- WORLD EDITIONAustraliaNorth AmericaWorld

Rare Earths Stocks: 5 Biggest ASX Companies in 2026

Rare Earths Stocks: 9 Biggest Companies

Overview

Rare earth metals are best classified as difficult to discover and extract. In 2019, nearly 60 percent of global annual production (an estimated 132,000 tonnes) came from China, with only 12.2 percent of production coming from the second largest producer, the United States. But, what are rare earth metals? And why are they more important than ever?

Rare earth metals are classified into two categories: light and heavy. Light rare earth elements (LREEs) are commonly available and include lanthanum, cerium, praseodymium, and neodymium. Heavy rare earth elements (HREEs) are more difficult to source (and therefore more expensive), and include samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium, yttrium, and scandium.

Known as the seeds of technology, rare earth metals set to play an ever growing important role in the future of clean energy, as well as serving as a key ingredient in the permanent magnets found in wind turbines and electric vehicles. With such rapid forecast demand looming it’s clear why this segment of the mining industry is attracting attention.

Ionic Rare Earths (ASX:IXR, or “IonicRE”) is an exploration and mining development company that aims to create rare opportunities for investors by operating a low capital operation with a high-margin product. The company currently has a 51 percent ownership (earning up to 60 percent) over the promising rare earth elements Makuutu project located in Uganda. Even though it is the company’s only project, the Makuutu project has a post-tax long-term free cash flow estimate of US$766 million over 11 years. This is expected to grow dramatically in the next 12 months as the company increases the resources to increase the potential life at Makuutu beyond 30 years.

The company is focused on developing its flagship Makuutu Rare Earths Project in Uganda into a significant, long life, high margin, supplier of high-value critical and heavy rare earths. Makuutu is an advanced-stage, ionic adsorption clay (IAC) hosted rare earth element (REE) project highlighted by near-surface mineralisation, significant exploration upside, excellent metallurgical characteristics, and access to tier one infrastructure. The clay-hosted geology at Makuutu is similar to major IAC rare earths projects in southern China, which are responsible for the majority of global supply of low-cost, high value Heavy REOs (>95% originating from IAC). Metallurgical testing at Makuutu has returned excellent recovery rates, which provide multiple avenues for a low-CAPEX process route. Makuutu is well-supported by tier-one existing infrastructure which includes access to major highways, roads, power, water and a professional workforce.

Makuutu will produce a mixed rare earth carbonate (MREC) product, and is planning on developing a standalone refinery to then process the radionuclide MREC product to produce secure and traceable individual rare earths required to supply a growing western demand.

Key investor take-aways:

- The Basket; High content of critical and heavy rare earths (73 percent) required to enable transition to carbon neutrality.

- Low capital development (US$89M); Scalable modular approach means that we can expand the operation from initial capital investment using free cash flows from the project.

- High payability mixed rare earth carbonate (MREC) with no radionuclides.

- Long life; 27 years defined but scope to increase this to be much greater with additional exploration upside pending.

- Investigating standalone heavy rare earth refinery to separate MREC into refined products for marketing to western end users.

Figure 1: Makuutu is quickly being defined as one of the world’s most strategically important rare earth projects.

Figure 2: Granit outcroppings south of the mineralisation trend, with the expansive Makuutu project area in the distant north.

Historically, the majority of rare earth metals have been produced in China. However, economically significant deposits are now being explored and developed all around the world due to the increased commercial interest in the element driven by desires to develop secure supply chains to meet dramatic increases in future demand.

Additionally, Makuutu is the third-largest scandium deposit on the planet with 9,450t+ of scandium available and near term potential for a step change in size.

“We’ve recently done some exploration drilling that indicated that the overall mineralization system of Makutuu is going to get a lot bigger, so we’re going to continue to add value to shareholders and build a very large project,” Tim Harrison said in a recent interview.

Figure 3: Phase 4 infill drilling at Makuutu which is expected to net a significant increase in resources at Makuutu.

