FPX Nickel Corp. (TSXV: FPX) (OTCQB: FPOCF) (" FPX " or the " Company ") is pleased to report an updated mineral resource estimate for the Baptiste Nickel Project (" Baptiste " or the " Project ") at the Decar Nickel District (" Decar ") in central British Columbia. The 2022 mineral resource estimate incorporates results from 2021's in-fill drilling program and is based on a new geological modelling approach and newly improved dike model, all of which contribute to significantly improved Davis Tube Recoverable ("DTR") nickel grades. The 2022 mineral resource estimate also reports, for the first time, the content of total nickel and potential by-product elements, cobalt and iron.

Highlights

- Significant improvement in DTR nickel grade, with a 6% DTR nickel grade increase in the indicated category and a 15% increase in the inferred category

- First-time reporting of total nickel content facilitates more accurate benchmarking to other large-scale nickel projects and highlights the potential for recovery of non-DTR nickel in the Baptiste deposit

- First-time reporting of DTR cobalt and DTR iron contents highlights potential new byproduct value sources for Baptiste

- Improved mineral resource modelling approach and estimate basis developed in collaboration with Equity Exploration Consultants Ltd. (" Equity ") and Next Mine Consulting Ltd. (" NMC ")

- An independent third-party review of the new modelling and estimation approach by SLR Consulting Ltd. (" SLR ", formerly Roscoe Postle Associates)

- 2022 mineral resource estimate will serve as the basis for the upcoming Baptiste Preliminary Feasibility Study (" PFS "), which is forecast for completion in the second half of 2023

"The new mineral resource estimate highlights the potential for improved project economics owing to a material increase in DTR nickel grade and new opportunities for recovery of cobalt and non-DTR nickel contained in the Baptiste deposit," noted Martin Turenne , FPX's President and CEO. "This marks an important de-risking step in the ongoing development of Baptiste as a large-scale, low-cost and low-carbon nickel project, setting the stage for the completion of our current metallurgical program which will culminate with the production of battery-grade nickel sulphate in the first quarter of 2023."

Approach

The new Baptiste Mineral Resource estimate incorporates results from 2021's successful in-fill drilling program (see the Company's news release dated March 14, 2022 ). The 2021 program included 17 holes totaling 2,856 metres, bringing total resource drilling to-date to 99 holes, totaling 33,695 metres. As previously reported, the 2021 Baptiste resource drilling program targeted the conversion of near-surface, higher-grade inferred resources to the indicated category.

The new modelling approach includes defined geological sub-domaining, grade shell modelling and more accurate modelling of dilutive dikes; collectively better representing the scale and characteristics of the Baptiste deposit. This compares to the previous approach applied in the 2020 Preliminary Economic Assessment (" PEA ") which solely used lithology domains and an assumed 3% removal of rock mass to account for waste or dike sections within the deposit.

Summary of Results

As seen in Table 1, along with updated tonnage and DTR nickel grades, the 2022 mineral resource estimate now includes total nickel, DTR cobalt, and DTR iron that all provide new potential value sources for Baptiste. In addition, the reporting of total nickel grade facilitates more accurate benchmarking with other large-scale nickel projects.

Table 1: 2022 Baptiste Deposit Pit-constrained Mineral Resource Estimate*

| Category | Tonnes | Grade | Contained Metal | ||||||

| DTR | Total | DTR | DTR | DTR | Total | DTR | DTR | ||

| Indicated | 1,815 | 0.129 | 0.211 | 0.0035 | 2.40 | 2,435 | 3,828 | 64.4 | 43.5 |

| Inferred | 339 | 0.131 | 0.212 | 0.0037 | 2.55 | 444 | 720 | 12.5 | 8.6 |

*Notes for Tables 1 and 2:

- Mineral Resource estimate prepared by Richard Flynn , P.Geo of NMC using ordinary kriging within grade shell domains and inverse distance squared in dike domains.

- Resources are reported using the 2014 CIM Definition Standards and were estimated in accordance with the CIM 2019 Best Practices Guidelines.

- Davis Tube magnetically-recovered ("DTR") nickel is the nickel content recovered by magnetic separation using a Davis Tube, followed by fusion XRF to determine the nickel content of the magnetic fraction; in effect a mini-scale metallurgical test. The Davis Tube method is the global, industry standard metallurgical testing apparatus for recovery of magnetic minerals.

- Indicated resources are drilled on approximate 200 x 200 metre drill spacing and confined to mineralized lithologic domains. Inferred resources are drilled on approximate 300 x 300 metre drill spacing.

- A cut-off grade of 0.06% DTR Ni was applied.

- An optimized pit shell was generated using the following assumptions: US $8.50 per pound nickel price; pit slopes between 42-44°; nickel payability of 96%; mining recovery of 97% DTR Ni; process recovery of 85% DTR Ni; exchange rate of US$1.00 = C$0.77 ; and total operating cost and minimum profit of US$9.37 per tonne.

