December 11, 2024

West Australian gold exploration and development company, Rox Resources Limited (“Rox” or “the Company”) (ASX: RXL), has received the final batch of assays from its 11,000m DD and RC program at the Youanmi Gold Project in WA.

- The latest batch of assays have been received from the 11,000m drilling program (both diamond core and reverse circulation) at the high gold-grade Youanmi Gold Project, located centrally in Western Australia’s prolific gold fields

- The recently-completed infill/exploration program aimed to improve resource confidence and open up corridors for resource growth; to underpin the Definitive Feasibility Study (DFS), and, additionally, provide sample material for ongoing metallurgical optimisation test-work for the DFS program

- Latest highlights from the program include:

- RXDD131: 4.38m @ 19.07 g/t Au from 387.98m,

- incl. 1.73m @ 41.43 g/t Au from 389.96m

- RXDD119: 4.56m @ 14.60 g/t Au from 220.64m

- RXDD115: 2.99m @ 21.11 g/t Au from 249.88m

- RXDD119: 4.0m @ 7.37 g/t Au from 162.0m

- RXDD132: 7.19m @ 3.90 g/t Au from 263.61m

- RXDD133: 2.83m @ 6.53 g/t Au from 431.00m

- RXDD128: 3.82m @ 4.51 g/t Au from 364.59m,

- incl. 1.73m @ 8.22 g/t Au from 364.59m

- incl. 1.73m @ 8.22 g/t Au from 364.59m

- RXDD122: 0.95m @ 13.50 g/t Au from 204.44m

- §These results further demonstrate the continuity of high- grade gold mineralisation along the Youanmi greenstone belt belt, and the potential for resource growth both at depth and along-strike, with discovery potential to the south

- 35,000m Step-up drill campaign well underway with the plan to bring forward ounces and increase the mine plan

The program focused on converting Inferred stopes at Pollard, United North and Youanmi Main to higher confidence Indicated classification and providing material for metallurgical testing for the upcoming Definitive Feasibility Study (DFS) – on track for H2 CY25.

