May 12, 2024

Sarama Resources Ltd. (“Sarama” or the “Company”) (ASX:SRR, TSX-V:SWA) is pleased to announce the Statement of Executive Compensation - 2023.

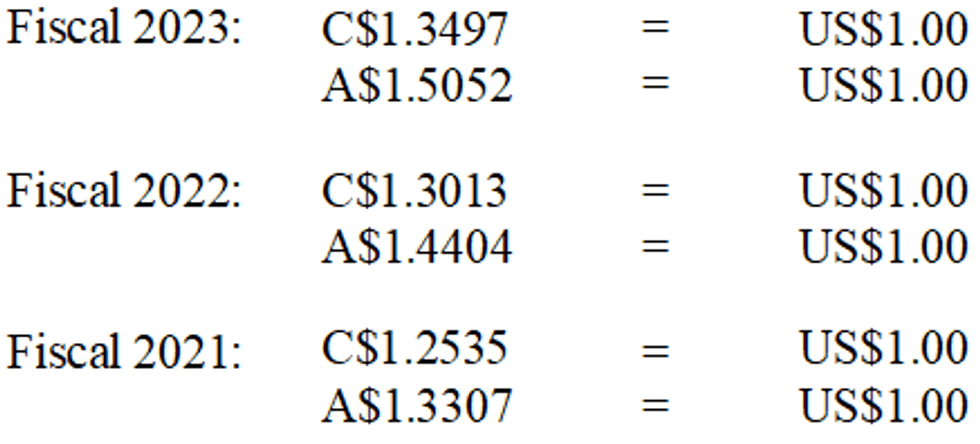

The following information is provided as required under Form 51-102F6 for Non-Venture Issuers, as that term is defined in National Instrument 51-102 – Continuous Disclosure Obligations for the financial year ended December 31, 2023. The Company reports its financial statements in United States dollars. Unless otherwise noted, all compensation described in this statement is awarded to, earned by, paid to, or payable to an NEO in either Canadian dollars or Australian dollars. Unless otherwise noted, all compensation amounts have been converted into United States dollars at the following Bank of Canada annual average rates.

All references to “C$”, “$” or “dollars” in this Statement of Executive Compensation refer to Canadian dollars unless otherwise indicated. References to “US$” or “U.S. dollars” refer to United States dollars. References to “A$” refers to Australian dollars.

Compensation Discussion and Analysis

The following compensation discussion and analysis provides insight into the compensation that the Company provided to its Chief Executive Officer, Chief Financial Officer and the three most highly compensated executive officers of the Company (the “NEOs”) for the year ended December 31, 2023 (the “2023 Fiscal Year”). For the 2023 Fiscal Year, the Company had the following NEOs: (i) Andrew Dinning, CEO; (ii) Lui Evangelista, CFO; (iii) Paul Schmiede, Vice President – Corporate Development; and (iv) Jack Hamilton, Vice President – Exploration.

During the 2023 Fiscal Year, the Company focused on completing a Preliminary Economic Assessment (“PEA”) on its Sanutura project in Burkina Faso (the “Project”), until the PEA was suspended in September 2023 due to the illegal withdrawal of the Company’s rights to the 100% owned Tankoro 2 Exploration Permit (the “Permit”) by the Government of Burkina Faso. Subsequently, the Company’s exploration activities were reduced to administrative and compliance requirements and exploration field camps were placed on care and maintenance.

Advancement of the Sanutura Project

In early 2023, the Company completed internal assessment work evaluating various project sizes, configurations and throughput rates, and staging the development of the Project. As a result of this work, the Company decided to undertake a PEA to evaluate accelerating the Project via a staged approach, commencing with a mid-sized mine development established using high-grade, free-milling oxide material, followed by successive upgrades and expansions to deliver a long life, high return project. The Company’s approach had been to optimise the Project to facilitate development funding, focusing on the payback period, minimising upfront capital and structuring the Project to generate cash flows as soon as practicably possible. Open pit mining was focused on bringing value forward and was being scheduled accordingly while underground mining was being scheduled to augment grade requirements later in the mine life. The PEA was scheduled for completion in September 2023.

Click here for the full ASX Release

This article includes content from Sarama Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SRR:AU

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 November 2025

Sarama Resources

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim.

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim. Keep Reading...

14 August 2025

Q2 2025 Interim Financial Statements

Sarama Resources (SRR:AU) has announced Q2 2025 Interim Financial StatementsDownload the PDF here. Keep Reading...

04 August 2025

Sarama Provides Update on Arbitration Proceedings

Sarama Resources (SRR:AU) has announced Sarama Provides Update on Arbitration ProceedingsDownload the PDF here. Keep Reading...

09 July 2025

Completion of Tranche 1 Equity Placement & Cleansing Notice

Sarama Resources (SRR:AU) has announced Completion of Tranche 1 Equity Placement & Cleansing NoticeDownload the PDF here. Keep Reading...

29 June 2025

A$2.7m Equity Placement to Fund Laverton Drilling Campaign

Sarama Resources (SRR:AU) has announced A$2.7m Equity Placement to Fund Laverton Drilling CampaignDownload the PDF here. Keep Reading...

25 June 2025

Trading Halt

Sarama Resources (SRR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

3h

Canadian Investment Regulatory Organization Trade Resumption - IMR

Trading resumes in: Company: iMetal Resources Inc. TSX-Venture Symbol: IMR All Issues: Yes Resumption (ET): 10:30 AM CIRO can make a decision to impose a temporary suspension (halt) of trading in a security of a publicly-listed company. Trading halts are implemented to ensure a fair and orderly... Keep Reading...

3h

iMetal Resources Intersects 16.65 Metres at 1.24 g/t Gold Within 62.25 Metres at 0.61 g/t Gold at Gowganda West

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company") has intersected 16.65 metres at 1.25 gt gold within 62.25 metres at 0.61 gt gold at its Gowganda West Gold Project, southwest of Timmins, Ontario. Drilling in the West Zone intersected broad levels... Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Boosted by Geopolitical and Trade Tensions

Precious metals are recovering their safe-haven demand appeal this week.Gold, silver and platinum are up this week, all still down from the all-time highs recorded in January. Escalating geopolitical tensions and US trade policy shifts are once again at center stage in this sector of the... Keep Reading...

19h

What Was the Highest Price for Gold?

Gold has long been considered a store of wealth, and the price of gold often makes its biggest gains during turbulent times as investors look for cover in this safe-haven asset.The 21st century has so far been heavily marked by episodes of economic and sociopolitical upheaval. Uncertainty has... Keep Reading...

25 February

Peruvian Metals Closes Private Placement

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce the closing of its non-brokered private placement (the "Offering") previously announced on January 29, 2026. Pursuant to the Offering, the Company issued an aggregate of 10,000,000 units... Keep Reading...

Latest News

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00