August 13, 2024

Binding Agreement Executed for the Large, Effectively Unexplored Cosmo Newbery Gold Project

Sarama Resources Ltd. (“Sarama” or the “Company”) (ASX:SRR, TSX- V:SWA) is pleased to announce that it has entered into a binding agreement to acquire a majority interest(1) in the Cosmo Newbery Gold Project (the “Project”) in Western Australia (refer Figure 1).

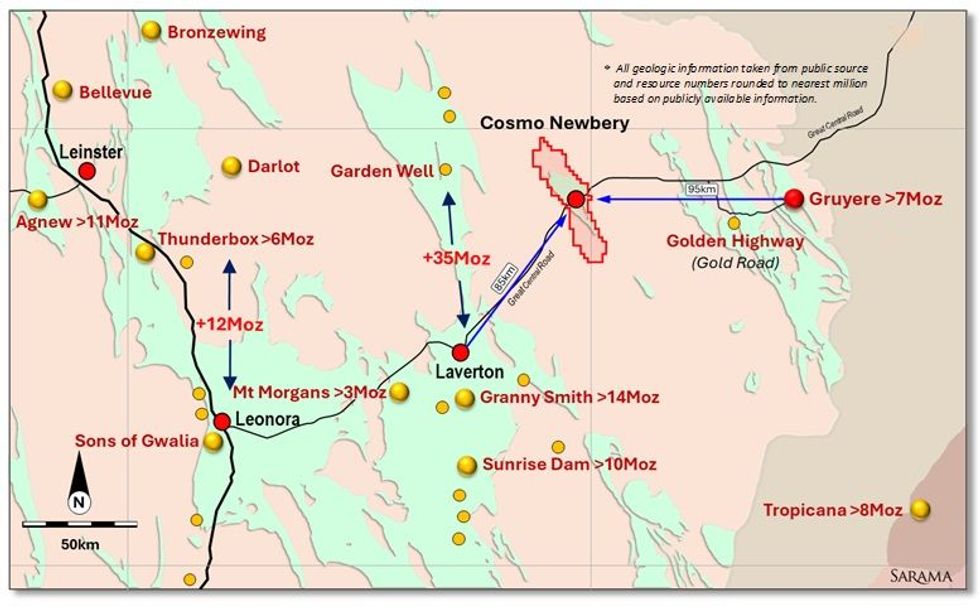

The 580km² project(2) covers the entirety of the Cosmo-Newbery Greenstone Belt and is located approximately 85km north-east of Laverton in a region known for its prolific gold endowment. As one of the last effectively unexplored greenstone belts in Western Australia, the Project presents a unique and compelling opportunity for the Company.

Highlights

- Binding agreement to acquire majority interest and control of Cosmo Newbery Gold Project in Western Australia

- 580km² landholding capturing +50km strike length in highly prospective gold producing region One of the last effectively unexplored greenstone belts in Western Australia

- Virtually no effective exploration undertaken for several decades

- Excellent access to infrastructure and nearby producing gold mines

- Sarama to initially acquire an 80% interest in the majority of the Project(1)

- Ability for Sarama to increase ownership to 100% in the majority of the Project(1) via an option to acquire the vendor’s remaining interest within a 2-year period post completion

Sarama’s President, CEO & MD, Andrew Dinning commented:

“We are pleased to have reached this milestone in the acquisition of a majority interest in the Cosmo Newbery Gold Project and look forward to completing the transaction in due course. The Company considers the Project to be highly prospective for a number of commodities and its scale, location, favourable geological setting and truly underexplored status presents a unique exploration opportunity.”

Cosmo Newbery Project

The Project is comprised of 7 contiguous exploration tenements covering 580km² in the Eastern Goldfields of Western Australia, approximately 85km north-east of Laverton and 95km west of the ~7Moz(3) Gruyere Gold Mine. The Project is readily accessible via the Great Central Road which services the Cosmo Newbery Community.

The Project captures one of the last unexplored greenstone belts in Western Australia and with a strike length of +50km, the Cosmo Newbery Belt represents a large and prospective system with gold first being discovered in the area in the 1890’s. Multiple historical gold workings are documented within the Project area and work undertaken to date, has identified multiple exploration targets for follow up.

Despite this significant prospectivity, the Project has seen virtually no modern exploration or drilling of merit due to a lack of land access persisting over a significant period. As a result, the Project has not benefited from the evolution of geochemical and geophysical techniques which now facilitate effective exploration in deeply weathered and complex regolith settings which is particularly pertinent given approximately 75% of the Project area is under cover.

Following the relatively recent securing of land access, the Project is now available for systematic and modern-day exploration programs to be conducted on a broad-scale. It is anticipated that future exploration programs will initially follow-up preliminary targets generated from regional soil sampling and limited reconnaissance drilling programs, a majority of which extended to approximately 5m below surface with a small percentage extending up to 30m below surface.

Click here for the full ASX Release

This article includes content from Sarama Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SRR:AU

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 November 2025

Sarama Resources

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim.

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim. Keep Reading...

14 August 2025

Q2 2025 Interim Financial Statements

Sarama Resources (SRR:AU) has announced Q2 2025 Interim Financial StatementsDownload the PDF here. Keep Reading...

04 August 2025

Sarama Provides Update on Arbitration Proceedings

Sarama Resources (SRR:AU) has announced Sarama Provides Update on Arbitration ProceedingsDownload the PDF here. Keep Reading...

09 July 2025

Completion of Tranche 1 Equity Placement & Cleansing Notice

Sarama Resources (SRR:AU) has announced Completion of Tranche 1 Equity Placement & Cleansing NoticeDownload the PDF here. Keep Reading...

29 June 2025

A$2.7m Equity Placement to Fund Laverton Drilling Campaign

Sarama Resources (SRR:AU) has announced A$2.7m Equity Placement to Fund Laverton Drilling CampaignDownload the PDF here. Keep Reading...

25 June 2025

Trading Halt

Sarama Resources (SRR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00