October 22, 2024

Reconnaissance drilling hits 7m at 4.3g/t Au in the oxide zone, plus base metal mineralisation in the first three drillholes

Eastern Metals Limited (ASX: EMS) (“Eastern Metals” or “the Company”) is pleased to report encouraging initial assay results from a recent reconnaissance drilling program across newly identified high-priority targets at its 100%-owned Cobar Project in NSW.

HIGHLIGHTS

- Reconnaissance drilling completed at two new targets, Kelpie Hill and Windmill Dam, and at the advanced Evergreen prospect within the 100%-owned Cobar Project in NSW.

- Assay results received for three Reverse Circulation percussion (RC) holes completed at Kelpie Hill, with hole KHRC001 intersecting significant high-grade gold plus base metal mineralisation:

- 7m @ 4.3g/t Au, 2.7g/t Ag, 0.3% Pb from 50m and 1m @ 4.17g/t Au, 2.7g/t Ag from 82m

- Holes KHRC002 and 003 intersected anomalous base metals, and were extended as diamond tails into the primary sulphide zone, returning intercepts of up to:

- 3.05m @ 3.9% Zn, 2% Pb, 29.5g/t Ag from 298.5 and 0.5m @ 7.2% Zn, 2.4% Pb from 299m

- Assays pending for two holes completed at Windmill Dam and Evergreen.

- Induced Polarisation (IP) survey due to commence in the coming weeks. Results from the IP survey will help define and prioritise targets for immediate, follow-up drill testing.

The Company has completed drilling at its two new targets, Kelpie Hill and Windmill Dam, as well as drilling at the more advanced Evergreen prospect (refer to Figure 1). Assays results have so far been received for three (3) holes at Kelpie Hill, where hole KHCRC001 returned an intercept of 7 metres at an average grade of 4.3g/t Au (incl. 1m at 8.56g/t Au) in the weathered, oxidised zone of the Preston Formation, along with silver and base metals. Refer to Table 1 for a summary of significant intercepts.

Base metal results were also returned from the other two holes, including deeper base metal zones in the primary (sulphide zone) of hole KHRCDD003. Assay results from drilling at Windmill Dam and Evergreen are still pending. In light of these highly encouraging results, the Company is finalising the design of an Induced Polarisation (IP) survey, which is due to commence in the coming weeks. Results from the IP survey will help define and prioritise targets for follow-up drill testing.

Eastern Metals’ Chief Executive Officer Ley Kingdom said: “While the high-grade gold zone intersected in the first hole was somewhat of a surprise, given that this was primarily a base metals target, intersecting significant mineralisation is an exciting development for any exploration team. While we are still in the process of evaluating the results and working out the geological context and significance of what we have seen in the first three holes at Kelpie Hill, the key takeaway for investors is that this is a highly complex, mineralised system which offers enormous discovery potential, particularly when considering how little drilling has been done. With results pending from the remaining holes, and an IP survey starting shortly, it’s definitely a case of ‘watch this space!’”.

Kelpie Hill Prospect, Browns Reef (EL6321)

