- WORLD EDITIONAustraliaNorth AmericaWorld

August 20, 2023

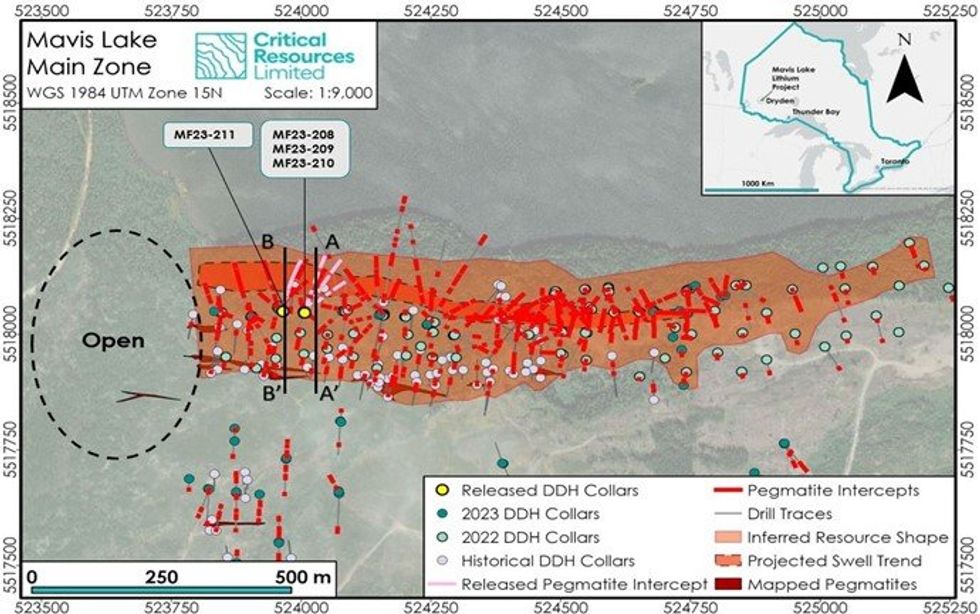

Lithium exploration and project development company Critical Resources Limited ASX:CRR (“Critical Resources” or “the Company”) is pleased to advise that follow-up drilling around the recent breakthrough 74.4m intercept (Drill-hole MF23-207: refer to ASX Announcement released 24 July 2023) has continued to validate and expand the recently discovered “Swell Zone” at the Mavis Lake Lithium Project in Ontario, Canada.

Highlights

- Continued drilling success along trend from the recently reported diamond drill-hole MF23-207 – 74.4m @ 1.18% Li2O including 32.95m @ 1.81% Li2O.

- Multiple wide mineralised zones intersected in further diamond drill-holes targeting the “Swell Zone”, with assayed intercepts including:

- Drill-hole MF23-211 with 41.0m @ 1.18% Li2O from 206.6m down-hole;

- Drill-hole MF23-210 with 41.25m @ 1.25% Li2O from 208.3m down-hole;

- Drill-hole MF23-209 with 20.7m @ 1.21% Li2O from 212m down-hole; and

- Drill-hole MF23-208 with 13.8m @ 1.81% Li2O from 156.5m down-hole and 13.3m @ 1.56% Li2O from 343.9m down-hole.

- The wide intercepts are outside of the current Mineral Resource envelope and will add significant tonnage to our next resource upgrade.

- Every drill-hole also displayed localised sections of very high-grade lithium mineralisation grading above 2.2% Li2O, with drill holes MF23-209 and MF23-210 containing sections grading over 3.1% Li2O.

- Drilling continues to test the mineralisation in the Swell Zone, with the Swell remaining open.

- Further assays from this new zone are pending and will be released to the market as soon as they become available.

Since that discovery intercept, the Company has completed a series of further drill-holes targeting this exciting new position, with multiple holes encountering thick mineralised intercepts, demonstrating consistency around the plunge theory at the Mavis Lake Main Zone.

