February 26, 2025

Binding Agreement Executed for Acquisition of Majority Interest (1) in Belt-Scale Gold Project

Sarama Resources Ltd. (“Sarama” or the “Company”) (ASX:SRR, TSX- V:SWA) is pleased to advise that it has reached binding agreement (the “Agreement”) with Orbminco Limited (“Orbminco”) (ASX: OB1), an arm’s length third party, to acquire a majority(1) and controlling interest(1) in the under- explored, belt-scale 420km² Mt Venn Project (the “Project”)(2), located in the Eastern Goldfields of Western Australia.

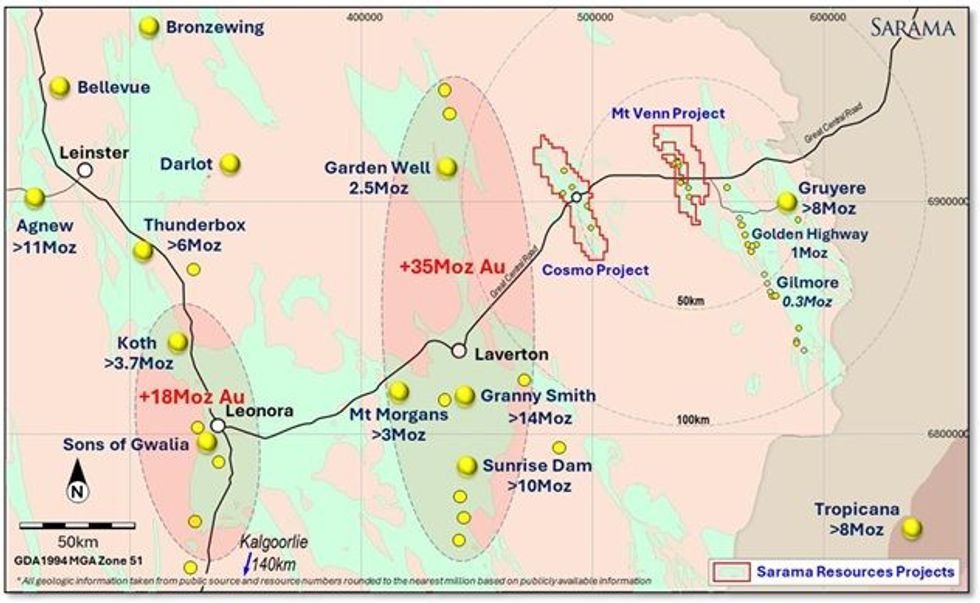

This follows Sarama’s recent acquisition of a majority interest in the nearby Cosmo Project (refer Sarama news release 6 December 2024). Together the projects create a 1,000km² well-positioned and underexplored landholding in the Laverton Gold District which is known for its prolific gold endowment (refer Figure 1) and recent discoveries.

Highlights

- Binding agreement executed for acquisition of 80% interest in belt-scale Mt Venn Project

- Located in the prolific Laverton Gold District, 35km from the producing Gruyere Gold Mine and less than 20km from Gold Road’s Golden Highway Deposit

- Project covers 420km² and features a favourable litho-structural setting, primarily in greenstone rocks

- Includes regional shear zone of ~50km strike length and 1-3km width extending full length of greenstone belt

- Advanced gold targets generated through historical exploration, including broad drill-defined gold mineralisation

- Highly complementary to Sarama’s recently acquired, underexplored and prospective Cosmo Project

- Creates 1,000km² exploration position in the Laverton Gold District, capturing 100km of strike length

- Land access agreement with Traditional Owners in place for exploration

- 100% scrip consideration with initial exploration funded by the November 2024 equity raise of A$2M

Sarama’s President, Executive Chairman, Andrew Dinning commented:

“We are very pleased to be nearing completion of the acquisition a majority interest in the Mt Venn Project and consolidating our position in the prolific Laverton Gold District of Western Australia. The addition of the Mt Venn Project will create a major 1,000km2 area-play and significantly enhances the probability of making the next big discovery in a region that continues to deliver new deposits in previously unexplored areas, including the regionally significant Gruyere Deposit just 35km east of the Mt Venn Project. Soil sampling programs at the Cosmo Project are progressing well, feeding into the process of bringing the Cosmo and Mt Venn Projects to account as expeditiously as we can.”

