January 23, 2024

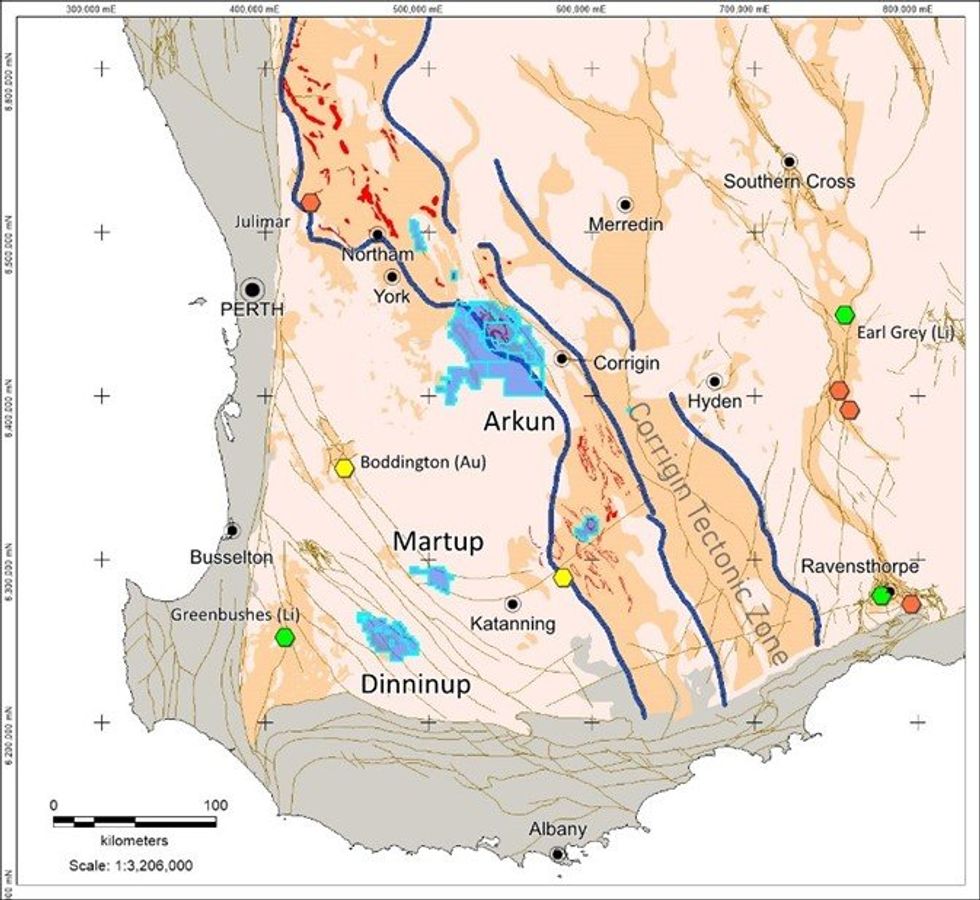

A large and significant target for porphyry copper-gold mineralisation has been identified at Impact Minerals Limited’s (ASX:IPT) 100% owned Arkun Project located 150 km east of Perth in the emerging mineral province of southwest Western Australia (Figure 1).

- A large and significant target for porphyry copper mineralisation has been identified in soil geochemistry data and Mobile Magneto-Telluric (MMT) data at the Caligula Prospect.

- A 5 km by 1 km soil geochemistry anomaly contains the key metal assemblage of copper- silver-cobalt+/-tellurium-bismuth-molybdenum, all indicators of porphyry copper mineralisation such as is found at Boddington and Calingiri in the same region of Western Australia. Gold assays are expected in February.

- The geochemistry anomaly coincides with numerous conductors identified in the MMT data that may represent disseminated or massive sulphides.

- Infill and extensional soil geochemistry surveys, together with a detailed interpretation of the MMT data, are underway to define the extent of Caligula and identify specific drill targets more fully.

- A follow-up aircore drill programme is to be undertaken as soon as practicable, which will also include the recently discovered Hyperion and Swordfish REE prospects.

The newly named Caligula prospect, initially identified in roadside and subsequent follow-up soil geochemistry surveys (Anomaly D: ASX Release 9th August 2023), has been significantly enhanced by the presence of several significant conductors within the geochemistry anomaly that may represent disseminated or massive sulphides.

The conductors were identified in recently acquired helicopter-borne Mobile Magneto-Telluric (MMT) data from one of the first surveys of this cutting-edge technology to be flown in Australia.

Caligula adds to Impact’s previously reported large Rare Earth Element soil geochemistry anomalies identified at Hyperion, located 15 km to the west, and Horseshoe, located 20 km to the east, and emphasises the significant exploration potential for a range of battery and strategic metals at the Arkun project (Figure 4 and ASX Releases 4th January 2024 and 1st June 2023).

Impact Minerals’ Managing Director, Dr Mike Jones, said, “The discovery of the Caligula Prospect is yet another significant and exciting breakthrough in our exploration at Arkun following the recent discovery of the Hyperion and Swordfish Rare Earth Element Prospects. It is one of the first of the many geochemical and geophysical targets we have at the project where we have actually been able to define the size and scale of the anomalies more fully and, given we have at least a dozen more similar areas to follow up, I am confident of more significant anomalies to come at Arkun. We are working towards a maiden drill programme as quickly as possible, and we will aim to cover as many targets as possible, including Hyperion and Swordfish. We are very encouraged by our results so far.”

Soil Geochemistry Results

The soil geochemistry results have defined an area of anomalous copper-in-soils that extends over about 5,000 metres north-south and up to at least 2,000 metres east-west. It is open to the east and the southwest (Figure 2 and Figure 4). The copper is associated with anomalous silver and cobalt and, in the southern part of the anomaly, also has a strong association with bismuth, tellurium and lesser molybdenum (Figure 2). Maximum and minimum values for the metals are given in Table 1.

This metal assemblage is characteristic of metals associated with porphyry copper deposits and this is encouraging for future exploration.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00