FPX Nickel Corp. (TSXV: FPX) (OTCQB: FPOCF) (" FPX " or the " Company ") is pleased to announce results from the preliminary feasibility study (" PFS ") for its 100%-owned Baptiste Nickel Project (" Baptiste " or the " Project ") in central British Columbia with an after-tax NPV 8% of $2.01 Billion and IRR of 18.6% at $8.75 lb Ni. The PFS has been prepared in accordance with National Instrument 43-101 (" NI 43-101 ") and demonstrates the potential to develop a high-margin, long-life, large-scale, and low-carbon mine with unparalleled flexibility to produce either a high-grade concentrate (60% nickel) for direct feed into the stainless steel industry (the " Base Case ") or further refining into battery-grade nickel sulphate, cobalt precipitate, and copper concentrate products for the battery material supply chain (the " Refinery Option "). All amounts are in US Dollars unless otherwise indicated.

Highlights

- After-tax NPV 8% of $2.01 Billion and IRR of 18.6% at $8.75 /lb Ni

- 29-year mine life producing an average 59,100 tonnes per year of nickel

- Phased development approach, with expansion following the 3.7-year after-tax payback period

- Life-of-mine (" LOM ") average C1 operating cost of $3.70 /lb Ni ( $8,150 /t), assuming no byproduct credits

- LOM average annual pre-tax free cash flow of $578 million during operating years

- Strategic product flexibility, with a Base Case high-grade nickel concentrate (60% nickel) for direct feed to the stainless steel industry, plus a Refinery Option to produce battery-grade nickel sulphate

"The PFS firmly establishes Baptiste as a key strategic asset in the development of Canada's critical minerals supply chain," commented Martin Turenne , FPX's President and Chief Executive Officer. "Despite the inflationary pressures observed in the mining industry in recent years, the study has yielded after-tax NPV and IRR superior to those observed in the 2020 preliminary economic assessment, reflecting greater engineering maturity and incorporating the several optimizations identified by our class-leading project team in regards to resource modelling, mine planning, process recovery, and site design. The Baptiste project represents a significant opportunity for First Nations, the governments of British Columbia and Canada , and FPX to work together to develop a project that creates substantial and sustainable benefits while protecting the environment for future generations. We look forward to continued collaboration with local Indigenous groups, and the provincial and federal governments to support the development of Canada's critical minerals ecosystem and to leverage health, economic and social benefits for local communities."

Webinar and Presentation

The Company's management will host a live webinar on Wednesday, September 6 at 10:00 a.m. Eastern ( 7:00 a.m. Pacific) to provide an overview of the PFS results and to answer questions from participants. Participants can access the live webinar at the following link:

https://www.renmarkfinancial.com/events/renmark-virtual-non-deal-roadshow-tsx-v-fpx-otcqb-fpocf-2023-09-06-100000

The results of the PFS are summarized in a corporate presentation available on the homepage of the Company's website at www.fpxnickel.com .

PFS Overview

The Base Case outlines an open-pit mining project in central British Columbia which will produce an average of 59,100 tonnes of nickel per year in concentrate over a 29-year mine life. The project will be developed in a phased approach, with an initial mill throughput rate of 108,000 tonnes per day (Phase 1), followed by an expansion to 162,000 tonnes per day (Phase 2) funded from free cash flow after the initial after-tax payback period of 3.7 years. The mining strip ratio averages 0.41 in the Phase 1, and 0.56 overall for life-of-mine (excluding capitalized pre-stripping).

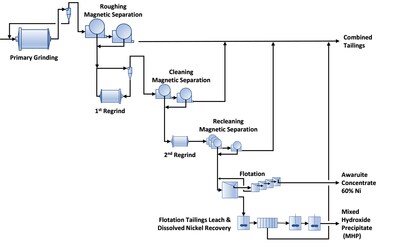

The Project will utilize a conventional processing flowsheet with SAG-mill based grinding followed by magnetic separation, froth flotation, and a flotation tailings leach circuit, as previously described in the Company's June 27, 2023 news release. Overall Davis Tube Recoverable (" DTR ") nickel recovery is estimated to average 88.7% for the life-of-mine, with 93% of the nickel produced contained in a high-grade flotation concentrate (60% nickel) and the balance (7% of nickel produced) contained in a mixed hydroxide precipitate (" MHP ") produced from a tailings leach circuit.

