October 01, 2024

Brightstar Resources Limited (ASX: BTR) (Brightstar) is pleased to announce the completion of the acquisition of the gold rights at the Montague East Gold project (MEGP) from Gateway Mining Limited (ASX: GML) (Gateway).

HIGHLIGHTS

- Brightstar has completed the acquisition of the Montague East Gold Project (MEGP) from Gateway Mining Limited

- The completion of the acquisition of the mineral resources at the MEGP signifies the strategic addition of shallow, advanced ounces to Brightstar which is aligned with the Company’s strategy of advancing multi assets towards near term commercialisation

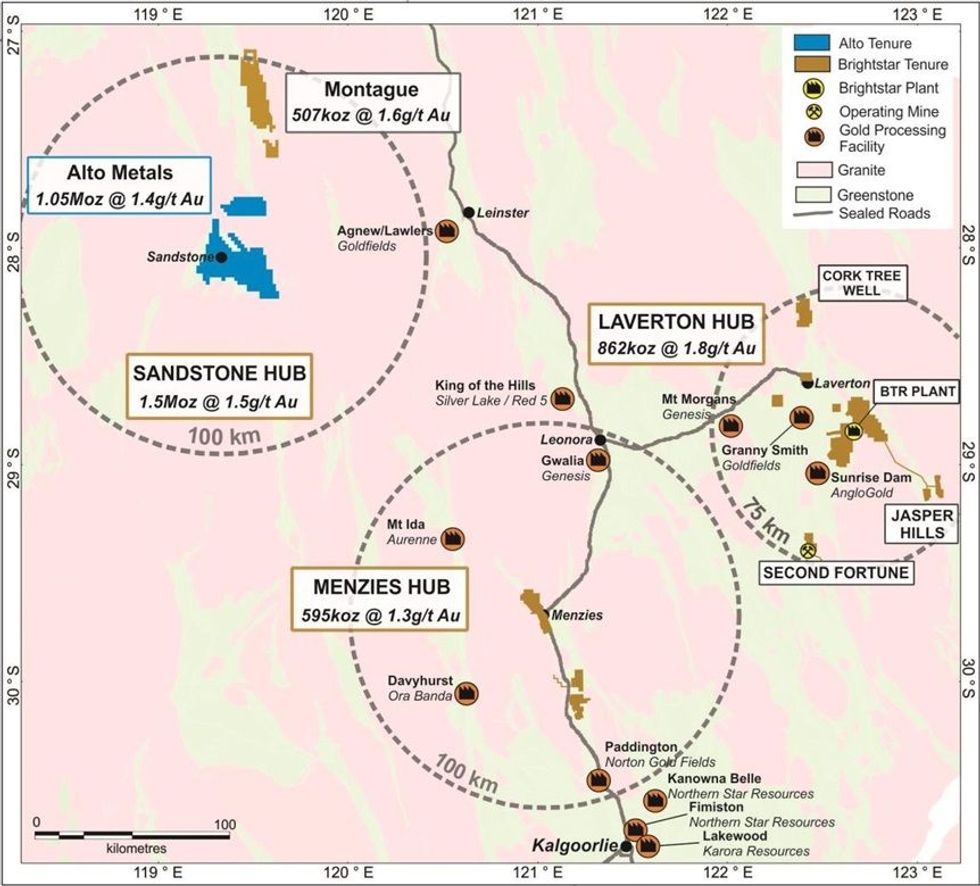

- The MEGP is located 70km from the Sandstone Gold Project, which is owned by Alto Metals Ltd, which is currently undertaking a merger with Brightstar by way of a Scheme of Arrangement

- $5 million cash consideration paid and 466.67 million Brightstar shares issued to Gateway

- Deferred contingent consideration of $2 million in Brightstar shares subject to further project milestones, including:

- upon the commencement of commercial mining operations in respect of the gold mineral rights at MEGP, or

- the delineation of a JORC Mineral Resource Estimate on the tenements exceeding 1.0 Moz Au.

- Following completion, the sale by Gateway of the consideration shares will be subject to orderly sales restrictions in consultation with Brightstar

- Brightstar is planning a drilling program to commence at the MEGP in late October, targeting infill and extensional targets within and proximal to the Mineral Resources located at the advanced Whistler and Montague-Boulder deposits

- Completion of the MEGP acquisition adds a further 9.6Mt @ 1.6g/t Au for 0.5Moz Au to Brightstar’s JORC Mineral Resource Estimate

- Total mineral endowment owned by Brightstar now 38.3Mt @ 1.6g/t Au for 2.0Moz Au

For further details regarding the Transaction please refer to the Company’s ASX announcement released on 1 August 20241.

Brightstar’s Managing Director, Alex Rovira, commented “The completion of the acquisition of the Montague East Gold Project from Gateway achieves the first step in Brightstar’s previously announced consolidation plan of the Sandstone district, adding shallow ounces and a meaningful Mineral Resource inventory to our portfolio of advanced exploration, development and producing gold assets in Western Australia.

We are working towards mobilising an RC drill rig to the Montague-Boulder and Whistler deposits in late October, which contain ~280koz Au of shallow, largely oxide material. It is our intent to move the Montague East Gold Project swiftly through resource drill-out and feasibility study workstreams to advance this asset towards development.

With 2Moz of gold Mineral Resources situated on granted mining leases in the Company, combined with our low capex growth plans and near-term development and production expansion, Brightstar is well placed to maximise value of the portfolio in an all-time high gold price environment.

Recent drilling success across the Lord Byron, Fish and Second Fortune deposits has illustrated the immense upside in the Company’s projects, as we seek to grow the Mineral Resource and de-risk future development through the DFS underway.”

MONTAGUE ACQUISITION

Brightstar, via its wholly-owned subsidiary Montague Gold Project Pty Ltd (MGP), has acquired the interests held by Gateway and its wholly owned subsidiary Gateway Projects Pty Ltd (GPWA) in certain mining tenements in respect of Gateway’s Montague Gold Project, with Brightstar obtaining 100% of the gold mineral rights and Gateway retaining all other mineral rights.

The total consideration paid by Brightstar in respect of the Montague acquisition is $14.0m, comprising:

- an upfront cash payment of $5.0m;

- 466,666,667 Brightstar shares issued at an implied issue price of $0.015 per share for $7 million worth of fully paid Brightstar shares (Gateway Consideration Shares); and

- $2.0m payable in cash or Brightstar shares, upon the commencement of commercial mining operations in respect of the gold mineral rights, or the delineation of a JORC Mineral Resource on the tenements exceeding 1.0 Moz Au.

Following Completion, the sale by Gateway of the Gateway Consideration Shares will be subject to orderly sales restrictions in consultation with Brightstar.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

03 March

Brightstar Secures US$120M Bond to Fund Goldfields Project

Brightstar Resources (BTR:AU) has announced Brightstar Secures US$120M Bond to Fund Goldfields ProjectDownload the PDF here. Keep Reading...

02 March

Results of Oversubscribed Share Purchase Plan

Brightstar Resources (BTR:AU) has announced Results of Oversubscribed Share Purchase PlanDownload the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

16 February

GNG: Preferred Contractor - Laverton Processing Plant

Brightstar Resources (BTR:AU) has announced GNG: Preferred Contractor - Laverton Processing PlantDownload the PDF here. Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

19h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00