October 23, 2024

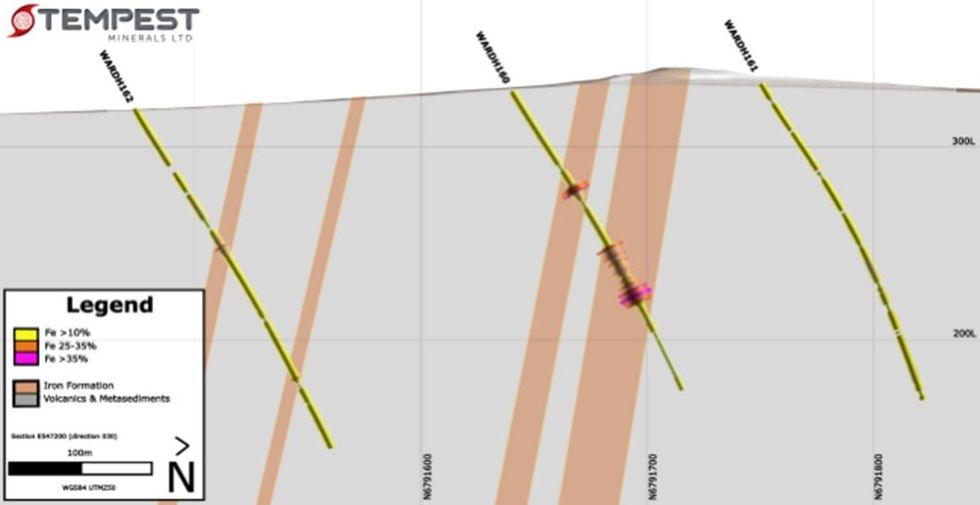

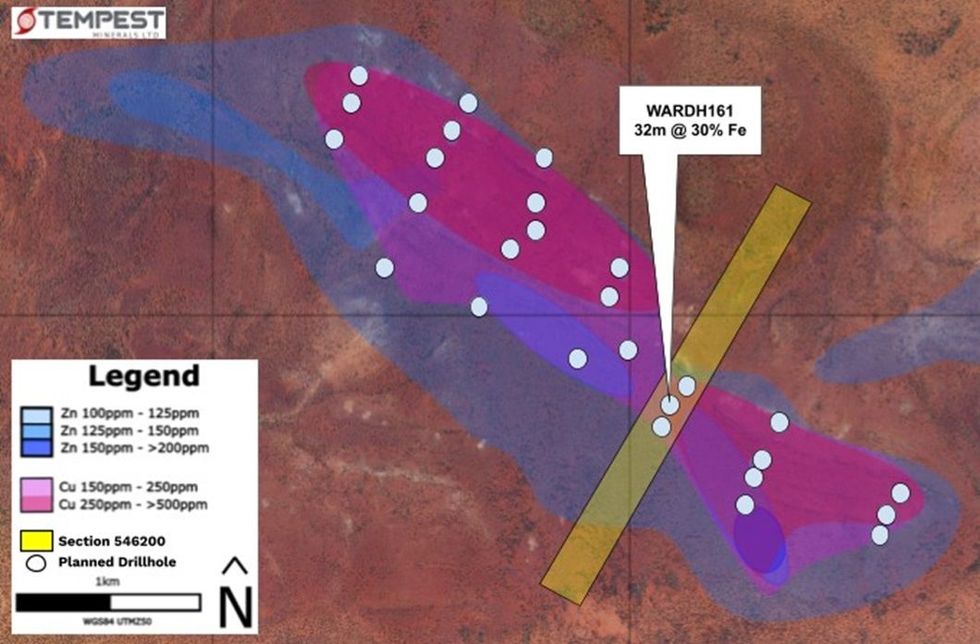

Tempest Minerals Limited (ASX: TEM) is pleased to provide an update on its ongoing exploration activities at the Yalgoo Project. The Company has received assay results from the first of the recently drilled holes at the Remorse Target which shows intercepts of high-grade iron. RC hole WARDH0160 has returned a 32m down-hole intersection of magnetite-hosted iron, grading up to 39.34% Fe. The promising iron grades were intersected whilst drilling the Remorse copper-zinc soil anomaly target and represent a significant opportunity for further iron-focussed exploration in addition to base and precious metals. Multiple untested zones exhibiting such magnetite mineralisation apparently exist, each being 7 km in strike length. Further results are expected in coming weeks.

Key Points

- High-grade magnetite iron intercepted in RC drilling.

- Extensive, consistent and unexplored iron targets.

- Undercover magnetic highs with similar signature show substantial additional potential.

Remorse Project

High-Grade Iron

Although assays are only available for one hole to date, the intersection of high-grade magnetite iron is an exciting development in the prospectivity of the Remorse target. Although extensive iron-rich stratigraphy was noted in all work to date, due to the surface expression, it was viewed through the geological lens of a gangue mineral associated with base metal deposit styles such as VMS. However, drilling into the fresh rock below weathered, cherty, haematite-goethite-magnetite outcrops has shown consistent medium-grained, massive, high-grade, magnetite-rich mineralisation in the sub-surface.

Click here for the full ASX Release

This article includes content from Tempest Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TEM:AU

The Conversation (0)

03 February 2025

Tempest Minerals

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore.

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore. Keep Reading...

25 June 2025

Completion of Shortfall Offer

Tempest Minerals (TEM:AU) has announced Completion of Shortfall OfferDownload the PDF here. Keep Reading...

15 June 2025

Further Excellent Metallurgical Results From Remorse-Yalgoo

Tempest Minerals (TEM:AU) has announced Further Excellent Metallurgical Results From Remorse-YalgooDownload the PDF here. Keep Reading...

10 June 2025

Entitlement Offer Results

Tempest Minerals (TEM:AU) has announced Entitlement Offer ResultsDownload the PDF here. Keep Reading...

30 May 2025

Geochemical Sampling Extends Sanity Gold Anomalies - amended

Tempest Minerals (TEM:AU) has announced Geochemical Sampling Extends Sanity Gold Anomalies - amendedDownload the PDF here. Keep Reading...

20 May 2025

Yalgoo - Geochemical Sampling Extends Sanity Gold Anomalies

Tempest Minerals (TEM:AU) has announced Yalgoo - Geochemical Sampling Extends Sanity Gold AnomaliesDownload the PDF here. Keep Reading...

10h

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

12h

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00