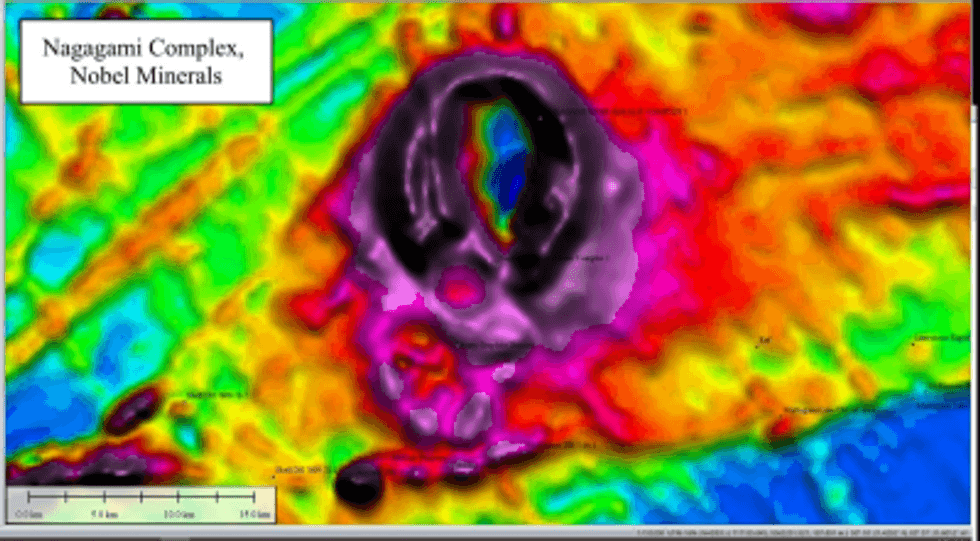

A study of the magnetic data for the Nagagami Complex and the Niobec Mine both indicate a donut shaped structures with syenitic rocks forming the circular magnetic high with carbonatitic rocks forming the central magnetic low. At Niobec, it is in the central magnetic low where the Niobium and Rare Earth mineralization is hosted. (See Fig 1 and 2)

Click Image To View Full Size

Figure 1: Magnetic map of the Niobec Mine near St Honore, Quebec. Green circles indicate drilling in the central magnetic low where niobium and rare earth mineralization is found.

Click Image To View Full Size

Figure 2: Magnetic map of the Nagagami Carbonatite Complex located northwest of Hearst, Ontario. Note the magnetic high ring and the central magnetic low similar to the Niobec Mine at St Honore Quebec.

Recently the Ontario Government, along with the Canadian and World governments have implemented policies in order to stimulate the search for strategic and critical metals that are in short supply due to the worldwide push for clean energy, battery and communication technology. To promote this, the Ontario Government has launched the Ontario Junior Exploration Program to help Mining companies explore for these metals in Ontario through grants. Noble will apply for the Ontario grant on the Nagagami project.

Previous work in the Nagagami area has been spotty due in part to the fact that the complex is not exposed on surface. Algoma Ore Properties performed the original airborne magnetic survey in the area that Identified the complex. Limited drilling was aimed at the magnetic ring structure in search of iron deposits. Despite drilling in the wrong geology for niobium and rare earth metals, one of the Algoma drillholes returned an assay of 0.3% Nb205 from a grab sample of syenite taken at 230 feet. Fluorite was noted in one drill hole as red-brown, waxy hydronephelite (an alteration form of nepheline) comprising 5-10% of the rock. The existence of fluorite is characteristic of carbonatite style mineralization.

About 4.5 kilometers south of the Nagagami Complex, Zenyatta Ventures is developing the Albany graphite deposit. The Albany deposit is classed as one of the largest known hydrothermal graphite deposits in the world. Hydrothermal graphite is the purest, but also the rarest, form of graphite. The graphite mineralization here appears to be related to the emplacement of the Nagagami complex resulting in the possible occurrence of similar mineralization and geology on the Noble property.

