October 27, 2024

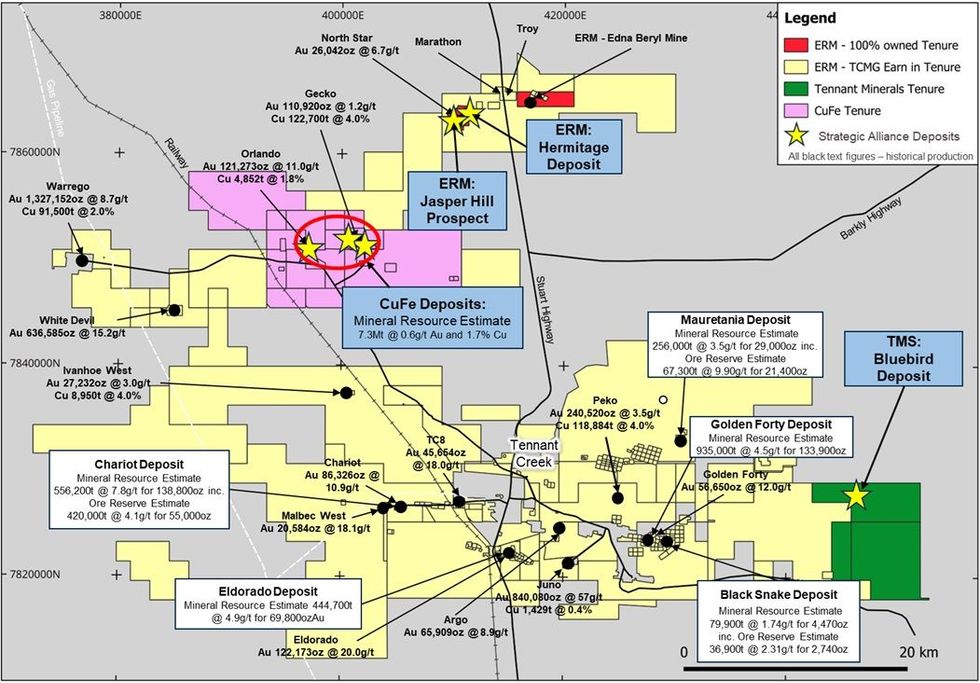

CuFe Limited (CuFe), Emmerson Resources Limited (Emmerson) and Tennant Minerals Limited (Tennant) (the Parties) are pleased to announce they have entered into a landmark Strategic Alliance Agreement to investigate the potential for development of a single, multi-user processing facility for Copper, Gold and Critical Metals for their Mineral Resources and recent high-grade exploration discoveries in the Tennant Creek region of the Northern Territory (see Figure 1).

Emmerson Resources Limited, CuFe Limited and Tennant Minerals Limited are pleased to announce the formation of a Strategic Alliance to collaborate on their copper, gold and critical metals development opportunities in the Tennant Creek Region of the Northern Territory.

The Alliance aims include:

- Assess the development options including the viability of a single multi-user processing facility in the high- grade Tennant Creek region including:

- The optimal processing plant configuration and location

- Mine scheduling

- Final products to be produced

- Infrastructure requirements including workforce, travel, power, water, accommodation, transportation, logistics, services and supply of reagents

- Environmental requirements and considerations including permits and approvals

- General logistics

- Completing a Scoping Study on development options for the Emmerson and Tennant Minerals 100% owned deposits and the CuFe operated JV deposits (CuFe 55% / Gecko Mining Company P/L 45%)

- Upon completing the Scoping Study, undertake a Pre-Feasibility Study (PFS) on the preferred option(s) to develop the deposits

- Investigate potential synergies with other explorers and developers in the region

- A commitment to work collaboratively including joint funding of Alliance activities

- Activities to commence in Q4 2024

Tennant Minerals Managing Director Vincent Algar said: “The production history of Tennant Creek copper and gold supports the shared facility model we plan to investigate in this collaboration. The strategy will provide a shorter pathway to production and incentivise TMS to continue its exploration effort targeting further discoveries like Bluebird on our tenements.”