Mt Venn Project

The Project is comprised of 3 contiguous exploration tenements covering approximately 420km² in the Eastern Goldfields of Western Australia, approximately 110km north-east of Laverton and 35km west of the regionally- significant Gruyere Gold Mine(3). The Project is readily accessible via the Great Central Road which services the regional area east of Laverton.

The Project captures the majority of the underexplored Jutson Rocks Greenstone Belt over a strike length of ~50km. Rocks within the belt feature a diverse sequence of volcanic lithologies of varying composition, together with pyroclastics and metasediments. Several internal intrusive units have been identified throughout the Project and are commonly associated with local structural features. A regionally extensive shear zone, spanning 1-3km in width, extends the entire length of the belt with subordinate splays interpreted in the southern area of the Project which provides a favourable structural setting for mineralisation.

Gold mineralisation was first discovered in the 1920’s with sampling returning very high grades and prompting the commencement of small-scale mining operations in the mid 1920’s. Multiple gold occurrences have since been identified throughout the Project, demonstrating the prospectivity of the system. Despite the identification of several km-scale gold-in-soil anomalies by soil geochemistry and auger drilling, many of these targets are yet to be properly tested. Encouragingly, drilling by Cazaly Resources Limited (“Cazaly”) (ASX: CAZ) at the Project intersected broad, gold mineralisation over several fences in weathered and fresh rock at the Three Bears Prospect, presenting a priority target for exploration (Cazaly news release 27 February 2017: “Widespread Gold & Zinc Mineralisation Defined”).

In addition to the attractiveness of the Project for gold, it is considered prospective for base metals and platinum group elements. Historical exploration work including auger geochemistry and geophysical surveys identified numerous targets for copper, nickel and zinc mineralisation. Several of these targets remain untested due to historical funding and land access constraints. Exploration in the belt to the immediate south of the Project area is noted to have intersected copper mineralisation of significant grade over a significant strike length(4).

In summary, the Project is located within a prolific gold district and has a favourable lithological and structural setting. A solid database of base-level historical exploration work by previous operators, including generation of drill-ready targets, provides a good platform for Sarama to advance the Project in conjunction with its activities at the Cosmo Project. The size and prospectivity of the landholding that Sarama will have in the Laverton Gold District upon completion of this transaction significantly enhances the chances of making an economic discovery, particularly given the infrastructure and proliferation of mines in the region which will have a favourable impact on the size threshold for finding something of economic value.

Click here for the full ASX Release

This article includes content from Sarama Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SRR:AU

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 November 2025

Sarama Resources

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim.

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim. Keep Reading...

14 August 2025

Q2 2025 Interim Financial Statements

Sarama Resources (SRR:AU) has announced Q2 2025 Interim Financial StatementsDownload the PDF here. Keep Reading...

04 August 2025

Sarama Provides Update on Arbitration Proceedings

Sarama Resources (SRR:AU) has announced Sarama Provides Update on Arbitration ProceedingsDownload the PDF here. Keep Reading...

09 July 2025

Completion of Tranche 1 Equity Placement & Cleansing Notice

Sarama Resources (SRR:AU) has announced Completion of Tranche 1 Equity Placement & Cleansing NoticeDownload the PDF here. Keep Reading...

29 June 2025

A$2.7m Equity Placement to Fund Laverton Drilling Campaign

Sarama Resources (SRR:AU) has announced A$2.7m Equity Placement to Fund Laverton Drilling CampaignDownload the PDF here. Keep Reading...

25 June 2025

Trading Halt

Sarama Resources (SRR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00