FPX Nickel Corp. (TSXV: FPX) (OTCQB: FPOCF) (" FPX " or the " Company ") is pleased to announce results of the summer 2021 infill drilling program at the Baptiste Project (the " Project ") at the Company's 100%-owned Decar Nickel District (the " District ") in central British Columbia. These results are highlighted by hole 21BAP073, which returned the third-highest grading broad interval of near-surface nickel mineralization in the Project's history.

Highlights

- Results validated the PEA block model and potentially expanded higher grade, near-surface DTR nickel mineralization at the Baptiste deposit beyond the 2020 PEA resource model

- Holes in the area of the planned starter pit in the southeastern portion of the Baptiste deposit all returned near-surface, broad intervals with average DTR Nickel grades at or above the global resource grade of 0.120% DTR nickel, including:

- 21BAP071 intersected 153.0 m grading 0.128% DTR nickel from 47 m downhole, including 79.0 m grading 0.139% DTR nickel (see Note 2 below regarding true width)

- 21BAP072 intersected 282.0 m grading 0.128% DTR nickel from 39 m downhole, including 119.8 m grading 0.146% DTR nickel

- 21BAP073 intersected 254.9 m grading 0.151% DTR nickel from 48.1 m downhole, including 157.3 m grading 0.154% DTR nickel, representing the third-highest grading, near-surface interval ever intersected at the Baptiste deposit

- 21BAP074 intersected 317.2 m grading 0.135% DTR nickel from 33.8 m downhole, including 114.0 m grading 0.159 % DTR nickel

- 21BAP075 intersected 136.4 m 0.120% DTR nickel from 39 m downhole

"We are very pleased to see that the 2021 drill results validated the 2020 PEA block model, while continuing to showcase very strong, near-surface DTR nickel grades in the Baptiste starter pit area," commented Martin Turenne , FPX's President and CEO. "We expect these results will confirm the conversion of inferred mineralization to the indicated category for a mineral resource estimate in support of a preliminary feasibility study at Baptiste, which stands as the world's third largest undeveloped nickel deposit."

Background

The 2021 Baptiste drilling campaign was designed to convert near-surface inferred resources to the indicated classification to support an eventual Baptiste preliminary feasibility study. The mine plan from the NI 43-101 2020 Preliminary Economic Assessment (" 2020 PEA ") envisaged the mining of a total of approximately 1.5 billion tonnes of indicated and inferred material averaging 0.120% Davis Tube magnetically recoverable (" DTR ") nickel over the Project's 35-year mine life, with approximately 89% of this mineralization classified in the indicated category and 11% in the inferred category.

The 2020 PEA highlighted the Baptiste Project's potential to deliver robust operating margins throughout the nickel price cycle, generating an after-tax net present value (" NPV 8% ") of US$1.7 billion and after-tax internal rate of return (" IRR ") of 18.3% at an assumed nickel price of US$7.75 /lb. At the recent nickel price of $12.00 /lb., the Project would generate an after-tax NPV 8 % of US$4.3 billion and after-tax IRR of 30.2%, based on 2020 PEA metrics.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that the conclusions or results as reported in the PEA will be realized.

2021 Drilling Results

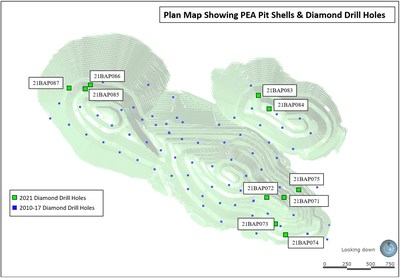

The ten holes drilled during last year's campaign are the first holes drilled at Baptiste since 2017. Figure 1 below provides a plan map of the locations for all holes drilled at Baptiste since the Project's inception, including those drilled in 2021. Table 1 summarizes the significant assays returned in the ten holes.