The Project will be supplied with low-carbon power from the BC Hydro provincial electricity transmission grid, resulting in an estimated Scope 1 and 2 carbon intensity of 2.4 t CO 2 /t nickel produced, placing Baptiste within the lowest decile of global nickel production. The Project will be accessed by a road system consisting of upgrades and expansions to an existing forest service road (" FSR ") network. All mine tailings and waste rock are proposed to be managed within a single integrated facility that will utilize open pit pre-stripping material and waste rock for embankment construction.

Base Case economics are presented in Table 1, based on a $8.75 /lb nickel price.

Table 1 – Base Case Economics

| Criteria | Units | Base Case | |

| Initial Capital Cost | USD, millions | 2,182 | |

| Operating Cost | $/t milled | 8.15 | |

| C1 Operating Cost 1 | USD /lb Ni | 3.70 | |

| All-in Sustaining Cost ("AISC") 2 | USD /lb Ni | 4.17 | |

| After- Tax | NPV 8% | USD, millions | 2,010 |

| IRR | % | 18.6 | |

| Payback Period | years | 3.7 | |

| Mine Life-to-Payback | ratio | 7.8 | |

| NPV-to-Initial Capex | ratio | 0.92 | |

| Annual Free Cash Flow, Pre-Tax 3 | USD, millions | 578 | |

| Notes: | |

| 1. | Exclusive of any byproduct credits. |

| 2. | Inclusive of operating cost, sustaining capital, expansion capital, closure capital, and royalties. |

| 3. | For production years. |

The Refinery Option outlines an off-site refinery to upgrade a portion of nickel-in-concentrate to produce 40,000 tpa of battery-grade nickel sulphate for the electric vehicle battery supply chain, with the balance of concentrate continuing to be directly supplied to the stainless steel industry. Along with battery-grade nickel sulphate, this option also supports the valorization of cobalt and copper as refinery byproducts. The Refinery Option presents incremental capital expenditure of $448 million with an incremental operating cost of $1.02 per pound of nickel (C1 cost of $0.79 /lb Ni, including credits for cobalt and copper byproducts), resulting in total NPV 8% of $2,127 million . Further discussion of the Refinery Option is contained within the "Refinery Option" section near the end of this news release.

Mining & Mineral Reserves

The Baptiste deposit will be mined as a conventional large-scale truck and shovel operation with up to 60 Mt of material mined per year during Phase 1 and up to 120 Mt of material mined per year during Phase 2. The mining operation will feature 250 mm blast-hole electric drills, 42 m 3 electric excavators, and 300 t haul trucks working on nominal 10 m high benches. A flexible combination of dozers, graders, wheel loaders, and excavators will form the core of the support equipment fleet.

The mineral resource estimate (effective November 14, 2022 , see FPX news release) for the Project is based on updated drilling from the 2021 season, informing the Baptiste deposit geological model. Taking advantage of the resource shape and local topography, mining will commence at the south of the deposit before moving northwest and northeast, respectively. This approach provides two distinct advantages during the initial operating years, including a higher average mill feed grade and a lower mining strip ratio. This approach allows capital advantages through the deferment of mining equipment to sustaining costs, as well as a lower mining operating cost during Phase 1.

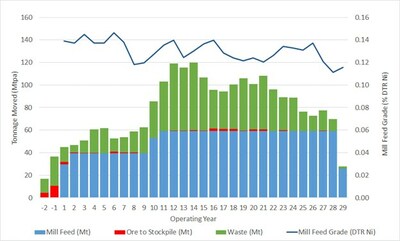

A summary of the PFS mine plan is presented in Table 2, followed by a chart of tonnage moved and average mill feed grade throughput for the envisioned mine life (Figure 1).

Table 2 – PFS Mine Plan Summary

| | Phase 1 | Phase 2 | Total |

| Operating Years | 1 to 9 | 10 to 29 | 29 years |

| Head Grade, Average (% DTR Ni) | 0.135 | 0.128 | 0.130 |

| Mill Throughput (tpd) | 108,000 | 162,000 | - |

| Tonnes Milled, Total (Mt) | 345 | 1,143 | 1,488 |

| Tonnes Waste, Total (Mt) 1 | 141 | 697 | 838 |

| Strip Ratio (waste:ore) 1 | 0.41 | 0.61 | 0.56 |

| Notes: | |

| 1. | Excludes capitalized pre-stripping. |

The Probable Mineral Reserves for the project are estimated at 1,488 Mt at an average grade of 0.13% DTR nickel (0.21% total nickel), resulting in 1,933 kt of contained DTR nickel metal (3,125 kt of total nickel metal) over the 29-year mine life. Included in waste material for the PFS are 44 Mt of inferred material at an average grade of 0.113% DTR nickel.

