October 29, 2024

Piche Resources Limited (ASX: PR2) (“Piche” or the “Company”) is pleased to announce drilling results from a further eight holes at its Ashburton uranium project in Western Australia. Results to date highlight the potential for both high grade and broad zones of uranium mineralisation.

HIGHLIGHTS

- ADD003 has delivered the widest intersection recorded to date with a 39m intersection immediately above the Proterozoic unconformity.

- Equivalent U3O8 concentration from recent drillholes include:

ADD003 39.28m @ 553 ppm eU3O8 from 124.12m

incl 1.28m @ 1,460 ppm eU3O8 from 125.46m and 0.84m @ 1,184 ppm eU3O8 from 151.54m and 2.42m @ 2,681 ppm eU3O8 from 155.10m and 1.90m @ 2,215 ppm eU3O8 from 161.40m

ARC0083.86m @ 720 ppm eU3O8 from 137.36m

ARCD0056.50m @ 639 ppm eU3O8 from 115.23m

incl 3.02m @ 930 ppm eU3O8 from 115.23m

ADD00510.48m @ 1412 ppm eU3O8 from 114.30m

incl 2.04m @ 3508 ppm eU3O8 from 115.72m and 0.50m @ 2911 ppm eU3O8 from 119.28m

4.08m @ 2075 ppm eU3O8 from 141.94m incl 2.04m @ 2875 ppm eU3O8 from 142.10m

1.04m @ 1918 ppm eU3O8 from 145.80m

1.04m @ 1103 ppm eU3O8 from 148.44m

- Analyses of the drill core has

1. demonstrated a northwest structural control on mineralisation

2. mineralisation along the unconformity and

3. within the overlying sandstone and the basement.

The combined reverse circulation and diamond drilling programme has exceeded the Company’s expectations, having met its original aims of confirming historical results, testing the potential northwest structural control of mineralisation, and expanding the known uranium mineralised envelope.

Results from the drilling are included in Table 1 with the drill hole details in Table 2. In total, 1,776m of reverse circulation drilling and 1,147m of diamond drilling have been completed for a total of 18 holes.

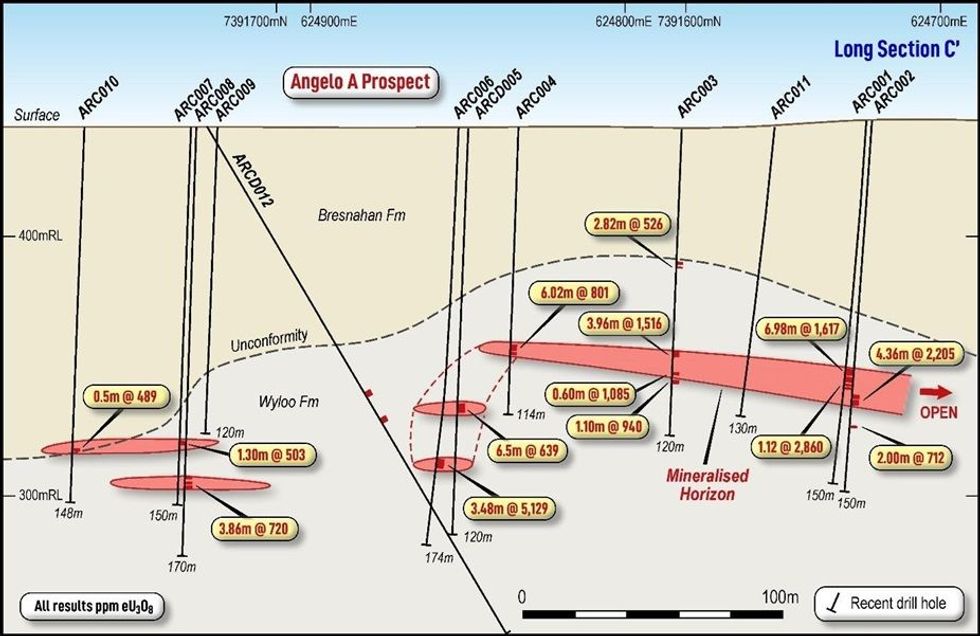

Drilling at Angelo A has confirmed the continuity of mineralisation, identified a steeply dipping mineralised structure and highlighted the undulating nature of the Proterozoic unconformity (Figure 1). A potential northwest trending structure containing uranium mineralisation was intersected between ARC004 and ARC006.

Evidence of a mineralised northwest oriented structure was encountered in ADD001, located over 1km to the northwest of Angelo A. Structural logging of this hole highlighted a shallow dipping (35 degrees) mineralised structural trending to the northwest.

The drilling programme has also confirmed historical drill results from over 40 years ago.

Diamond drill hole ADD003 identified 39.28 metres of uranium mineralisation (Figure 2), highlighting the potential to expand the area of mineralisation at both the Angelo A & B prospects, and along strike to the northwest and southeast.

Additionally, high grade uranium results may represent steeply dipping zones intersecting the flatter lying unconformity hosted mineralisation. The zone of uranium mineralisation in Section A’ is exceeds 100m wide and varies in thickness up to 39m. Mineralisation is continuous along strike with further drilling required to determine it’s extent and continuity.

Click here for the full ASX Release

This article includes content from Piche Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

silver investinguranium investingasx stocksasx:pr2gold explorationgold investinggold stockscopper investing

PR2:AU

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 July 2025

Piche Resources

Targeting globally significant uranium and gold discoveries in Australia and Argentina

Targeting globally significant uranium and gold discoveries in Australia and Argentina Keep Reading...

25 February

Board Changes

Piche Resources (PR2:AU) has announced Board ChangesDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

04 December 2025

Commences Maiden RC Drilling at Cerro Chacon Gold Project

Piche Resources (PR2:AU) has announced Commences Maiden RC Drilling at Cerro Chacon Gold ProjectDownload the PDF here. Keep Reading...

06 November 2025

Reinstatement to Quotation

Piche Resources (PR2:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

06 November 2025

$2million placement to advance Argentine exploration

Piche Resources (PR2:AU) has announced $2million placement to advance Argentine explorationDownload the PDF here. Keep Reading...

17h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

18h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

22h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00