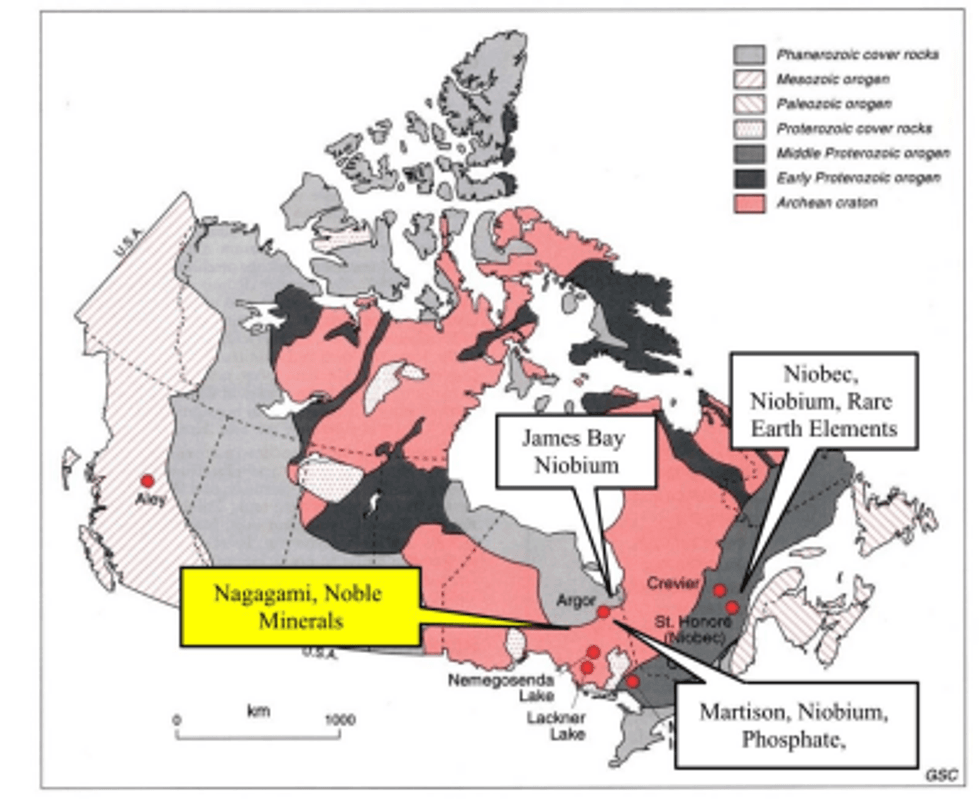

Identified carbonatites in the area known to host economic mineralization are identified in Figure 3.

Click Image To View Full Size

Vance White, President and CEO of Noble, said "we are very pleased to add this project to our portfolio of mineral projects most of which are directed at the search for the battery and strategic related minerals. The Nagagami Carbonatite complex is virtually virgin ground due to a lack of modern exploration techniques. We are preparing a work program for early 2022."

Michael Newbury P.Eng. (ON), a "qualified person" as such term is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Noble.

About Noble Mineral Exploration Inc.:

Noble Mineral Exploration Inc. is a Canadian-based junior exploration company which, in addition to its shareholdings in Canada Nickel Company Inc., Spruce Ridge Resources Ltd. and MacDonald Mines Exploration Ltd., and its interest in the Holdsworth gold exploration property in the area of Wawa, Ontario, holds approximately 72,000 hectares of mineral rights in the Timmins-Cochrane areas of Northern Ontario known as Project 81 as well as an additional ~11,000 hectares in the Timmins area. Project 81 hosts diversified drill-ready gold, nickel-cobalt and base metal exploration targets at various stages of exploration. It also owns the Buckingham Graphite Property, the Laverlochere Nickel, Copper, PGM property and the Cere-Villebon Nickel, Copper PGM property all of which are in the province of Quebec. More detailed information is available on the website at www.noblemineralexploration.com .

Noble's common shares trade on the TSX Venture Exchange under the symbol "NOB".

Cautionary Statement:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

The foregoing information may contain forward-looking statements relating to the future performance of Noble Mineral Exploration Inc. Forward-looking statements, specifically those concerning future performance, are subject to certain risks and uncertainties, and actual results may differ materially from the Company's plans and expectations. These plans, expectations, risks and uncertainties are detailed herein and from time to time in the filings made by the Company with the TSX Venture Exchange and securities regulators. Noble Mineral Exploration Inc. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

Contacts:

H. Vance White, President

Phone: 416-214-2250

Fax: 416-367-1954

Email: info@noblemineralexploration.com

Investor Relations

Email: ir@noblemineralexploration.com

Copyright (c) 2021 TheNewswire - All rights reserved.