- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

February 18, 2025

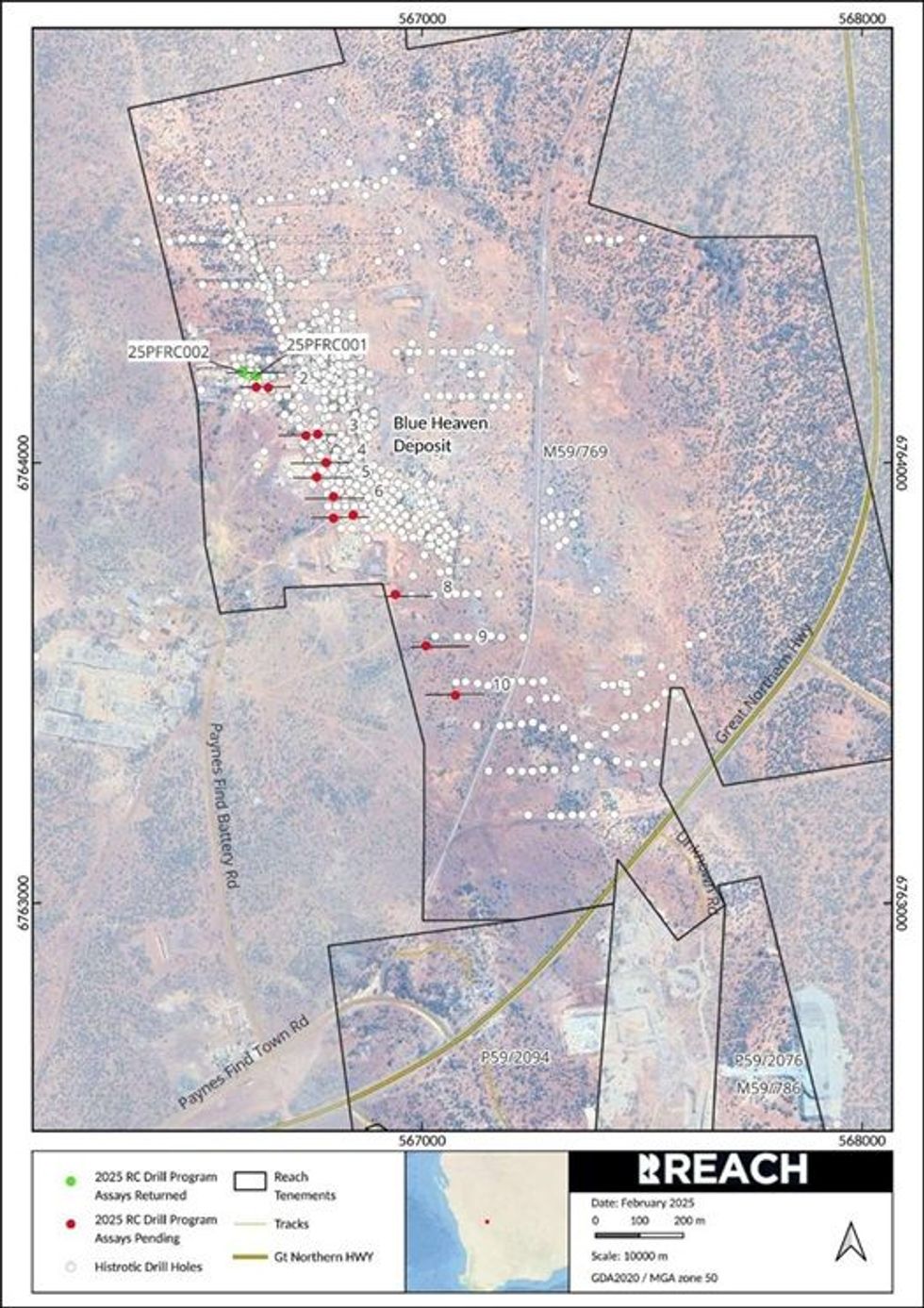

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce assay results from the first two (2) of fourteen (14), RC drill holes at the Company’s 100% owned Murchison South gold project, near Payne’s Find, in the gold rich Murchison Mineral Field W.A (see Figure 1). The initial results broadly support the interim mineralisation model developed by Mining Plus, with high-grade mineralisation consistently associated with quartz veins within hornblende gneiss.