Current drilling forms part of the summer 2023 resource extension drilling program, seeking to establish Mavis Lake as the largest single-site, JORC Code 2012 Compliant Lithium Resource in Ontario.

Full exploration results are provided in Appendix 1.

Extension of Swell Plunge Trend

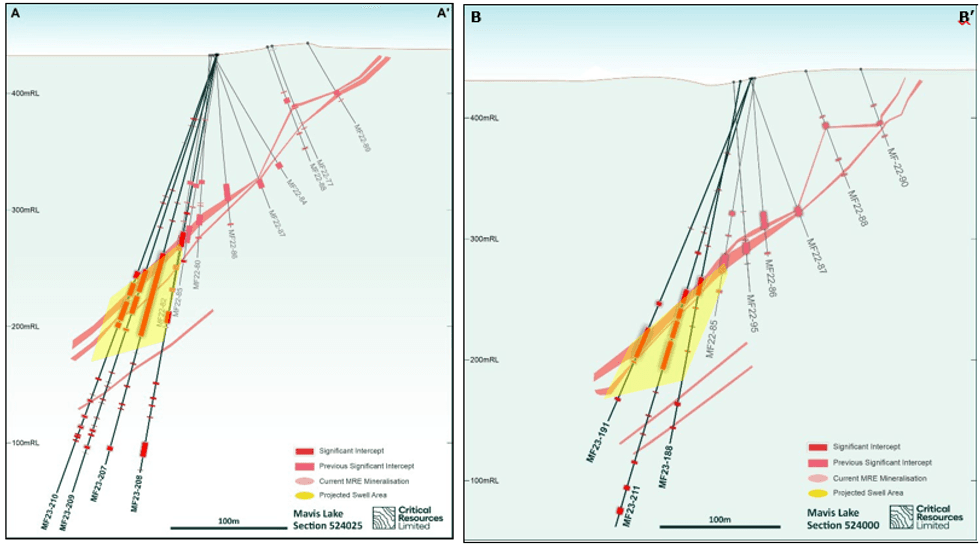

The drilling was designed to follow up the successful intercept in Drill-hole MF23-207 and test both the lateral, up-dip and down-dip extents of the newly identified Swell Zone. The new intercepts can be seen in Figure 2, with a summary of assay results in Table1.

Drill-hole MF23-208 was immediately drilled following the success of MF23-207, however this hole was originally designed for resource extension and intersected the Main Zone up-dip of the swell trend.

The hole was able to intersect three significant mineralised zones, with multiple high-grade sections over 2.2% Li2O. The drill-hole also demonstrated continuity, with two intercepts of continuous, high- grade mineralisation, each over 13 metres down-hole grading over 1.5% Li2O.

A full breakdown of assay results is provided in Table 1. The deepest zone, starting at 343m down- hole, demonstrates the presence of significant spodumene mineralisation at depth, which will continue to be tested.

Drill-holes MF23-209 and MF23-210 were designed to test the down-dip extents of the swell trend identified by MF23-207. Both returned multiple thick intercepts of high-grade spodumene, including exceptionally high-grade zones grading over 3% Li2O. Some mineralised segments were separated by very thin mafic volcanic units.

These intercepts have extended the mineralisation in the Swell Zone by an additional ~50m down- dip and ~25m east. These holes were also used to assist in defining the geometry of the Swell Zone and allow for future drill-hole planning.

MF23-211 was a step-out, collared west of MF23-207 and designed to test the lateral extension of the Swell Zone. MF23-211 successfully intersected thick spodumene-bearing pegmatite, with an average grade of 1.18% Li2O over 41m down-hole, with multiple sections grading over 2.1% Li2O. This key intercept helps validate the theory that the Swell Zone is expanding laterally.

Click here for the full ASX Release

This article includes content from Critical Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CRR:AU

The Conversation (0)

21 June 2022

Critical Resources

High-grade Lithium Portfolio, in a Tier 1 Location, Aligned with the World’s Green Energy Transition

High-grade Lithium Portfolio, in a Tier 1 Location, Aligned with the World’s Green Energy Transition Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00