Table 3 – Baptiste Nickel Project Reserve Estimate

| Category | Tonnes (Mt) | DTR (%) | Total (%) | Contained Metal (kt DTR nickel) | Contained Metal (kt total nickel) |

| Proven | - | - | - | - | - |

| Probable | 1,488 | 0.13 | 0.21 | 1,933 | 3,125 |

| Proven & | 1,488 | 0.13 | 0.21 | 1,933 | 3,125 |

| Notes: | |

| 1. | Mineral Reserves are reported effective September 6, 2023. |

| 2. | The Qualified Person for the estimate is Mr. Cristian Hernan Garcia Jimenez, P.Eng, an independent consultant. |

| 3. | Mineral Reserves were developed in accordance with CIM Definition Standards (2014). |

| 4. | Mineral Reserves are reported using a fixed 0.06% DTR Ni cut-off grade, which represent approximately US$9/t NSR value, which is above the economic cut-off grade of US$5.5/t. |

| 5. | The Mineral Reserves are supported by a mine plan, based on a pit design, guided by a Lerchs Grossmann (LG) pit shell. Inputs include $8.75/lb Ni, $1.98/t mining opex, $3.72/t process opex, $1.10 /t G&A opex, pit slopes varying from 42-44 degrees, and 85% process recovery |

| 6. | Life-of-mine strip ratio is 0.56 (W:O), excluding capitalized pre-stripping. |

| 7. | Ore and contained nickel tonnes are reported in metric units and grades are reported as percentages. |

| 8. | All figures are rounded to reflect the relative accuracy of the estimate. Totals may not sum due to rounding as required by reporting guidelines. |

Metallurgy & Process Facilities

The PFS metallurgical testwork program involved multiple bench- and pilot-scale campaigns (see FPX's June 27, 2023 news release). The overall processing strategy takes advantage of awaruite's unique characteristics in a simple flowsheet utilizing well-proven unit operations, as presented in Figure 2. The estimated life-of-mine DTR nickel recovery for the PFS is 88.7%, as presented in Table 4. Based on average grade of 0.21% total nickel, this equates to a 55% total nickel recovery.

Table 4 – Life of Mine DTR Nickel Recovery

| Recovery | DTR Nickel | |

| By | Roughing Magnetic Separation | 95.0 |

| Cleaning Magnetic Separation | 99.3 | |

| Recleaning Magnetic Separation | 99.7 | |

| Flotation | 87.4 | |

| Flotation Tailings Treatment | 54.8 | |

| Overall | To Awaruite Concentrate | 82.2 |

| To Mixed Hydroxide Precipitate | 6.5 | |

| Combined To Both Nickel Products | 88.7 | |

The process plant will be developed in two phases, with the Phase 1 plant capable of processing 108,000 tpd of ore, and the Phase 2 expansion bringing total processing capacity to 162,000 tpd. Processing facilities utilize conventional unit operations and configurations in comminution, magnetic separation, flotation, and tailings leach.

In consideration of ore grindability, low abrasivity, and low power cost, comminution will consist of primary gyratory crushing, followed by semi-autogenous (" SAG ") mill and ball mill grinding. Based on awaruite's intense magnetic response, a coarse primary grind of 250 mm allows approximately 84% of the fresh plant feed to be diverted directly to final tailings in the primary magnetic separation stage. Followed by two stages of regrind and cleaner magnetic separation, a further 12% of fresh plant feed is diverted to final tailings, resulting in a "magnetics only" concentrate consisting of awaruite and magnetite. This results in a flotation circuit which only needs to treat less than 5% of fresh plant feed.