- Totals may not sum due to rounding.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

As seen in Table 2, contained DTR nickel metal in the indicated category remains unchanged at 2.435 million tonnes, with an approximate 9% reduction in tonnage offset by an approximate 6% increase in DTR nickel grade. The indicated grade increase is primarily due to (a) the introduction of grade shell modeling; and (b) the exclusion of near or below cut-off grade material within the mineralized zone through the improved dike model; and (c) the conversion of previously inferred higher-grade material through the inclusion of 2021 in-fill drilling data.

In the inferred category, tonnage is down by 42%; however, the average DTR nickel grade has increased by 15% which mutes the reduction in contained DTR nickel metal to 34%. The reduction of inferred tonnage is due to (a) conversion of inferred to the indicated category; and (b) the exclusion of near or below cut-off grade material at the periphery of the mineralized zone through the new geological modelling approach.

Table 2: Updated Baptiste Resource Estimate vs. 2020 PEA Resource Estimate

| Category | Tonnes | Grade | Contained Metal | ||||||

| 2020 | 2022 | Change | 2020 | 2022 | Change | 2020 | 2022 | Change | |

| Indicated | 1,996 | 1,815 | -9 % | 0.122 | 0.129 | +6 % | 2,435 | 2,435 | - |

| Inferred | 593 | 339 | -42 % | 0.114 | 0.131 | +15 % | 675 | 444 | -34 % |

Geological Model Update

The new modelling approach includes defined geological sub-domaining, new grade shell modelling and an improved dike model to provide an improved basis for the exclusion of near or below cut-off grade material for mine design purposes. This compares to the previous approach, applied in the 2020 PEA, which solely used lithology domains and an assumed 3% removal of rock mass to account for waste or dike sections within the deposit.

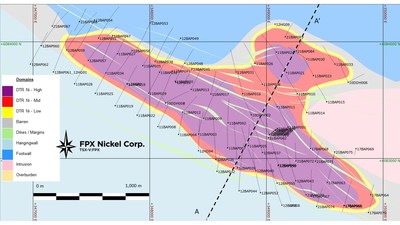

The new grade shell modelling methodology includes grouping of DTR nickel intercepts into high-, medium-, and low-grade domains. As seen in Figure 1, this approach defines two high-grade DTR nickel domains (>0.10% DTR nickel), each surrounded by a medium-grade domain (0.08-0.10% DTR nickel) and collectively bound by a low-grade halo (0.06-0.08% DTR nickel). This grade shell domaining has been used in conjunction with geological sub-domaining to further refine and accurately model the internal deposit variability.

The newly improved dike model incorporates data from 2021's in-fill drilling program, previously unincorporated oriented core drilling, surface geophysics, and lithological logging. Within the deposit, two dike swarms are interpreted to strike northwest to southeast and wrap around the intrusion to the east of the deposit. The updated interpretation now has a 95% coincidence between wireframes and assays. The previous explicit model had a much lower coincidence at less than 65%, which means dike grades in the 2020 mineral resource estimate were associated with serpentinized peridotite and vice versa.

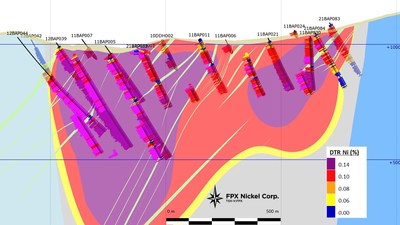

Dikes are non-mineralized, steeply dipping, and have widths ranging from an average of 2 to 3 metres up to 15 metres. Separation of dike and mineralized material during mining is considered feasible due to the consistency of dike orientation and visual distinction between the respective rock types. Figure 1 presents a plan view of the grade shell model within the mineralized peridotite and the orientation of the dike swarms. Figure 2 presents a cross section through the thickest part of the deposit (Section A-A' from Figure 1).

The Company expects to publish the results of the updated Baptiste Mineral Resource estimate with a NI-43-101 compliant PFS report in the second half of 2023.

Data Verification

The data used in this Mineral Resource estimate is supported by industry standard Quality Assurance and Quality Control (" QA/QC" ) procedures, such as the insertion of certified standards and blanks into the sample stream and the utilization of certified independent analytical laboratories for all assays. Historical QA/QC data and methodology on the project were reviewed and will be presented in detail in the upcoming PFS technical report. No significant QA/QC issues were discovered during review of the data.

All geological data used in the Mineral Resource estimate was reviewed and verified by Ron Voordouw , PhD, P.Geo. (Director of Geoscience at Equity) and Richard Flynn , P.Geo. (Principal Consultant at NMC). Mr. Voordouw and Mr. Flynn visited the Baptiste project from July 3 rd to 5 th , 2022. The site visit included a review of historical and recent drill core; a review of procedures used to collect, record, store and analyze project exploration data; independent sampling of ten duplicate assays sent for analysis; observation of drill hole locations; and an overview of claim/property boundaries.

NMC compared a portion of the original laboratory data certificates, geological logs, and downhole deviation in surveys within the drillhole database. The database subset was compared line-by-line to the fundamental data and no material errors were observed during the review. The verification data represents approximately 5% of total drilling.

