May 01, 2025

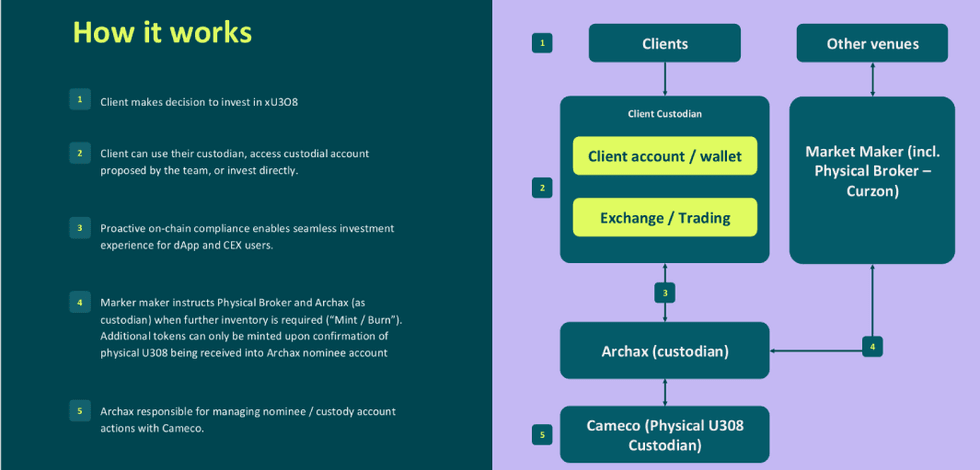

Uranium.io is a next-generation platform transforming access to physical uranium (U₃O₈) through the power of blockchain technology. It empowers both individual and institutional investors to directly own and trade uranium, eliminating many of the traditional barriers, such as high costs, limited transparency, and market inefficiencies. Each xU₃O₈ token is fully backed by physical uranium stored in a secure, regulated facility operated by Cameco. Custodianship is provided by Archax, a UK-regulated digital asset firm, ensuring robust transparency and trust in the asset’s backing.

The platform meets rising investor demand for uranium—a key driver of the global energy transition. As nations pursue net-zero targets, nuclear energy is gaining momentum as a reliable, low-carbon power source. Governments across North America, Europe, and Asia are expanding nuclear capacity by restarting reactors, building new ones, and advancing small modular reactor development.

Uranium.io combines blockchain, digital custody, and real-world uranium supply to deliver secure, transparent access to the uranium market. By bridging traditional commodity trading with Web3, the platform enables users to seamlessly acquire, hold, and trade physical uranium through xU₃O₈ tokens.

Company Highlights

- Uranium.io is a pioneering platform for buying and selling uranium, providing direct ownership of physical uranium via a blockchain-powered token xU3O8.

- Built on Etherlink, powered by Tezos technology, enabling transparency, low fees, energy efficiency and programmable compliance.

- FCA-regulated digital asset custodian, Archax, holds physical uranium in trust on behalf of token holders.

- Physical supply is brokered by Curzon Uranium, a trusted uranium trading and logistics partner with deep industry roots and over $1 billion in uranium trades.

- The uranium bought on the platform is physically stored at a regulated depository owned and operated by Cameco, one of the world’s leading global uranium providers/converters.

- Global 24/7 market access offering fractionalized and direct uranium exposure with real-time settlement and cross-border accessibility.

- Capitalizing on nuclear energy’s role in clean energy transition and the financialization of critical minerals.

This Uranium.io profile is part of a paid investor education campaign.*

Click here to connect with xU3O8 (uranium.io) to receive an Investor Presentation

Sign up to get your FREE

AmeriTrust Financial Technologies Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 February

AmeriTrust Financial Technologies

Unlocking opportunity in used vehicle leasing through proprietary finance technology

Unlocking opportunity in used vehicle leasing through proprietary finance technology Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

AmeriTrust Financial Technologies Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00