Flotation utilizes well-defined conditions in conventional mechanical flotation cells. Roughing flotation followed by four stages of cleaning flotation produces a high-grade nickel concentrate (60% nickel) which is then dewatered, briquetted, and bagged for sale to market. Flotation tailings are subjected to mild atmospheric tank leaching conditions to recover nickel not recovered in flotation (approximately 6.5% of DTR nickel). Leach solution is purified and nickel is subsequently precipitated to a MHP product (containing 45% nickel) which is then dewatered and bagged for sale to market.

Other Facilities

The proposed tailings facility design considers management of tailings and mine waste in a single integrated facility, utilizing open pit pre-stripping material and waste rock for dam construction. Deposition of waste rock and tailings is considered within the open pit in the final years of operations. The tailings facility will incorporate cross-valley dams and is situated in close proximity to the open pit, with gravity-flow of tailings for the first 6 years of operations, followed by the installation of a tailings pumping system in Year 7.

The conceptual site water management plan includes management of site contact water in the tailings facility with collection of runoff water downstream of all other Project infrastructure/disturbances. PFS water balance modelling indicates the site to be in an annual water deficit, requiring a modest allowance for freshwater makeup during operations, including for potable water requirements.

The Project considers a full suite of on-site infrastructure and ancillaries. Both the construction and operation phases will be supported by an on-site camp facility.

The Project will connect with BC Hydro's low-carbon grid, with multiple options having been validated through a formal BC Hydro study. The PFS considers a 230 kV connection to the Glenannan substation located to the south of the Project, with a line length of approximately 155 km. The current FSR network will suitably support the early stages of site construction. The current road network will be upgraded, including minor expansions, at the end of the first year of construction resulting in reduced travel times to site. No other off-site facilities are envisioned to be required for the Project.

Project Execution

The Gantt chart presented in Figure 3 summarizes the conceptual project development timeline. The critical path runs through the environmental assessment (" EA ") and permitting process, with an anticipated EA decision in the first quarter of 2027. Approximately 9-12 months off the critical path are engineering studies, with key events including the feasibility study and front-end engineering and design (" FEED ") ahead of the final investment decision (" FID "). Following a positive EA decision and permitting the project through 2027, the FID will approve the project to proceed with construction early works commencing in early 2028, followed by full construction and subsequent production of first nickel in the fourth quarter of 2030.

Capital Cost Estimate

Initial capital costs have been estimated in alignment with AACE (Association for the Advancement of Cost Engineering) Class 4 standards and have a stated accuracy of +/- 25%. The PFS contributors completed engineering, design, and costing inputs for their respective scope, with the overall estimate consolidated by Ausenco Engineering Canada Inc. Sustaining and expansion capital costs have been estimated in alignment with AACE Class 5 standards, and closure capital costs have been estimated on an order-of-magnitude basis.

The total initial capital cost for the Project is estimated to be $2,182 million and is expended in Years -3, -2, and -1 ahead of start-up at the commencement of Year 1. Expansion capital cost is estimated to be $763 million and is expended ahead of expansion start-up at the commencement of Year 10. Sustaining capital cost is estimated to be $1,281 million . Total closure capital cost is estimated to be $284 million . No salvage value is considered due to the 29-year mine life.

Table 5 – Total Estimated Capital Costs

| Capital | Category | Total (USD, millions) |

| Initial Costs | Mining | 325 |

| Process Plant | 730 | |

| Tailings Facility | 115 | |

| On-Site Infrastructure | 106 | |

| Off-Site Infrastructure | 127 | |

| Indirect Costs | 401 | |

| Owner's Costs | 106 | |

| Contingency | 272 | |

| Total Initial Capital | 2,182 | |

| Sustaining Costs | Mine Equipment | 643 |

| Tailings Facility | 421 | |

| Indirect Costs | 20 | |

| Contingency | 97 | |

| Total Sustaining Capital | 1,181 | |

| Total Expansion Capital Costs | 763 | |

| Total Closure Capital Costs | 284 | |

| Total Capital Costs (life-of-mine) | 4,410 | |

Operating Cost Estimate

Total operating costs are estimated to average $8.15 per tonne milled for life-of-mine, for an equivalent C1 cost of $3.70 /lb nickel produced (exclusive of any byproduct credits). Phase 1 operating costs of $7.88 /t milled are lower than the life-of-mine average, primarily due to the impact of the lower strip ratio in the early operating years. Inclusive of royalties, sustaining capital, expansion capital, and closure capital, AISC is estimated to average $4.17 /lb nickel produced for life-of-mine.