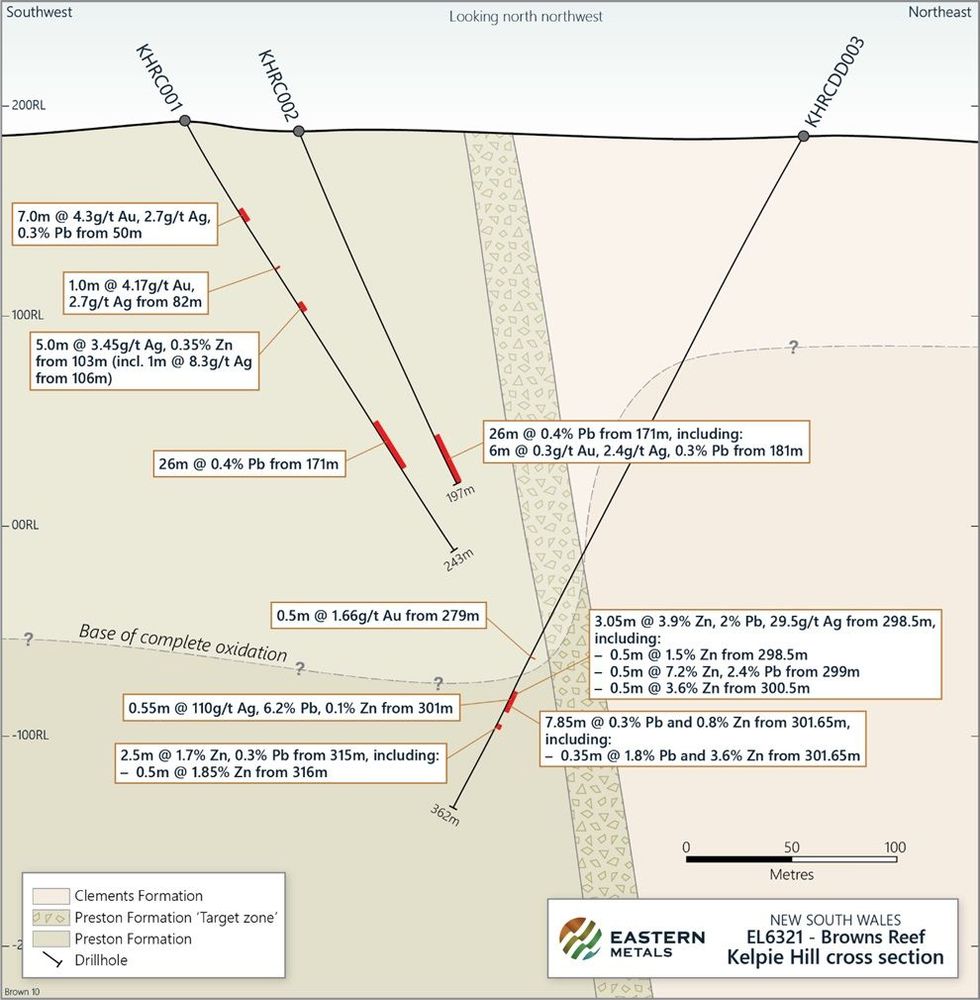

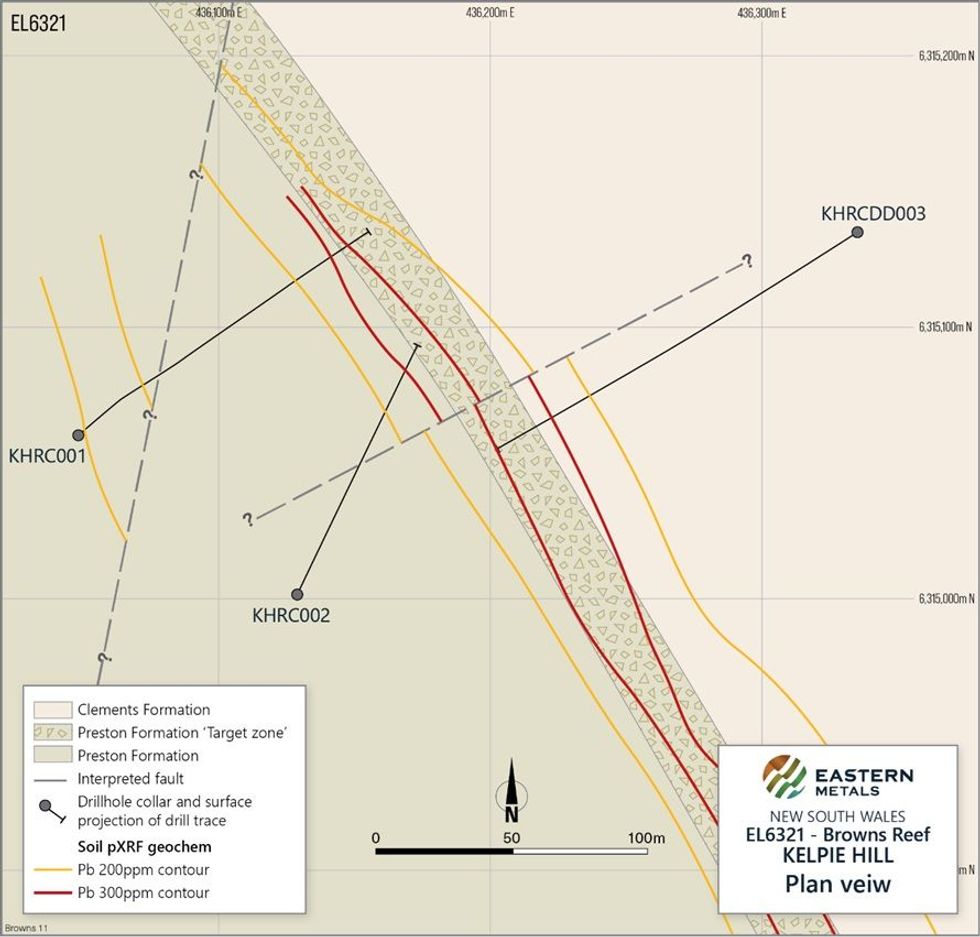

Three Reverse Circulation percussion (“RC”) holes were completed at the Kelpie Hill prospect for 560 metres. Two of the holes (KHRC001 and KHRC002) directly targeted a strong lead-arsenic soil geochemical anomaly, while the third (KHRC003) was drilled as a pre-collar for a planned diamond tail (KHRCDD003) to intersect the target zone at greater depth (see Figure 2).

