September 27, 2022

Elevate Uranium Limited (“Elevate Uranium”, or the “Company”) (ASX:EL8) (OTC:ELVUF) is pleased to announce the discovery of a uranium mineralised zone extending continuously over a further 10 kilometres to the northeast of the Koppies 2 resource. On 4 May 2022, in an ASX release titled “22% Increase in Mineral Resources”, the Company announced the initial JORC (2012) Inferred Mineral Resource Estimate (“MRE”) of 20.3 million pounds (“Mlb”) eU3O8 at its Koppies Uranium Project in Namibia (See Page 8). The announcement also identified the potential to expand the mineralisation of Koppies beneath, adjacent and to the northeast.

Highlights:

- Uranium mineralisation identified, extending the anomaly another 10 km to the northeast of Koppies.

- Mineralisation is up to 1,000 metres wide.

- Mineralisation is generally less than 10 metres below surface.

- Potential to add significantly to existing 20 Mlb U3O8 mineral resource at Koppies.

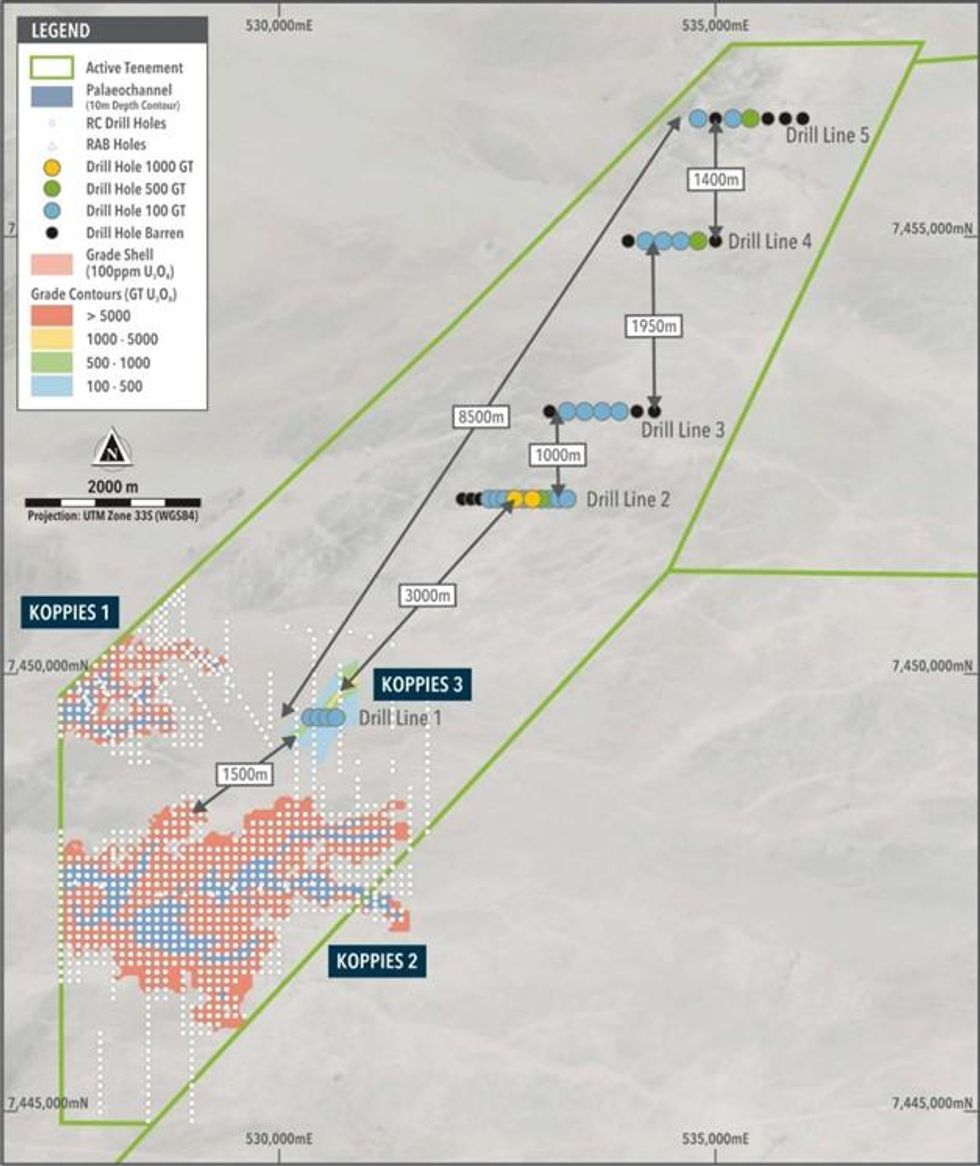

Subsequent to identifying the potential for mineralisation to the northeast, a field trip was undertaken in July 2022 to ground truth the regional trend northeast of Koppies 2 within the radiometric anomaly identified from the airborne survey completed in 2008. This area is now referred to as Koppies 3 (see Figure 2). Following that field trip, it was decided to drill five lines progressively along the radiometric anomaly, with the fifth drill line 10 kilometres northeast of Koppies 2. All five drill lines intersected uranium mineralisation greater than 100 ppm eU3O8.

Figure 1 highlights the mineralisation identified to date at Koppies 3 and the drilling completed on Koppies 3 Extension to the northeast of Koppies.

Elevate Uranium’s Managing Director, Murray Hill, commented:

“The potential of Koppies continues to improve with each drill line. We currently have a mineral resource of 20.3 million pounds of uranium at Koppies and we have identified that uranium mineralisation extends for another 10 kilometres to the northeast of the Koppies 1 and 2 resources. As is the case at Koppies 1 and 2, the uranium mineralisation is shallow and generally less than 10 metres below the surface.

This discovery has the potential to substantially expand the Koppies uranium resource. A second drill rig has been mobilised to Koppies to accelerate the drill program.”

Figure 1 The New Discovery at Koppies 3 Extension

Click here for the full ASX Release for the full ASX Release

This article includes content from Elevate Uranium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EL8:AU

The Conversation (0)

6h

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00