Table 1: Baptiste Deposit Drill Hole Results

| Hole 1 | Intersections 2 | DTR Nickel (%) 3 | Total Nickel (%) 3 | ||

| From | To | Length | |||

| 21BAP071 | 47.0 | 200.0 | 153.0 | 0.128 | 0.194 |

| including | 47.0 | 126.0 | 79.0 | 0.139 | 0.191 |

| | | | | | |

| 21BAP072 | 39.0 | 321.0 | 282.0 | 0.128 | 0.193 |

| including | 39.0 | 158.8 | 119.8 | 0.146 | 0.196 |

| and | 158.8 | 285.0 | 126.2 | 0.131 | 0.194 |

| | | | | | |

| 21BAP073 | 48.1 | 303.0 | 254.9 | 0.151 | 0.189 |

| including | 145.7 | 303.0 | 157.3 | 0.154 | 0.191 |

| and | 48.1 | 145.7 | 97.6 | 0.146 | 0.186 |

| | | | | | |

| 21BAP074 | 33.8 | 351.0 | 317.2 | 0.135 | 0.202 |

| including | 237.0 | 351.0 | 114.0 | 0.159 | 0.209 |

| and | 33.8 | 237.0 | 203.2 | 0.122 | 0.198 |

| | | | | | |

| 21BAP075 | 39.0 | 175.4 | 136.4 | 0.120 | 0.197 |

| | | | | | |

| 21BAP083 | 8.9 | 138.0 | 129.2 | 0.112 | 0.198 |

| | | | | | |

| 21BAP084 | 31.0 | 151.0 | 120.0 | 0.112 | 0.199 |

| | | | | | |

| 21BAP086 | 0.0 | 223.0 | 223.0 | 0.109 | 0.236 |

| | | | | | |

| 21BAP087 | 3.0 | 147.0 | 144.0 | 0.147 | 0.208 |

1 An additional 7 short, vertical holes (21BAP076 to 21BAP082) were drilled to define the location of a future bulk sample for metallurgical test work. These were used to further inform the Project's bedrock model. Full assays results are not yet available for hole 21BAP085; see discussion of 21BAP085 below.

2 The vertical depth (true width) of all quoted intersections in this news release is interpreted to be approximately 75% of downhole depth.

3 Core samples are assayed for "total nickel" and Davis Tube Recoverable ("DTR") nickel." "DTR nickel" analyses measure only the magnetically recoverable nickel hosted in awaruite (nickel-iron alloy), whereas the "total nickel" analyses measure both magnetically and non-magnetically recoverable nickel. The Davis Tube method is in effect a mini-scale metallurgical test procedure used to provide a more accurate measure of recoverable nickel and is the global industry-standard geometallurgical test for magnetic recovery operations and exploration projects. See "Sampling and Analytical Method", below.

In general, results from the 2021 Baptiste in-fill drilling program validated the PEA block model. In particular, drilling results in the starter pit area (holes 21BAP071 to 21BAP075) returned the expected nearer-surface, higher-grade tonnage. Upon a future update of the Baptiste resource model, it is expected that the intended conversion from inferred to indicated categorization will be realized. In addition, the drilling results also improve the Company's understanding of dikes and their influence on internal dilution, yielding further benefits in an eventual resource model update.

Hole 21BAP071 was collared within the 2020 PEA resource pit outline and drilled to the northwest at an angle of minus 58 degrees. Drilling intersected bedrock at a depth of 47 m downhole, with strong awaruite mineralization extending to 200 m . Weaker awaruite mineralization characterized the remainder of the hole due to pervasive Iron Carbonate alteration. Results include a 2.5 m section of gabbro dike.

21BAP072 was collared 170 m along strike from 21BAP071 and drilled to the north at an angle of minus 61 degrees. Drilling intersected bedrock at 39 m , with strong awaruite mineralization extending to 285 m . Weaker awaruite mineralization characterized the remainder of the hole due to pervasive iron carbonate alteration. Results include 11.6 m and 6.37 m sections of gabbro dike.

21BAP073 was collared approximately 300 m south of 21BAP072 and drilled to the northwest at an angle of minus 61 degrees. Drilling intersected bedrock at 48.1 m , with strong awaruite mineralization extending the remaining length of the hole to 303 m . Results include several 1- 3 m gabbro dikes.

21BAP074 was collared approximately 135 m along strike of 21BAP073 and drilled to the northeast at an angle of minus 61 degrees. Drilling intersected bedrock at 33.8 m , with strong awaruite mineralization extending the remaining length of the hole to 351 m . Results include several 1- 3 m gabbro dikes.

