July 16, 2023

Queensland Pacific Metals Limited (ASX:QPM) is pleased to announce QPME production and financial guidance for the Moranbah Project.

Highlights

- QPM Energy (“QPME”) has been working closely with the Moranbah Project vendors to finalise ownership transition with completion currently estimated to occur around the end of July.

- Upon completion of the acquisition, QPME will receive net cash of $30m.

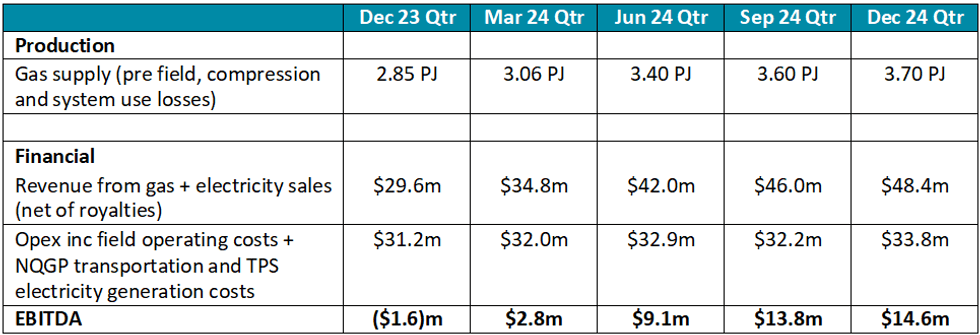

- QPME has developed gas supply forecasts and operating budgets based on an extensive review of historical operations and field development plans and is pleased to provide indicative production and financial guidance for the Moranbah Project through to the end of 2024.

- QPME is forecasting that the Moranbah Project will generate positive EBITDA through 2024 based on production, operating and electricity price assumptions outlined in the Appendix.

Summary

Summary guidance is provided in the table below. As the date of transfer of ownership and operating control to QPME has not been finalised, guidance has not been provided for the September 23 quarter. Further information and assumptions can be found in the Appendix

Transaction Update

QPME has been working closely with relevant stakeholders to satisfy the necessary condition precedents to reach financial close on the Moranbah Project acquisition. Importantly, QPME has received official correspondance from the Queensland Government regarding its intention to approve the transfer of the Moranbah Project Petroleum Licenses to QPME. At this stage, financial close is targeted around the end of July.

Furthermore, QPME is pleased to advise that Ben Visser will join the company as General Manager - Development and Operations. Ben has extensive operating and asset management experience across the oil and gas, mining and petrochemical industries. In particular, Ben has been directly responsible for developing and managing large coal seam gas and conventional production operations in Queensland and the Northern Territory

Upstream Production Solutions (“UPS”), an experienced gas field operator, has been contracted to operate the Moranbah Project and is well advanced on achieving operational readiness including the transfer of a significant portion of the experienced Moranbah Project team.

At financial close, QPME will own the Moranbah Project assets, receive all project revenues and have financial responsibility for operating and capital costs. Arrow Energy will continue to operate the project for a short period of time to facilitate a smooth tansfer of operatorship to UPS.

Click here for the full ASX Release

This article includes content from Queensland Pacific Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

QPM:AU

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

20 April 2022

Queensland Pacific Metals

Developing a Sustainable and High-Purity Battery Materials Refinery Project

Developing a Sustainable and High-Purity Battery Materials Refinery Project Keep Reading...

Keep reading...Show less

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

19 December 2025

Nickel Price 2025 Year-End Review

After peaking above US$20,000 per metric ton (MT) in May 2024, nickel prices have trended steadily down. Behind the numbers is persistent oversupply driven by high output from Indonesia, the world’s largest nickel producer. At the same time, demand from China's manufacturing and construction... Keep Reading...

Latest News

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00