Mine operating costs are estimated to average $3.14 per tonne milled for life-of-mine, with lower costs during Phase 1 ( $2.59 per tonne milled) due to the lower strip ratio. Processing costs are estimated to average $3.63 per tonne milled for life-of-mine, with the Phase 2 costs slightly lower due to increased throughput. G&A averages $1.09 per tonne milled for life-of-mine, benchmarking consistently with nearby major operating mines. Concentrate transport averages $0.29 per tonne milled for life-of-mine, assuming shipment of concentrates from Baptiste to east Asia .

The Project is subject to a 1% net smelter return (" NSR ") which is payable on annual sales less transportation costs to market.

Table 6 – Life-Of-Mine Operating Cost and AISC

| Category | Units | Phase 1 | Phase 2 | LOM |

| Mining | $/t milled | 2.59 | 3.31 | 3.14 |

| Processing | $/t milled | 3.75 | 3.59 | 3.63 |

| G&A | $/t milled | 1.23 | 1.05 | 1.09 |

| Concentrate Transport | $/t milled | 0.31 | 0.29 | 0.29 |

| Total Cash Costs | $/t milled | 7.88 | 8.24 | 8.15 |

| C1 Operating Cost 1 | $/lb nickel produced | 3.48 | 3.76 | 3.70 |

| AISC 2 | $/lb nickel produced | 3.97 | 4.23 | 4.17 |

| Notes: | |

| 1. | Exclusive of any byproduct credits. |

| 2. | Inclusive of operating cost, expansion capital, sustaining capital, royalties, and closure capital. |

Economic Analysis

At an assumed nickel price of $8.75 /lb and a CAD:USD exchange rate of 0.76, the Project generates an after-tax NPV 8% of $2.01 billion , an after-tax IRR of 18.6%, and an after-tax payback of 3.7 years. See Table 7 for further details regarding PFS economics and Table 8 for NPV 8% sensitivity to nickel price, recovery, initial capital cost, and operating cost.

CRU, a leading provider of analysis and consulting in the mining, metals and fertilizer markets, prepared a market analysis report that looked at the global ferronickel (" FeNi ") market and considered the applicability of the Baptiste FeNi briquette to stainless steel production and the strong comparability of the Baptiste FeNi briquette to standard FeNi. Based on an average of the last six years of published data from a leading western ferronickel producer, payability of 95% of the LME nickel price has been assumed for the Baptiste FeNi product.

Based on published market data, the payability for nickel content in MHP ranged from 70% to 90% of the LME nickel price over the 2020-22 period, with the low-end of that payability range coinciding with the period of extreme market volatility and elevated LME nickel prices in the first half of 2022. For the purposes of the PFS economic analysis, payability of 87% of the LME nickel price has been assumed for the Baptiste MHP product.

The PFS models provincial mining taxes in accordance with the British Columbia Mineral Tax Act, and combined provincial and federal income taxes. The PFS reflects the impact of the federal government's refundable critical minerals investment tax credit, announced in the 2023 Federal Budget, which is proposed to be equal to 30% of the capital cost of eligible property for the extraction and processing of certain critical minerals, including nickel. The PFS estimates total LOM taxes paid of C$6.3 billion including C$2.5 billion to the Province of British Columbia and C$3.8 billion to the Government of Canada , implying an estimated LOM tax rate on taxable income of approximately 37%.

Table 7 – PFS Economics

| Economic Basis/Result | Units | Base Case | |

| Nickel Price | USD/lb | 8.75 | |

| Payability, FeNi Briquette | % | 95 | |

| Payability, MHP | % | 87 | |

| Pre-Tax | NPV 8% | USD, millions | 2,923 |

| After-Tax | NPV 8% | USD, millions | 2,010 |

| IRR | % | 18.6 | |

| Payback | years | 3.7 | |

| Mine Life-to-Payback | Ratio | 7.8 | |

| NPV-to-Initial Capex | Ratio | 0.92 | |

| Annual Free Cash Flow, Pre-Tax 1 | USD, millions | $578 | |

| Notes: | |

| 1. | During operating years. |

Table 8 – NPV Sensitivity

| After-tax NPV 8% (USD, millions) | -20 % | -10 % | Base | +10 % | +20 % |

| Nickel Price | 837 | 1,427 | 2,010 | 2,593 | 3,173 |

| Recovery | 837 | 1,427 | 2,593 | 3,173 | |

| Initial Capital Cost | 2,217 | 2,114 | 1,907 | 1,803 | |

| Operating Cost | 2,444 | 2,227 | 1,794 | 1,577 |

As seen in Table 8, the project is most and equally sensitive to nickel price and recovery; however, economics remain robust at levels below Base Case assumptions. In keeping with the long mine life, the Project is more sensitive to operating cost than initial capital cost.

