June 22, 2023

CuFe Ltd (ASX: CUF) (CuFe or the Company) is pleased to advise it has entered an agreement to acquire rights to lithium and rare earth related minerals over M15/1893, covering approximately 7.4km2 of ground, located 30km south of Mineral Resources Mt Marion Mine.

HIGHLIGHTS

- CuFe acquires further exploration tenure within the emerging Southern Yilgarn Lithium Belt, located approximately 48km SSE of Coolgardie, in the Goldfields region of Western Australia via lithium and rare earth mineral rights deal over M15/1893

- The mining lease covers 7.4km2 and to date has been primarily explored for Gold. Acquisition has no upfront consideration and takes the form of a rights swap with CuFe providing vendor with gold rights over E15/1495 as consideration

- Located within 30km of the Mt Marion Lithium Mine and 2km along strike from CuFe’s recently acquired tenement E15/1495 and immediately along strike from Marquee Resources West Spargoville Lithium Project

- Initial field work at E15/1495 underway

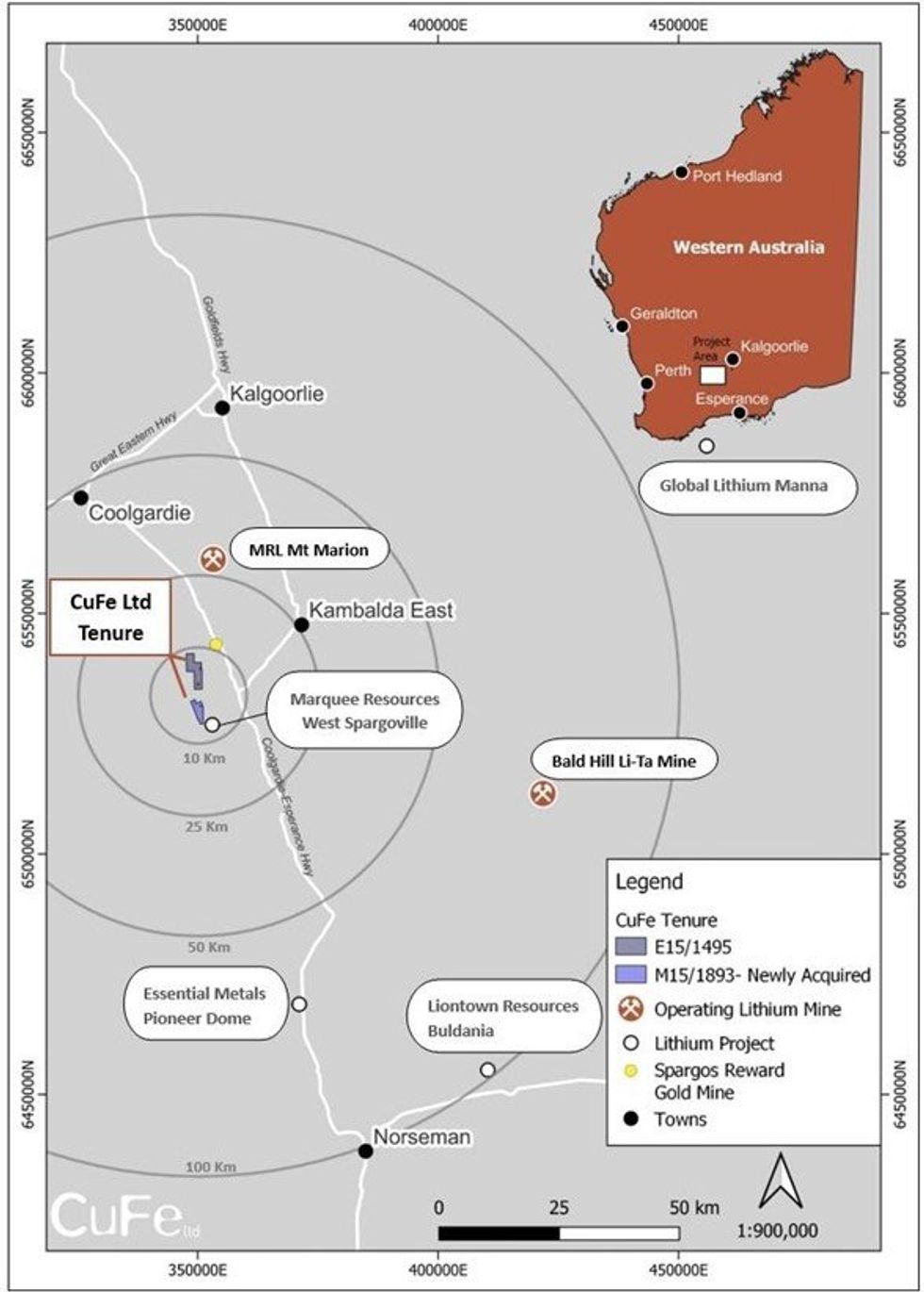

The tenement is approximately 48km SSE of the township of Coolgardie, within the Southern Yilgarn Lithium Belt that includes the known spodumene deposits and projects such as the Bald Hill Mine, the Mt Marion Mine, the Pioneer Dome Project, Manna Lithium Project and the West Spargoville Project - Marquee Resources (see Figure 1). The area over which the newly acquired rights is located 2km south and along strike of E15/1495, which was recently acquired by the Company (refer ASX announcement dated 9 May 2023). The addition of this tenure gives CuFe over 12km of strike length exposure to a 30km corridor that is proven to host Lithium-Caesium-Tantalum (LCT) bearing pegmatites.

