December 15, 2022

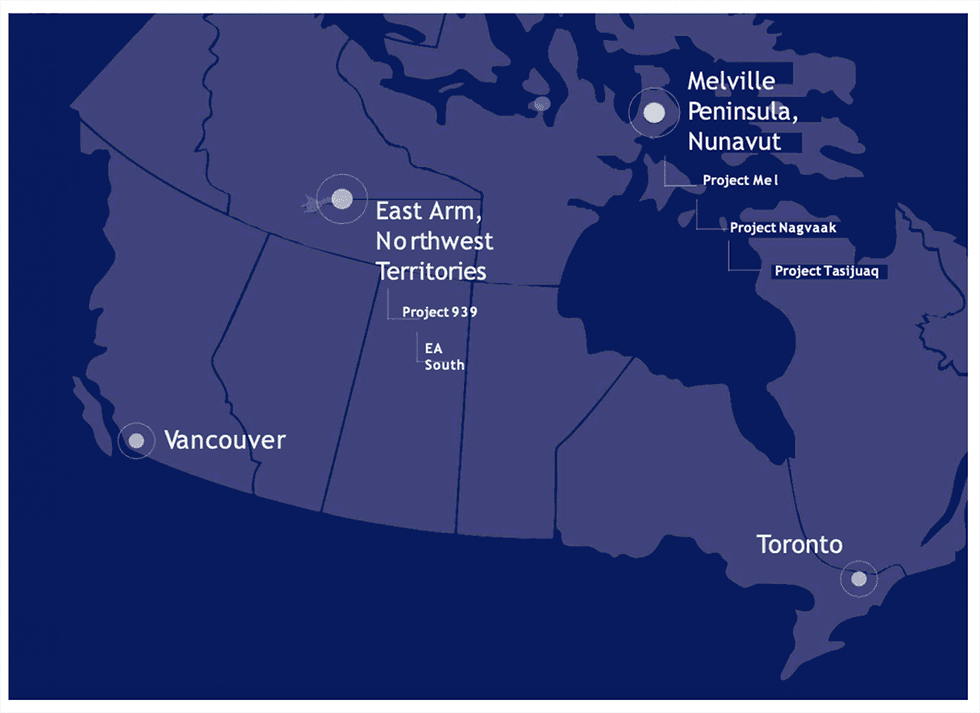

StrategX Elements Corp. (CNSX:STGX) focuses on discovering new energy transition metal deposits required for the shift to clean and sustainable energy technologies. The company’s assets centers on cobalt, nickel, and other energy transition metals to contribute to Canada’s domestic supply chain. StrategX’s five 100-percent-owned assets are within Nunavut and the Northwest Territories.

The company’s assets cover 110,00 hectares in the Northwest Territories and 60,000 hectares in Nunavut. StrategX’s flagship project, Nagvaak in Nunavut, is highly prospective for nickel, vanadium, cobalt, copper, molybdenum, silver and PGMs. In Q1 2023, the company plans to conduct a first phase 2,000-meter drill program to confirm suspected deposits. The company’s additional projects are moving towards exploratory drilling as exploration campaigns aim to identify priority targets.

StrategX believes in the importance of maintaining a positive ESGI rating as a company focusing on supporting renewable energy. Leadership has prioritized building solid relationships with local communities from the beginning and integrating these communities into the project. The company understands that communities need to be involved in unlocking the critical mineral potential of its assets.

Company Highlights

- StrategX is a Canadian exploration company with assets in Nunavut and the Northwest Territories focusing on making discoveries of energy metals, including cobalt, nickel, vanadium, and PGEs.

- The company aims to contribute to Canada’s emerging critical metal supply chain to support net-zero initiatives.

- StrategX has five 100-percent-owned projects in Nunavut and the Northwest Territories targeting metals critical to transitioning to clean energy technologies.

- The Nagvaak project, the company’s flagship asset, is scheduled to begin exploratory drilling in Q1 2023 to follow up on priority targets identified in the Q3-Q4 2022 campaign.

- A strong emphasis is placed on achieving a positive ESGI rating, and management has prioritized building relationships with local communities from the beginning.

- A management team with expertise throughout the natural resources industry and a track record of success lead the company toward its goals.

This StrategX Elements Corp profile is part of a paid investor education campaign.*

Click here to connect with StrategX Elements Corp. (CNSX:STGX) to receive an Investor Presentation

STGX:CC

The Conversation (0)

14 December 2022

StrategX Elements

Targeting Underexplored Regions in Northern Canada for Energy Transition Metals

Targeting Underexplored Regions in Northern Canada for Energy Transition Metals Keep Reading...

20 January

Top 3 ASX Cobalt Stocks (Updated January 2026)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to demand for EVs. The EV market may be facing headwinds now, but the... Keep Reading...

19 January

Cobalt Market Forecast: Top Trends for Cobalt in 2026

Cobalt metal prices have trended steadily higher since September of last year, entering 2026 at US$56,414 per metric ton and touching highs unseen since July 2022. The cobalt market's dramatic reversal began in 2025, when it shifted from deep oversupply to structural tightness after a decisive... Keep Reading...

19 January

Top 5 Canadian Cobalt Stocks (Updated January 2026)

The cobalt market staged a dramatic turnaround in 2025, lifting sentiment across equity markets after years of oversupply and near-record price lows. Early in the year, the Democratic Republic of Congo’s (DRC) decision to suspend cobalt exports sparked a major price rebound, with benchmark metal... Keep Reading...

13 January

Cobalt Market 2025 Year-End Review

The cobalt market entered 2025 under pressure from a prolonged supply glut, but the balance shifted sharply as the year unfolded, due almost entirely to intervention from the Democratic Republic of Congo (DRC).After starting the year near nine year lows of US$24,343.40 per metric ton, cobalt... Keep Reading...

31 October 2025

Top 5 Canadian Cobalt Stocks (Updated October 2025)

Cobalt prices regained momentum in the third quarter of 2025 as tighter export controls from the Democratic Republic of Congo (DRC) fueled expectations of a market rebound. After languishing near multi-year lows early in the year, the metal surged to US$47,110 per metric ton in late October, its... Keep Reading...

27 October 2025

Top 3 ASX Cobalt Stocks (Updated October 2025)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to EVs. While EV demand may be facing headwinds now, the long-term... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

6h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00