February 19, 2024

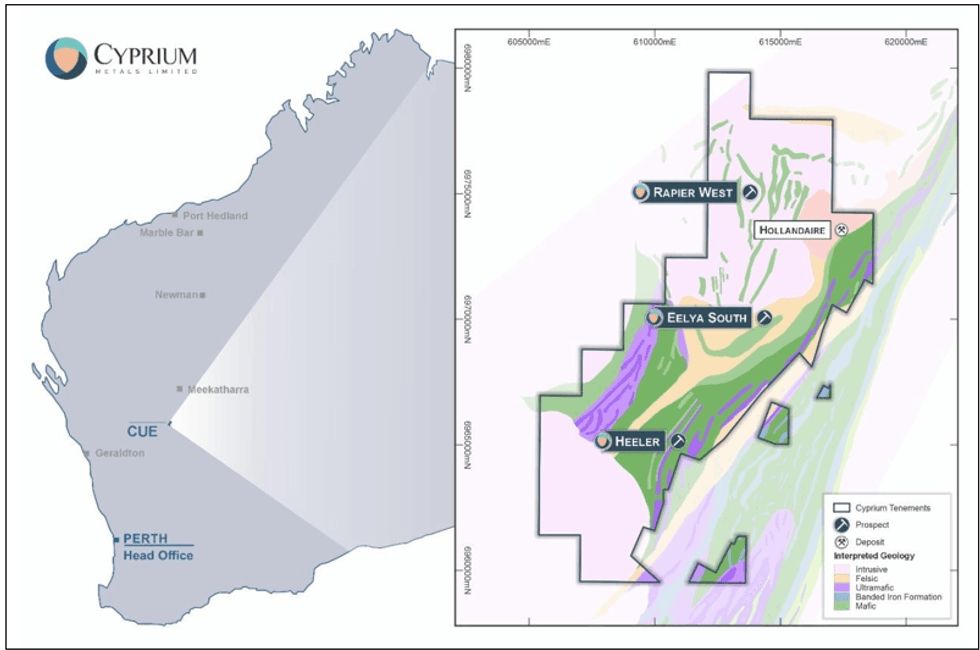

Cyprium Metals Limited (ASX:CYM) (CYM, Cyprium or the Company) has made a shallow high-grade discovery near Cue at the Heeler Prospect approximately 10km southwest of the Company’s Hollandaire copper-gold deposit.

Highlights include:

- Drill intercept of 15m at 3.26% Cu, 0.70g/t Au, 7.4g/t Ag, 151ppm Co from 70 metres downhole in 24CURC004

- Including: 7m at 5.04% Cu, 0.81g/t Au, 11.4g/t Ag, 197ppm Co, 0.11% Ni from 71m

- Second intercept in 24CURC004 of 3m at 1.09% Cu, 0.44g/t Au from 108m

- Including: 1m at 2.54% Cu, 1.19g/t Au from 109m

- Mineralisation is open to depth and along strike in both directions within a lightly tested copper soil anomaly extending for 2.5 kilometres along strike

“While the Company remains focused on delivering a robust plan for Nifty, we continue to maintain our outstanding portfolio of exploration assets,” said Executive Chairman Matt Fifield. “This new Heeler discovery is a great reminder of the prospective value within the Company’s earlier-stage assets in the Paterson and Murchison provinces. Our exploration team targeted our limited drilling budget in the Murchison around the most prospective areas and hit outstanding grade that shows potential for an economic orebody. Solid focused work by the team – congratulations to Mark, Peter and Milan on the discovery hole.”

The Heeler Prospect is in the Murchison Province on tenements within the Company’s Cue joint venture with Ramelius Resources Ltd (ASX: RMS). This joint venture is operated by Cyprium, with 80% of the rights to base metals owned by Cyprium and 20% by Ramelius.

“With Heeler, Cyprium continues to build on its copper-gold resource inventory in the Murchison,” said COO Milan Jerkovic. “We have 203,000 tonnes of copper resource and 153,0000 ounces of gold (100% basis) at the nearby Hollandaire and Nanadie Well deposits and follow up work around Heeler may well bring additional grade and scale into our portfolio. There are assays from this program outstanding, but we’re pleased to have hit shallow high- grade mineralisation.”

“The Cue region is an area that’s known for its gold deposits but hasn’t been well explored for its base metals potential,” said Cyprium geologist Mark Styles. “At Heeler for example, we were attracted by the large, lightly tested +100ppm copper soil anomaly up to 400m wide and 2.5 kilometres long, historic shallow drill results with 0.3% copper in the core of the soil anomaly and a coincident geophysical magnetic high. These features are suggestive of a mafic-ultramafic association with base metal mineralisation in a style distinct from the felsic- hosted Hollandaire copper-gold deposit located 10km northeast of Heeler.”

“We drilled four holes in our programme focusing on Heeler, following up on work in 2022. So far we have assays back from a single drillhole completed in our January 2024 programme. The 24CURC004 intercept showed stacked shallow sulphide mineralisation that was visible in the drill chips. We also hit sulphides in the three other holes, but we’re expecting lower tenor assay results, <1% copper,” said Styles.

24CURC004 assay results show 15m at 3.26% Cu, 0.70g/t Au, 7.4g/t Ag, 151ppm Co from 70m, including 7m at 5.04% Cu, 0.81g/t Au, 11.4g/t Ag, 197ppm Co, 0.11% Ni from 71m. A second intercept in the same hole returned 3m at 1.09% Cu, 0.44g/t Au from 108m, including 1m at 2.54% Cu, 1.19g/t Au from 109m.

Click here for the full ASX Release

This article includes content from Cyprium Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CYM:AU

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 March 2025

Cyprium Metals

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth Keep Reading...

23 January

Capital Raise Presentation

Cyprium Metals (CYM:AU) has announced Capital Raise PresentationDownload the PDF here. Keep Reading...

22 January

A$41M Capital Raise via Placement & Entitlement Offer

Cyprium Metals (CYM:AU) has announced A$41M Capital Raise via Placement & Entitlement OfferDownload the PDF here. Keep Reading...

19 January

Paterson Exploration Review Update

Cyprium Metals (CYM:AU) has announced Paterson Exploration Review UpdateDownload the PDF here. Keep Reading...

19 November 2025

Cathode Restart Approved by Cyprium Board

Cyprium Metals (CYM:AU) has announced Cathode Restart Approved by Cyprium BoardDownload the PDF here. Keep Reading...

13 November 2025

Senior Loan Facility Refinanced with Nebari

Cyprium Metals (CYM:AU) has announced Senior Loan Facility Refinanced with NebariDownload the PDF here. Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00