Under the terms of the agreement, CuFe acquires rights to lithium and rare earth related minerals over M15/1893 (a mining lease which is presently under application pending finalisation of native title negotiations) from Rosa Management Pty Ltd (“Rosa”), and in return CuFe assigns Rosa rights to gold on the recently acquired E15/1495. The parties each assume the obligations to pay a $300,000 milestone payment payable to the previous owner in the event production occurs in the future from the tenure and a 1% gross sales royalty. Completion of the transaction is expected occur within 30 days.

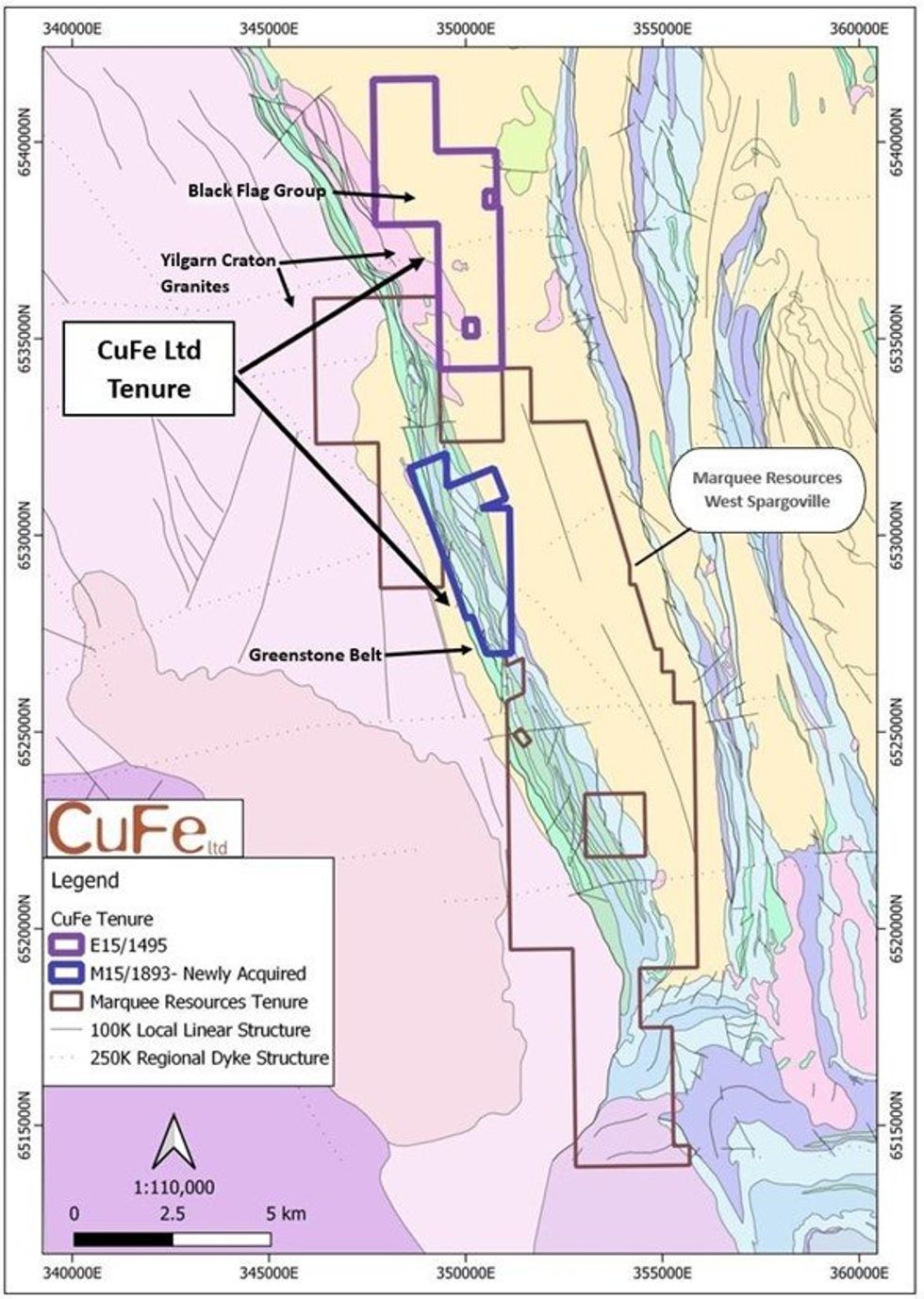

The local geology comprises mafic and ultramafic intrusive within felsic volcanics and siliciclastics of the Black Flag Group and is characterised by NNW trending networks of pegmatites (see Figure 2).

Initial visits to the site have occurred, with more detailed field work including detailed mapping and rock chip sampling planned across both tenements over the next 2-3 weeks.

CuFe Executive Director, Mark Hancock, commented “We are pleased to secure these rights in a commonsense way that enables each company to focus on their commodities of choice and maximise use of the ground. There is a lot of activity in the region, as illustrated by the recent acceleration of Mineral Resources farmin to the Marquee Resources tenure which surrounds our ground so that encourages us that we are in the right region. We look forward to the outcome and results of the planned field work across this tenement package.”

Released with the authority of the CuFe Board.

Click here for the full ASX Release

This article includes content from CUFE LTD, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 July 2025

CuFe Limited

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium.

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00