21BAP075 was collared approximately 185 m along strike from 21BAP071 and drilled to the southwest at an angle of minus 60 degrees. Drilling intersected bedrock at 39 m , with strong awaruite mineralization extending the remaining length of the hole to 175.4 m . Results include two 1- 3 m dikes.

21BAP083 was collared 165 m along strike to the northwest from 21BAP084. Drilling intersected bedrock at 8.9 m , with moderate awaruite mineralization extending to 138 m . This mineralization was associated with a higher degree of antigorite alteration. A larger 5.82 m gabbro dike was encountered near the end of the hole.

21BAP084 was collared within the northeastern section of the Baptiste deposit and drilled to the northeast at an angle of minus 60 degrees. Drilling intersected bedrock at 31 m , with moderate awaruite mineralization extending to 151 m . The results included two 2- 4 m gabbro dikes.

21BAP085 was collared adjacent to 21BAP86, drilling to the southwest at an angle of minus 60 degrees. Drilling intersected bedrock at the collar with moderate awaruite mineralization extending the remaining length of the hole to 161.6 m . Assay results from the top of the hole to 77.9 m have not been finalized; from 77.9 m to the end of the hole at 161.6 m , the hole encountered 83.7 m grading 0.120% DTR Ni (0.190% total Ni).

21BAP086 was collared within the northwestern portion of the Baptiste deposit and drilled to the northeast at an angle of minus 60 degrees. Drilling intersected bedrock at the collar, with moderate awaruite mineralization extending from 43 m to 159 m downhole.

21BAP087 was collared 245 m to the west of 21BAP086 and drilled to the northeast at an angle of minus 61 degrees. Drilling intersected bedrock at 3 m , with strong awaruite mineralization extending from 3 m to 147 m .

Sampling and Analytical Method

For a description of the Company's sampling and analytical method, including a description of QA/QC procedures, see the news release dated October 19, 2021 .

Peter Bradshaw , P. Eng., FPX Nickel's Qualified Person under NI 43-101, has reviewed and approved the technical content of this news release.

About the Decar Nickel District

The Company's Decar Nickel District claims cover 245 km 2 of the Mount Sidney Williams ultramafic/ophiolite complex, 90 km northwest of Fort St. James in central British Columbia . The district is a two-hour drive from Fort St. James on a high-speed logging road.

Decar hosts a greenfield discovery of nickel mineralization in the form of a naturally occurring nickel-iron alloy called awaruite (Ni 3 Fe), which is amenable to bulk-tonnage, open-pit mining. Awaruite mineralization has been identified in four target areas within this ophiolite complex, being the Baptiste Deposit, and the B, Sid and Van targets, as confirmed by drilling, petrographic examination, electron probe analyses and outcrop sampling on all four. Since 2010, approximately US $28 million has been spent on the exploration and development of Decar.

Of the four targets in the Decar Nickel District, the Baptiste Deposit, which was initially the most accessible and had the biggest known surface footprint, has been the focus of diamond drilling since 2010, with a total of 99 holes and 33,700 m of drilling completed. The Sid target was tested with two holes in 2010 and the B target had a single hole drilled in 2011; all three holes intersected nickel-iron alloy mineralization over wide intervals with DTR nickel grades comparable to the Baptiste Deposit. The Van target was not drill-tested at that time as bedrock exposures in the area were very poor prior to more recent logging activity. In 2021, the Company executed a maiden drilling program at Van, which has returned promising results comparable with the strongest results at Baptiste.

About FPX Nickel Corp.

FPX Nickel Corp. is focused on the exploration and development of the Decar Nickel District, located in central British Columbia , and other occurrences of the same unique style of naturally occurring nickel-iron alloy mineralization known as awaruite. For more information, please view the Company's website at www.fpxnickel.com .

On behalf of FPX Nickel Corp.

"Martin Turenne"

Martin Turenne , President, CEO and Director

Forward-Looking Statements

Certain of the statements made and information contained herein is considered "forward-looking information" within the meaning of applicable Canadian securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed in the Company's periodic filings with Canadian securities regulators. Actual results could differ from those currently projected. The Company does not assume the obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE FPX Nickel Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/March2022/14/c3302.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/March2022/14/c3302.html