Assays were composited at 5 metres to match the block size in the z-direction. DTR nickel composite grades within the updated grade shell sub-domains of the mineralized peridotite and the dikes illustrate adequate stationarity.

Specific gravity was assigned based on lithology with only minor changes from the 2018 values; updating was based on an additional 224 measurements to bring the total number of measurements to 1,202.

Estimation

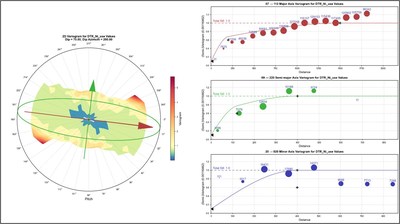

Kriging parameters, search parameters and anisotropy were determined with semi-variograms for DTR nickel content using composites falling within the mineralized domains. As presented in Figure 3, models showed a maximum range of 1,500 metres. The resulting search ellipsoid has a major axis trending at an azimuth of 110° with a near vertical semi-major axis.

The block model was created in Leapfrog Edge using a block size of 10 metres x 10 metres x 5 metres, while the previous block model was created in Surpac using a block size of 10 metres x 10 metres x 10 metres.

DTR nickel grades within the corresponding domains were estimated in two passes using ordinary kriging (" OK ") for grade shells and inverse distance squared (" ID 2 ") for the dikes. A single pass nearest-neighbour (" NN ") estimate was used to decluster composites for use in model validation swath plots. The anisotropy conforms to the search ellipsoids derived from the variogram models. Locally varying anisotropy was used for all grade shell and dike domains. The grade shells utilized concentric patterns that honoured the shape of their "nested" contacts and samples should be paired as such for estimation. The high-grade shell also used the major axis of the variogram model.

Resource classifications used in this study conform to the CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014). To be classified as Indicated material, a block had to be:

- Estimated using composites from three separate holes and restricted to the one of the four mineralized sub-domains (high-, medium-, and low-grade shells or in the dike domain); and

- Within a 200-metre drill spacing

Blocks not classified as indicated were assigned to the inferred category if they fell within a 300-metre drill spacing and used a minimum of two holes.

Qualified Persons

The scientific and technical information contained in this news release pertaining to the Baptiste deposit has been reviewed and approved by the following qualified persons under NI 43-101:

- Mineral Resource estimate: Richard Flynn , P.Geo., Principal Consultant at Next Mine Consulting Ltd.

- Data QA/QC: Ron Voordouw , PhD, P.Geo., Director of Geoscience at Equity Exploration Consultants Ltd.

- Geology: Erin Wilson , P.Geo., Principal Geologist at FPX Nickel Corp, and Richard Flynn , P.Geo.,

The qualified persons have verified the information disclosed herein and are not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

Additionally, an independent third-party review by SLR Consulting (formerly Roscoe Postle Associates) was undertaken of the new modelling and estimation approach.

About the Decar Nickel District

The Company's Decar Nickel District claims cover 245 km 2 of the Mount Sidney Williams ultramafic/ophiolite complex, 90 km northwest of Fort St. James in central British Columbia . The district is a two-hour drive from Fort St. James on a high-speed logging road.

Decar hosts a greenfield discovery of nickel mineralization in the form of a naturally occurring nickel-iron alloy called awaruite (Ni 3 Fe), which is amenable to bulk-tonnage, open-pit mining. Awaruite mineralization has been identified in four target areas within this ophiolite complex, being the Baptiste deposit, and the B, Sid and Van targets, as confirmed by drilling, petrographic examination, electron probe analyses and outcrop sampling on all four targets. Since 2010, approximately US$28 million has been spent on the exploration and development of Decar.

Of the four targets in the Decar Nickel District, the Baptiste deposit, which is the most accessible and has the biggest surface footprint, has been the focus of diamond drilling since 2010 with a total of 99 holes and 33,695 m of drilling completed. The Sid target was tested with two holes in 2010 and the B target had a single hole drilled in 2011; all three holes intersected nickel-iron alloy mineralization over wide intervals with DTR nickel grades comparable to the Baptiste deposit. At the Van target, the Company followed up 2021's highly successful maiden drilling program with an aggressive step-out program in the summer of 2022, with results forecast for sequential release in the fourth quarter of 2022 and first quarter of 2023.

About FPX Nickel Corp.

FPX Nickel Corp. is focused on the exploration and development of the Decar Nickel District, located in central British Columbia , and other occurrences of the same unique style of naturally occurring nickel-iron alloy mineralization known as awaruite. For more information, please view the Company's website at www.fpxnickel.com or contact Martin Turenne , President and CEO, at (604) 681-8600 or ceo@fpxnickel.com .

On behalf of FPX Nickel Corp.

"Martin Turenne"

Martin Turenne , President, CEO and Director

Forward-Looking Statements

Certain of the statements made and information contained herein is considered "forward-looking information" within the meaning of applicable Canadian securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed in the Company's periodic filings with Canadian securities regulators. Actual results could differ from those currently projected. The Company does not assume the obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE FPX Nickel Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/November2022/14/c7923.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/November2022/14/c7923.html