HIGHLIGHTS

- RC drilling from the first two (2) holes at the Murchison South gold project has intersected high grade gold, providing initial validation of historical drilling results

- Significant assay results include (down hole widths):

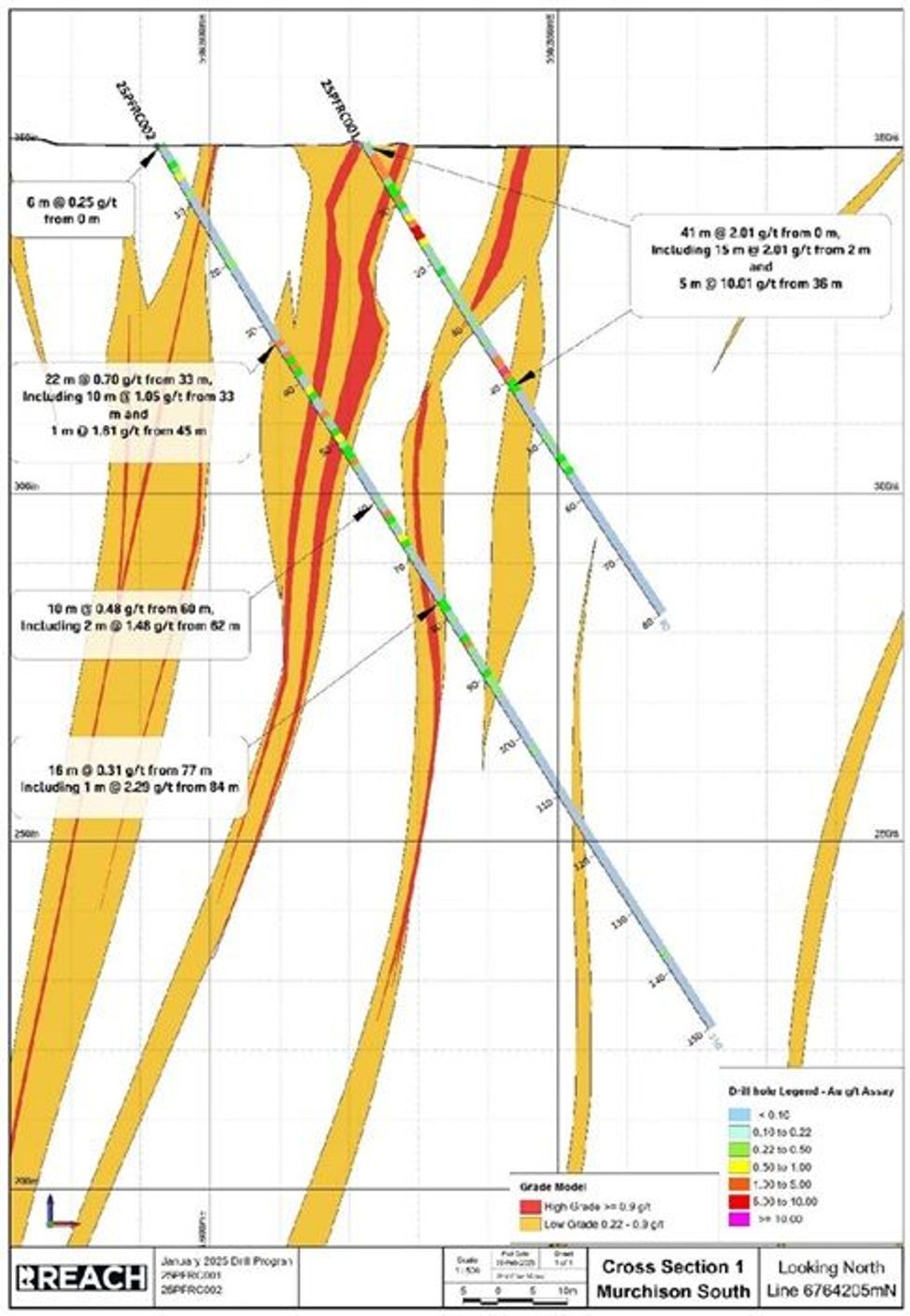

- 25PFRC001 (Hole 1)