All three holes intersected anomalous lead-zinc gossanous ironstones, with KHRCDD003 also intersecting primary sulphides below the depth of oxidation. Diamond cored HQ “tails” were drilled to extend holes KHRC002 and KHRC003.

The 50-56 metre interval was logged by the site geologist as “massive red haematitic ironstone, gossanous” in the weathered oxidised zone of the Preston Formation to the west of the interpreted Woorara Fault, a large regional scale structure on the Preston-Clements contact. Refer to Figure 3.

Significant intercepts for KHRC001 include:

- 7m @ 4.3g/t Au, 2.7g/t Ag, 0.3% Pb from 50m, including:

- 1m @ 8.56g/t Au from 51m

- 1m @ 4.17g/t Au, 2.7g/t Ag from 82m

- 5m @ 3.45g/t Ag, 0.35% Zn from 103m, including:

- 1m @ 8.3g/t Ag from 106m

Hole KHRC002 was extended as hole KHRCDD002 with a diamond cored tail from 197 metres to 201.35 metres; however, this hole was abandoned due to drilling complications and did not reach the planned target depth into the Clements Formation on the eastern side of the target zone.

The oxide zone interval 169 to 197 metres is strongly lead anomalous, with the interval 175.5 to 197 metres logged by the site geologist as “strongly silica altered ex-shale and sandstone, often highly ferruginous to gossanous, limonite and haematite stain, pits ex-sulphide, quartz veins”.

Click here for the full ASX Release

This article includes content from Eastern Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EMS:AU

The Conversation (0)

07 October 2024

Eastern Metals

Exploring for strategic metals vital to energy security in Australian, resource-rich provinces

Exploring for strategic metals vital to energy security in Australian, resource-rich provinces Keep Reading...

31 January 2025

Quarterly Activities and Cash Flow Reports 31 December 2024

Eastern Metals (EMS:AU) has announced Quarterly Activities and Cash Flow Reports 31 December 2024Download the PDF here. Keep Reading...

10h

Panelists: Silver in Bull Market, but Expect Price Volatility

Gold often dominates conversations at the annual Vancouver Resource Investment Conference (VRIC), but silver's price surge, which began in 2025 and continued into January, placed the metal firmly in the spotlight. At this year’s silver forecast panel, Commodity Culture host and producer Jesse... Keep Reading...

20h

Southern Silver Intersects 5.8 metres averaging 781g/t AgEq at Cerro Las Minitas Project in Durango, México

Southern Silver Exploration Corp. (TSXV: SSV,OTC:SSVFF) (the "Company" or "Southern Silver") reports additional assays from drilling which continues to outline extensions of mineralization on the recently acquired Puro Corazon claim and identified further thick intervals of high-grade and... Keep Reading...

06 February

After Major Gold Payout, Bian Ximing Turns Bearish Sights on Silver

A Chinese billionaire trader known for profiting from gold’s multi-year rally has turned sharply bearish on silver, building a short position now worth nearly US$300 million as the metal's price slides. Bian Ximing, who earned billions riding gold’s multi-year rally and later turned aggressively... Keep Reading...

03 February

Silver Supply Tight, Demand Rising — What's Next? First Majestic's Mani Alkhafaji

Mani Alkhafaji, president of First Majestic Silver (TSX:AG,NYSE:AG), discusses silver supply, demand and price dynamics, as well as how the company is positioning for 2026.He also shares his thoughts on when silver stocks may catch up to the silver price: "You've got to give it a couple of... Keep Reading...

03 February

Rio Silver’s Path to Near-Term Cashflow

Rio Silver (TSXV:RYO,OTCPL:RYOOF) President and CEO Chris Verrico outlines the company’s transition into a pure-play silver developer. With the silver price reaching historic highs, Rio Silver is capitalizing on its strategic position in Peru — the world’s second largest silver producer — to... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00