August 06, 2023

GALENA MINING LTD. (“Galena” or the “Company”) (ASX: G1A) announces that the Abra Base Metals Mine (“Abra” or the “Mine”) has updated its JORC Code 2012 Mineral Resource Estimate (“July 2023 Resource” or “MRE”). This update is the first MRE annual update including all underground diamond drilling up to 5 May 2023, and all underground geological mapping, and mining and processing up to 30 June 2023.

HIGHLIGHTS

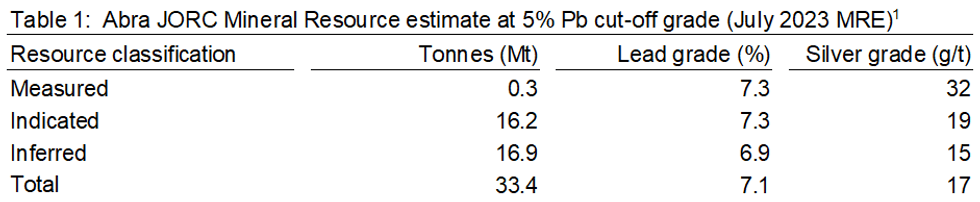

- Revised total Abra MRE of 33.4Mt at 7.1% Pb and 17g/t Ag (5% Pb cut-off grade):

- Measured 0.3Mt at 7.3% Pb and 32g/t Ag,

- Indicated 16.2Mt at 7.3% Pb and 19g/t Ag,

- Inferred 16.9Mt at 6.9% Pb and 15g/t Ag.

- No material difference from the previous MRE (April 2021), supporting Abra’s long-term mining plans.

- Includes 26,277m (163 holes) of underground diamond drilling, geology mapping associated with 7,319m underground development, and includes mining depletion.

- Identification and understanding of potential new lead and silver mineralisation associated with Carbonatic Dome structures within the Apron Zone and strong conversion of Inferred Mineral Resources to Indicated Mineral Resources in the eastern end of the mine.

Managing Director, Tony James commented, “The updated Abra MRE reflects substantial work achieved at Abra over the last 12-months, greatly improving the understanding of the deposit. Importantly, it shows no material difference from the April 2021 MRE, and therefore continues to support our long-term mining plans. The Resource update work also confirms that mining and processing grades seen during Abra’s commissioning and ramp-up, which is dominated by mine development, are not representative of the total MRE at Abra. As mining areas open- up, grades through the mill continue to improve, particularly as we move away from the upper northern margin near the Abra Fault.”

SUMMARY

Since June 2022, 26,277m (163 holes) of underground diamond NQ drilling has been completed and during commissioning and ramp-up of the mine, 325,924 tonnes at 4.8% lead and 20g/t silver has been mined and processed (note the early stages of mining is development focussed with 244,332t (75%) associated with development which is subject to a mining cut-off grade of 3.3% lead). Material mined and processed also includes both high-grade and sub-grade material produced during commissioning and early stages of ramp-up. A total of 7,319m of underground development has also been completed to 30 June 2023 in the Apron Zone section of the ore body allowing access for detailed mapping and geological interpretation.

The 2023 Mineral Resource estimate (MRE) takes into account the ore losses seen on the upper- northern margin of the orebody, as outlined in April 2023 (see Galena ASX announcement of 20 April 2023).

To complete and update the 2023 MRE with the latest technical understanding and confidence, drilling data was cut-off on 5 May 2023 and mine production data cut-off on 30 June 2023. Table 1 (below) states the Abra July 2023 Resource at a 5.0% lead cut-off grade, as at 30 June 2023. The July 2023 Resource has been independently reviewed by Snowden Optiro Pty Ltd (“Snowden Optiro”).

Notes: 1. Calculated using ordinary kriging method at a 5.0% lead cut-off grade. Tonnages are rounded to the nearest 100,000t, lead grades to one decimal place and silver to the nearest gram. Rounding errors may occur when using the above figures.

The previously published MRE is dated April 2021 (5% lead cut-off grade) based entirely on surface drilling and interpretation, and comprised a total of 34.5Mt at 7.2% lead and 16g/t silver (see Galena ASX announcement of 28 April 2021).

Click here for the full ASX Release

This article includes content from Galena Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

6h

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

7h

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

19 February

Mercado Minerals Provides Exploration Update on Copalito; Reveals New Vein Discoveries

Mercado Minerals Ltd. (CSE: MERC) ("Mercado" or the "Company") is pleased to report continued progress from ongoing exploration activities at its flagship Copalito Project ("Copalito" or the "Project"). The Company's technical team in Mexico has been actively mapping, sampling, and advancing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00