41m @ 2.01 g/t from surface; including 15m @ 2.01 g/t from 2m, and

5m @ 10.01 g/t from 36m

- 25PFRC002 (Hole 2)

22m @ 0.70 g/t from 33m; including 10m @ 1.05 g/t from 33m, and

1m @1.61 g/t from 45m

- 25PFRC001 (Hole 1)

- A total of fourteen holes were drilled for 1463m at an average depth of 104m, at the Blue Heaven deposit

- Results from the first two drill holes align with the interim mineralisation analysis completed by Mining Plus, with the holes having intercepted the main rock types and showing a well- defined weathering profile

- Assays from the remaining 12 holes are due next week

Commenting on the results CEO Jeremy Bower said:

“These fantastic initial results give us a great start towards validation of the historic drilling and resource model at our Blue Heaven deposit. We have hit some high-grade shallow gold intervals, which align with the model, which is very encouraging, and we now eagerly await assays from the remaining 12 holes so we can get a complete understanding of our project.”

The drill program comprised 14 RC holes for a total of 1463m at an average depth of 104m and collection of 1588 samples for assay. This announcement relates to the first two (2) drill holes only (Refer to JORC Table 1 Appendix A for full results and collar table from holes 25PFRC001 & 25PFRC002).

The weathering zone is not intercepted in this cross-section but appears further south from Section 3 (Figure 1). Cross-Section 1 (Figure 2) displays multiple high-grade zones that broadly align with the existing model. Low-grade zones (yellow) envelop the high-grade mineralisation and correlate well with the new drilling.

Once all the drilling results have been received, Mining Plus will have sufficient data to interrogate the results before integrating them into their model. This will guide the next steps in optimizing pit designs at the Blue Heaven deposit and additionally will help determine the number and locations of planned diamond drill holes, which will be the source of sample material for the required metallurgical testing and geotechnical analysis.

Key Next Steps

- Receipt of remaining assay results

- Mining plus continue their independent mining review

- Metallurgical test work

- Negotiations with mining contractors and processors

Click here for the full ASX Release

This article includes content from Reach Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

RR1:AU

The Conversation (0)

03 May 2022

Reach Resources Limited

Sourcing the Critical Minerals of the Future

Sourcing the Critical Minerals of the Future Keep Reading...

13 May 2025

Murchison South Increases to 67koz Gold Across Two Pits

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce the completion of a new Mineral Resource Estimate (MRE) for the Pansy Pit deposit at its Murchison South Gold Project. The estimate, prepared by independent consultants Mining Plus, reported above a... Keep Reading...

28 July 2023

Quarterly Activities/Appendix 5B Cash Flow Report

Reach Resources Limited (ASX: RR1) (“Reach” or “the Company”) provides its activities report for the quarter ended 30 June 2023. HIGHLIGHTS High-Grade Lithium Results at Yinnetharra (15 May 2023) Lithium mineralisation confirmed with rock chip samples reporting highly encouraging assays of up to... Keep Reading...

18 May 2023

Outcropping Copper Gossan Delivers 33% Cu Assays At Morrissey Hill Project, Yinnetharra

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce that it has received high grade copper, gold and silver results up to 33% copper, 0.2g/t gold and 142g/t silver from its recently completed rock chip sampling program at the Company’s Morrissey Hill... Keep Reading...

14 May 2023

Reach Resources’ Strategic Position Between Two of WA’s Mining Heavyweights

Reach Resources’ (ASX:RR1) strategic position with its Morrissey Hill project has placed the critical mineral explorer on the radar of two of Western Australia’s mining giants Delta Lithium (ASX:DLI) and Minerals 260 (ASX:MI6), according to an article published in The West Australian.“While... Keep Reading...

6h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

14h

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

03 March

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

02 March

Steve Barton: Gold, Silver, Oil — Key Price Levels to Watch Now

Steve Barton, host of In It To Win It, shares key price levels for silver and gold.He also explains his current approach to the oil and copper markets, and outlines an emerging opportunity in nickel as Indonesia loosens its hold on the space. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00