Emmerson Managing Director Mike Dunbar said: “A number of the high-grade copper, gold and critical metals deposits in the Tennant Creek region start as relatively small scale mines and grow significantly after mining commences. With modern environmental, regulatory and financial hurdles, development of these modest sized deposits independently is now significantly harder than it was historically. As a result, a collaborative approach of working together with like-minded ASX listed Companies to investigate shared facilities to build the scale of operations needed for a modern development is, in my opinion, the best way of developing the field. I am pleased to be working with the Tennant Minerals and CuFe teams, as I believe this will lead to the best development option for each of the Companies and the Tennant Creek community as a whole.”

CuFe Executive Director Mark Hancock said: “We are pleased to have signed a Strategic Alliance Agreement to investigate the potential for a single multi-user processing facility for copper, gold and critical metals for our Mineral Resources and others recent high-grade exploration discoveries in the Tennant Creek region of the Northern Territory. With the historical high-grade Orlando and Gecko deposits, which produced over 127,500t of copper and 232,000oz of gold, the remaining Mineral Resources form the backbone of the Alliance, while the ability to also leverage from the recent high-grade discoveries by Tennant Minerals and Emmerson in the region provides a unique development opportunity.”

Collectively the Parties control 7.3Mt @ 0.6g/t gold, 1.7% Copper for 145,000oz of gold and 127,000t of copper in Mineral Resources (See Table 1 for breakdown of the JORC Minerals Resources) in addition to the recent high-grade copper, gold and critical metals discoveries in the Tennant Creek region. This includes Tennant Mineral’s Bluebird discovery which has returned intersections of up to 61.8m @ 2.3% Cu and 0.4 g/t gold and 63m @ 2.1% Cu and 4.6g/t gold (See ASX:TMS announcements dated 12 February 2024 and 17 August 2022 ) and Emmerson’s Jasper Hills prospect and the nearby Hermitage discovery which has returned intersections up to 119m @ 3.3% Cu and 0.87g/t gold and 94.4m @ 2.74% Cu and 5.58g/t gold (see ASX:ERM announcement dated 17 August 2022).

The Alliance recognises that as with all of the historical high-grade deposits in the Tennant Creek district, developing the deposits independently can be economically challenging, however with collaboration the potential of the deposits can be combined, allowing the collective group to investigate larger, more meaningful and more financially attractive development options. This strategy will provide a significant shift in the scale of any potential development in the Tennant Creek district to the benefit of each of the Companies and the Tennant Creek community as a whole.

The proposed shared facility is similar to the way the Tennant Creek Mineral Field (TCMF) operated historically, with centralised processing facilities from a number of the high-grade mines “feeding” the processing facilities through a “hub and spoke” development and operational model. It is this style of development and processing solution that the Strategic Alliance plans to actively investigate. As a first step the Alliance has commenced a review of information to determine options for the initial Scoping Study, with a view to then moving quickly onto a Pre-Feasibility Study and we look forward to positive outcomes emerging.

There is a significant opportunity in the Tennant Creek region for development of a dedicated multi-user copper (and associated metals including gold) facility in the region. Any proposed copper, gold and critical metals facility would be independent of the CIL gold only facility currently under construction in the region by Emmerson’s joint venture partner TCMG.

Click here for the full ASX Release

This article includes content from CUFE LTD, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CUF:AU

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 July 2025

CuFe Limited

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium.

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium. Keep Reading...

02 February

Government Funding to Unlock Critical Metals Processing

CuFe Limited (CUF:AU) has announced Government Funding to Unlock Critical Metals ProcessingDownload the PDF here. Keep Reading...

29 January

Quarterly Activities and Cashflow Report

CuFe Limited (CUF:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

28 October 2025

Quarterly Activities and Cashflow Report

CuFe Limited (CUF:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

20 October 2025

Review Highlights High Grade Bismuth Intercepts at Orlando

CuFe Limited (CUF:AU) has announced Review Highlights High Grade Bismuth Intercepts at OrlandoDownload the PDF here. Keep Reading...

14 October 2025

Placement to Raise $5.4 Million

CuFe Limited (CUF:AU) has announced Placement to Raise $5.4 MillionDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00