Refinery Option

To demonstrate Baptiste's strategic flexibility to also produce nickel and cobalt for the battery material supply chain, a Refinery Option was developed to be discrete from the Base Case, envisioning the operation of a standalone refinery in Central British Columbia. Located in an urban setting, the refinery would benefit from the infrastructure, services, and labour which would be available at an integrated battery material processing hub, such as those being developed in eastern Canada and other locations worldwide.

The refinery flowsheet has been optimized based on the results of FPX's hydrometallurgical testwork program (see FPX's May 17, 2023 news release). Substantial improvements to the refinery flowsheet are centred in the optimization of the leaching circuit and the resultant simplification of downstream purification requirements.

The refinery is sized to produce 40,000 tonnes per year of nickel contained in battery grade nickel sulphate. In addition, the refinery would produce approximately 700 tonnes per year of cobalt in MHP and 300 tonnes per year of copper in concentrate. For the Refinery Option, the balance of nickel produced at the Baptiste mine (over and above the 40,000 tonnes in nickel sulphate) would continue to be marketed as a FeNi product to the stainless steel industry.

Based on market data published by Asian Metal, the 2022 nickel sulphate price in China ranged from a low of $23,677 to a high of $33,036 per tonne of contained nickel. For the Baptiste nickel sulphate product, a premium of $1.00 /lb ( $2,205 /tonne) to the assumed base LME Ni price of $8.75 /lb ( $19,290 /tonne) has been applied in the Refinery Option economic analysis.

Initial capital costs for the Refinery Option have been estimated in alignment with AACE Class 5 standards. As seen in Table 9, the Refinery Option economics are comparable to the Base Case.

Table 9 – Refinery Option Economics

| Economic Basis/Result | Units | Refinery Option Only | PFS Base Case + | |

| Nickel Refinery Capacity | Tpa | 40,000 tpa of contained nickel in nickel sulphate | ||

| Nickel Sulphate Premium | $/lb Ni | 1.00 | ||

| Nickel Price | USD/lb | 8.75 | ||

| Cobalt Price | USD/lb | 15.00 | ||

| USD/lb | 3.50 | |||

| Initial Capital Cost | USD, millions | 448 | 2,629 | |

| C1 Operating Cost 1 | USD/ lb Ni | 0.79 | 3.89 | |

| Payability, MHP | % LME price | 87 | 87 | |

| After-Tax | NPV 8% | USD, millions | 63 | 2,127 |

| IRR | % | 9.9 | 17.7 | |

| Payback | years | 7.5 | 3.9 | |

| Notes: | |

| 1. | Inclusive of cobalt and copper byproduct credits from refinery. |

Indigenous Engagement

The Baptiste area is located on the traditional territories of Tl'azt'en Nation and Binche Whut'en and within several Tl'azt'enne and Binche Whut'enne keyohs, a traditional governance system of the Dakelh people of the Stuart-Trembleur Lake area. FPX has maintained regular engagement with Tl'azt'en Nation and Binche Whut'en, formalizing those activities with a Memorandum of Understanding (" MoU ") signed in 2012 with Tl'azt'en Nation, and an Exploration and Development Memorandum of Agreement (" MoA" ) signed in 2022 with the Binche Keyoh Bu Society.

FPX acknowledges the potential impacts of resource projects and the concerns that Indigenous communities may have for such activities occurring on their territories. The Company has been working collaboratively and meeting with local communities to understand key valued species and habitats in order to avoid and minimize impacts, and to identify significant mitigations and enhancements that have the potential to create long-term environmental benefits for the local area. The Company is committed to ensuring the Rights of Indigenous Peoples are respected, and is focused on working with Indigenous leadership to advance a modern mining project that is aligned with global sustainable development goals and that protects people and the environment. FPX looks forward to continuing to evaluate all aspects of the potential project, building on on-going geological and engineering studies, Indigenous-led cultural and environmental baseline studies, and continued early engagement with all potentially-affected communities.