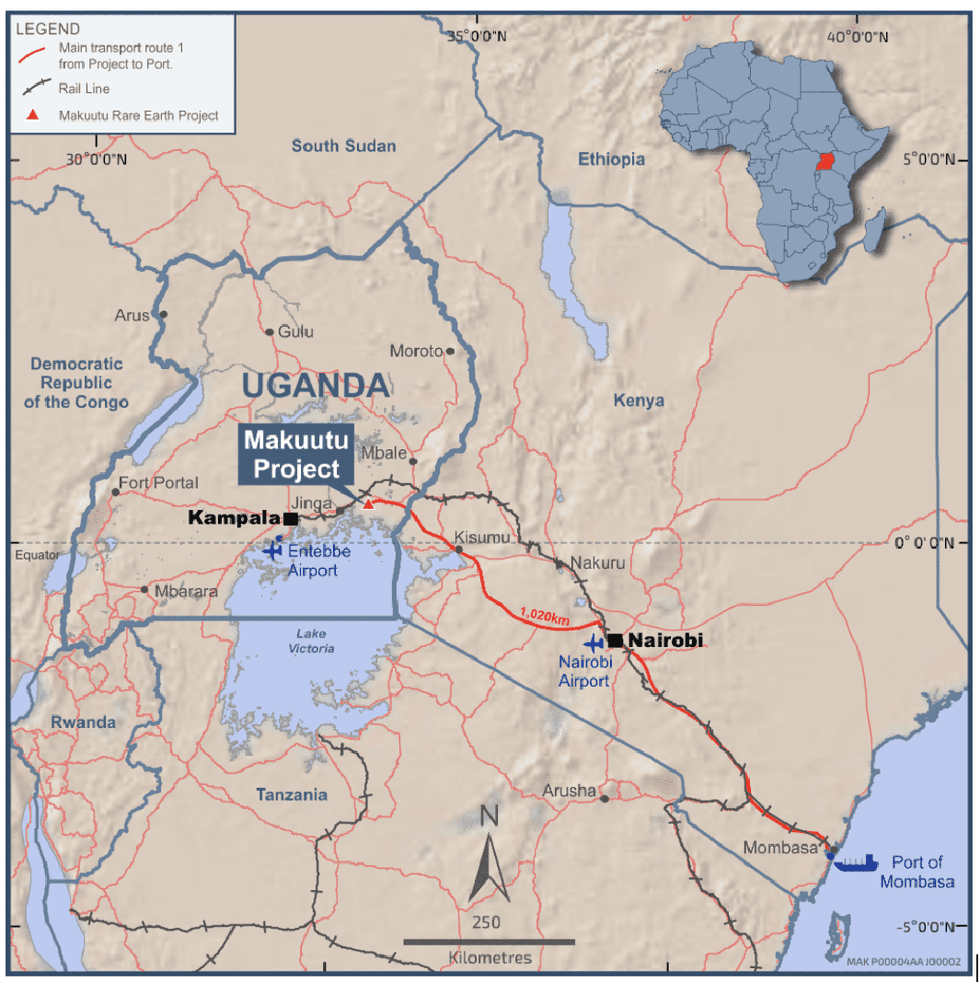

Figure 4: Makuutu project location, 120 km east of Kampala, Uganda.

Makuutu may have a strong presence of scandium, but the project also serves as a “one-stop-shop” for many other rare earth elements, especially the high value and high demand magnet rare earths , neodymium, praseodymium, dysprosium and terbium, and many others. There are 16 rare earth elements found in the Makuutu IAC mineralization, with lanthanum oxide, yttrium oxide, and neodymium oxide being found in the highest concentrations. Forecasting the price of all the rare earth elements found at Makuutu is how Ionic Rare Earths is expected to earn US$766 million over 11 years, with much more upside long term given sensitivity analysis indicated a 10% increase in rare earth prices projected a massive 30% increase in NPV post tax.

Ionic Rare Earths is led by a strong corporate management team with decades of applicable experience. Trevor Benson, the chairman, has over 30 years experience with investment banking and stockbroking, focusing on the resources sector. Tim Harrison, managing director, brings 20 years of experience in mineral processing and hydrometallurgy. Max McGarvie, the non-executive director, has 45 years of experience in mining development and mineral processing. Combined, the experienced management team is fully equipped to lead Ionic Rare Earths to success.

Company Highlights

- Ionic Rare Elements is an exploration and mining company that is cultivating a promising basket of rare earth metals, which includes magnet rare earths neodymium, praseodymium, dysprosium and terbium, in high demand to feed the insatiable demand for Evs and offshore wind turbines

- Makuutu’s unique rare earth basket has the full list of all individual REEs required for the future industries dependent upon a secure and stable supply

- The Makuutu project is a low-capital development that will produce a high-margin product

- Rare earth metals already have many applications, but a forecast demand of these technology metals already exceeds potential supply indicating that long term REE procing is set for significant gains

- The Makuutu project is considered the third-largest scandium resource globally, and has the potential to produce many other in-demand REEs

- IonicRE is dedicated to developing and extracting value from the Makuutu project with a potential of extending the to 2050 and beyond

- IonicRE is planning on developing heavy rare earth refining capacity and supplying western markets as the next step in maximising the value of the Makuutu basket in a climate of strained supply.

- IonicRE’s magnet recycling business Ionic Technologies, has executed landmark partnership agreements with Ford Technologies, Less Common Metals, and British Geological Survey (BGS) to create a UK rare earth supply chain from recycled magnets.

Get access to more exclusive Rare Earth Investing Stock profiles here