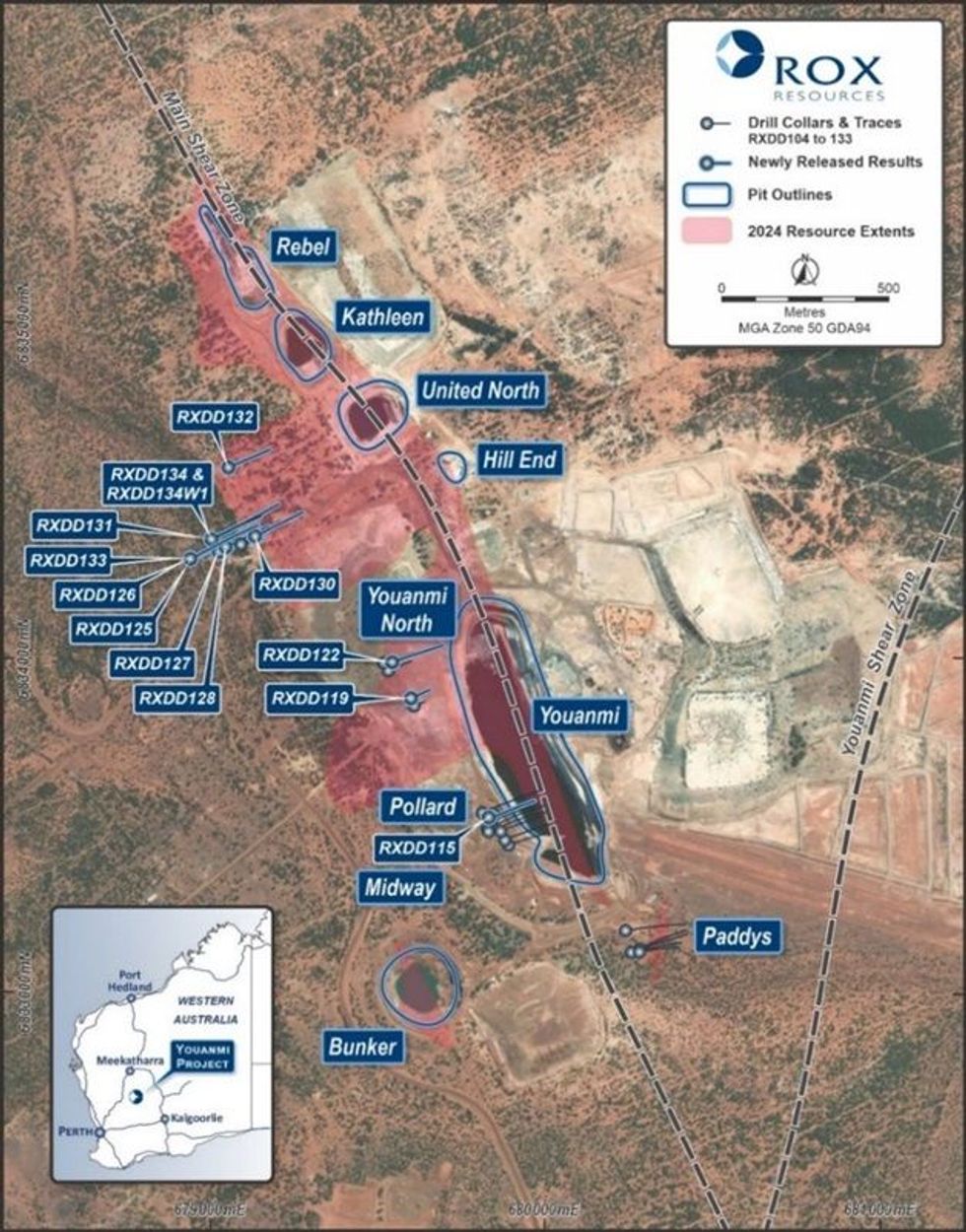

This final consignment of diamond assay results are the fourth batch of assays results returned from the drill program and have been entirely drilled from the Pollard, Youanmi and United North areas (Figure 1).

Rox Resources’ Chief Executive Officer, Phillip Wilding, commented:

“It’s pleasing to round out the 11,000m RD and DD drilling program with another batch of excellent intercepts.

“More importantly, the program has significantly improved our knowledge of the high grade and underexplored Youanmi ore system, and shown that mineralisation remains open at depth.

“Next steps are to convert Inferred areas of the Resource to the higher confidence Indicated classification, and finalise key intercepts of sample material for metallurgical test work to feed into the Youanmi DFS.

“We are excited to have commenced the 35,000m Step-up program to potentially bring forward ounces in the mine plan and significantly increase the size of the Pollard ore zone.”

Youanmi Major Growth Drill program

Resource drilling has focused on converting selected Inferred stopes in the current Mineral Resource of 16.2Mt at 4.4g/t Au for 2.3Moz (Indicated: 10.7Mt at 4.5g/t Au for 1.6 Moz : Inferred 5.5Mt at 4.2g/t Au for 0.7 Moz) 1 to higher confidence Indicated classification at Pollard, United North and Youanmi Main as shown in plan on Figure 1. The drilling has also provided both sample material for metallurgical testing and valuable geological data for the pending Definitive Feasibility Study (“DFS”) planned for second half of 2025.

Outside of the immediate resource area, drilling was also conducted on near-mine exploration and focused on the Youanmi South prospect area, or Paddy’s Lode, first reporting high-grade intercepts in 20232. The drilling at Paddy’s has complimented the Company’s exploration strategy moving south along the Main Lode Shear Zone (MLSZ) and adding additional gold ounces to the Resource. Youanmi South has the potential to grow the Resource above the 103kozpa Production Target outlined in the recently completed Pre-Feasibility Study (“PFS”)3.

Click here for the full ASX Release

This article includes content from Rox Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00