Technical Report

FPX intends to file on SEDAR and the FPX website within 45 days of this news release the Technical Report for the PFS prepared in accordance with the requirements of NI 43-101, including a description of the updated Mineral Resource Estimate and the Mineral Reserve Estimate. For readers to fully understand the information in this news release, they should read the Technical Report in its entirety, including all qualifications, assumptions, exclusions, and risks that relate to the PFS. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

PFS Contributors

The Baptiste PFS included contribution from the parties listed in Table 10 (" PFS Contributors "), each of whom is a qualified person under NI 43-101.

Table 10 – PFS Contributors

| PFS Contributor | Qualified Person | Scope of Responsibility |

| Ausenco Engineering Canada Inc. | Kevin Murray, P.Eng. | Recovery methods, process plant, on- |

| Carisbrooke Consulting Inc. | David Baldwin, P.Eng. | Off-site power |

| Equity Exploration Consultants Ltd. | Ron Voordouw, P.Geo. | Geology |

| ERM Consultants Canada Ltd. | Rolf Schmitt, P.Geo. | Environmental, Permitting |

| International Metallurgical & | Jeff Austin, P.Eng. | Metallurgy |

| Knight Piésold Ltd. | Duke Reimer, P.Eng. | Tailings, water management, & |

| Next Mine Consulting Ltd. | Richard Flynn, P.Geo. | Mineral resource estimate |

| Onsite Engineering Ltd. | Paul Mysak, P.Eng. | Off-site roads and bridges |

| TechSer Mining Consultants Ltd. | Cristian Garcia, P.Eng. | Mine design & mineral reserve |

Qualified Persons Murray, Voordouw, Reimer, Flynn, Mysak, and Garcia all visited the Baptiste Nickel Project site during the development of their respective PFS contributions. Additional information can be found in the pending Technical Report.

Qualified Person

The PFS contributors prepared or supervised the preparation of information that forms the basis of the PFS disclosure in this news release.

Andrew Osterloh , P.Eng., Senior Vice President, Projects and Operations for FPX, is a qualified person as defined by NI 43-101. Mr. Osterloh has reviewed and approved the technical content of this news release.

About the Decar Nickel District

The Company's Decar Nickel District represents a large-scale greenfield discovery of nickel mineralization in the form of a naturally occurring nickel-iron alloy called awaruite (Ni 3 Fe) hosted in an ultramafic/ophiolite complex. FPX's mineral claims cover an area of 245 km 2 west of the Middle River and north of Trembleur Lake, in central British Columbia. Awaruite mineralization has been identified in several target areas within the ophiolite complex including the Baptiste Deposit and the Van Target, as confirmed by drilling, petrographic examination, electron probe analyses and outcrop sampling. Since 2010, approximately US $30 million has been spent on the exploration and development of Decar.

Of the four targets in the Decar Nickel District, the Baptiste Deposit has been the focus of increasing resource definition (a total of 99 holes and 33,700 m of drilling completed), as well as environmental and engineering studies to evaluate its potential as a bulk-tonnage open pit mining project. The Baptiste Deposit is located within the Baptiste Creek watershed, on the traditional and unceded territories of Tl'azt'en Nation and Binche Whut'en, and within several Tl'azt'enne and Binche Whut'enne keyohs. FPX has conducted mineral exploration activities to date subject to the conditions of our agreements with the Nations and keyoh holders.

About FPX Nickel Corp.

FPX Nickel Corp. is focused on the exploration and development of the Decar Nickel District, located in central British Columbia , and other occurrences of the same unique style of naturally occurring nickel-iron alloy mineralization known as awaruite.

On behalf of FPX Nickel Corp.

"Martin Turenne"

Martin Turenne , President, CEO and Director

Forward-Looking Statements

Certain of the statements made and information contained herein is considered "forward-looking information" within the meaning of applicable Canadian securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed in the Company's periodic filings with Canadian securities regulators. Actual results could differ from those currently projected. The Company does not assume the obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE FPX Nickel Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/September2023/06/c2104.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/September2023/06/c2104.html